[ad_1]

In February 2023 I wrote the article What Does 2023 Have In-Store for Global Supply Chains? . It introduced the survey we had just launched to determine the perceptions, priorities, and strategic initiatives of today’s supply chain and logistics executives. This post was subsequently followed by two articles that discussed some of the findings from the survey. Today I will provide some updated insights and discuss the essence of what we learned. I believe our findings capture the pulse of North America logistics operations and the executives’ perceptions and priorities going into the second half of 2023.

We learned from the Conference Board C-Suite Outlook that rising inflation, labor shortages, and supply chain disruptions were high impact issues for CEOs in 2022. And recent disruptions, including the war in Ukraine, placed supply chain resilience as a priority on the top of the agenda for CEOs. All of these issues remained relevant in 2023 as well (see Conference Board C-Suite Outlook 2023). However, “economic downturn/recession” entered and occupied the top spot on that list. We conducted ARC Advisory Group’s survey at the same time as the Conference Board updated its C-Suite Outlook for 2023. Our findings complement and provide additional insights to the Conference Board’s findings.

Competing Objectives, Competition, and Operational Uncertainty

Our findings were far from a one dimensional “silver bullet. Our results show that today’s supply chain and logistics operations are balancing multiple competing objectives while contending with substantial uncertainty. Simply put, the disruptions of the recent past have exposed the vulnerabilities within supply chains. The operational impacts have been severe enough for executives to take action in support of supply chain resilience. At the same time, competitive forces have made supply chain operations more relevant to the customer experience and revenue generation. Meanwhile, labor constraints are as binding as ever. But demand remains strong – at least for now. It seems as if many are patiently anticipating an economic downturn that is expected to be shallow in depth and short in duration.

The factors impacting broader supply chains extend all the way down to the warehouse floor. In fact, pressures are very similar with warehouse labor cost inflation, labor shortages, and inventory shortages at the top of the “concerns” list. Simply put, supply chain operations are under strain with pressures coming from multiple sources. And they must be capable of adapting to various demands. Meanwhile, executives are focusing on the present, with an eye to the future a concern for a repeat of the recent past.

Taking Action Across the Supply Chain and in the Warehouse

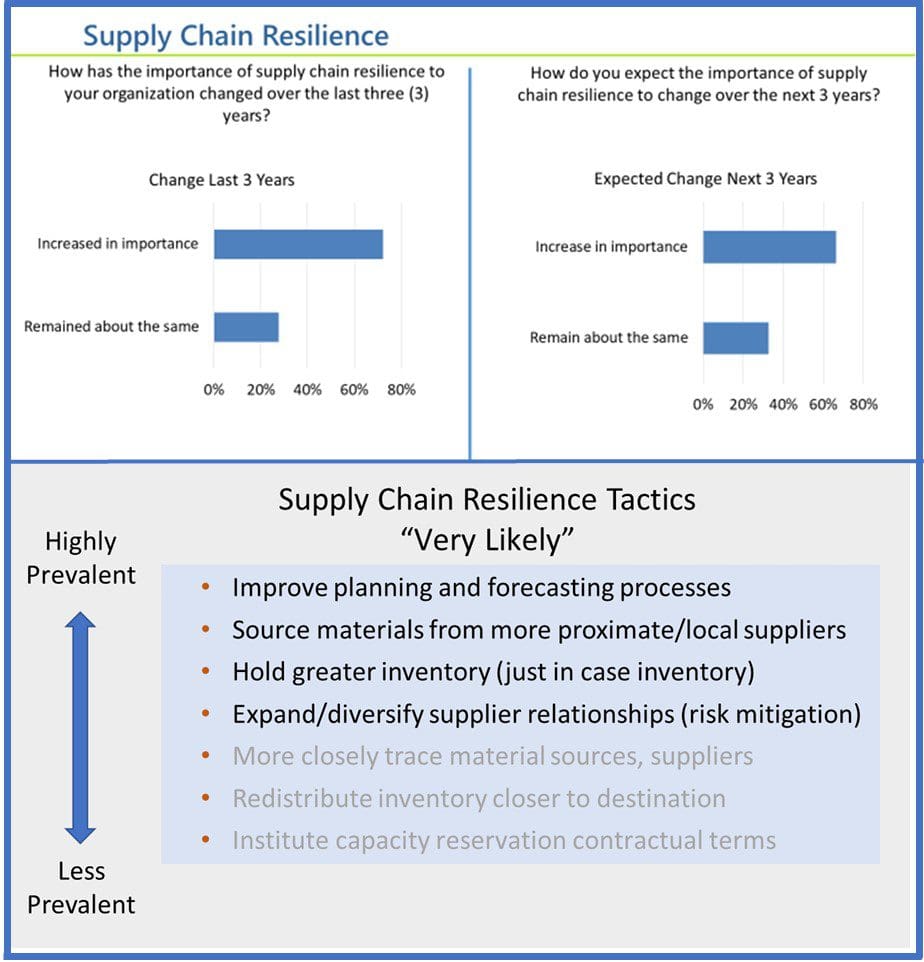

Executives are taking action to ensure ongoing performance while mitigating operational risks. With respect to supply chain resilience efforts, making improvements to planning and forecasting processes is a lever that many expect to pull over the next year. Additionally, many organizations are also planning to source materials from suppliers in closer proximity and to hold greater inventory to assure short lead times and high inventory availability. Furthermore, some organizations plan to take steps to diversify supplier relationships, indicating a broader supply chain risk management approach.

Technology investment in the warehouse is very much focused on better utilization of warehouse labor. The comments that respondents made in our survey provided valuable insight into their logic. One executive simply stated that it’s “an easy variable to address.” But others provided clarity on labor management’s value for them in comparison to an alternative. For example, one respondent stated warehouse visibility had been established and now they are focused on better labor management for capacity planning. Yet another stated that bots are cost-prohibitive given their operation’s product variability. And yet another stated that it is more cost-efficient to have well managed manual operations than to deploy bots.

Final Word

Today’s supply chain and logistics operations are balancing multiple competing objectives while contending with substantial uncertainty. That uncertainty is related primarily to concerns about a repeat of disruptions from the recent past and indications of a possible economic slowdown in the near future.

Additional reading:

Warehouse Performance Objectives Continue to Evolve – Logistics Viewpoints

[ad_2]

Source link