[ad_1]

Weekly highlights

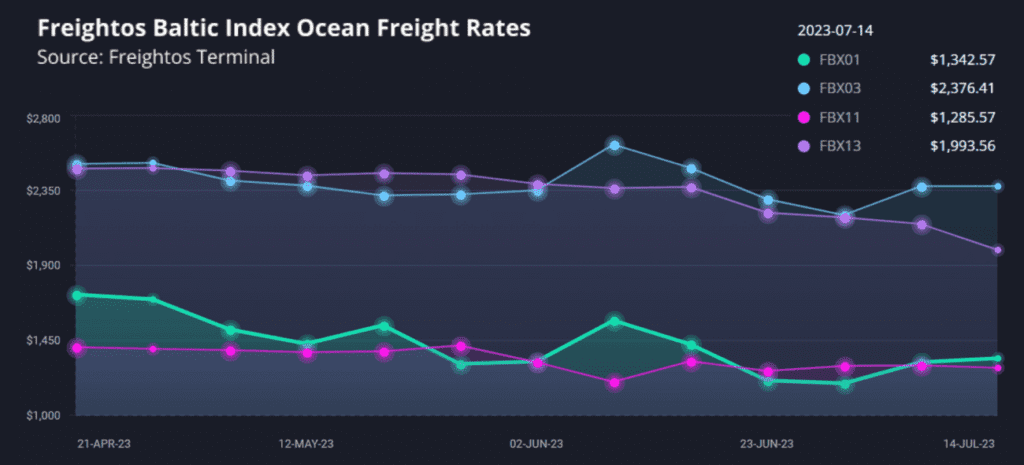

Ocean rates – Freightos Baltic Index:

- Asia-US West Coast prices (FBX01 Weekly) increased 2% to $1,366/FEU.

- Asia-US East Coast prices (FBX03 Weekly) climbed 6% to $2,519/FEU.

- Asia-N. Europe prices (FBX11 Weekly) were level at $1,285/FEU

- Asia-Mediterranean prices (FBX13 Weekly) fell 2% to $1,956/FEU.

Air rates – Freightos Air index

- China – N. America prices increased 1% to $4.29/kg

- China – N. Europe prices increased 3% to $3.12/kg.

- N. Europe – N. America prices fell 1% to $1.80/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Labor disputes in logistics had an eventful week and a half.

ILWU Canada negotiators accepted a mediated proposal and ended its two-week strike on July 13th, only to have its caucus reject the agreement and restart a strike before reconsidering and ending the strike again a week ago. Union leaders are now presenting the terms to its members with a vote on ratification expected later this week.

Teamsters at UPS – who had authorized an August 1st strike – accepted a tentative agreement yesterday, with ratification expected over the next few weeks. And Teamsters at LTL carrier Yellow called off a strike planned to begin yesterday as negotiations continue.

Transpacific ocean rates trended up last week, and daily rates so far this week have climbed another $200/FEU on both lanes, pushing Asia – US West Coast rates to more than $1,500/FEU – 3% above 2019 levels – and East Coast prices to about $2,600/FEU.

These rate increases come alongside reports of full vessels and even containers getting rolled to later sailings. Taken together, these developments likely reflect the beginning of a peak season increase in demand. But, while blanked sailings usually decrease during peak season, reports of increases in capacity reductions suggest that carriers are nonetheless facing an oversupplied market and need to reduce capacity in order to realize volume increases in the form of higher spot rates. And this challenge is only getting bigger as the delivery of new vessels will push transpacific capacity up 19% higher than last year by the end of August.

If we are seeing the start of peak season, projections still vary on how long it will last, with some expecting normal seasonality with elevated volumes through October, and others predicting an early decline by September.

The Panama Canal Authority has also announced reduced daily transits starting in August due to persistent low-water levels, which could also put some upward pressure on East Coast rates.

In Asia – N. Europe trade, carriers have faced lagging volumes and increases in capacity from new ultra large vessels, but have kept rates at about $1,300/FEU – on par with 2019 levels – since early June through blanked sailings and slow steaming, without canceling as many sailings as they did last year. Despite these market conditions, several carriers have announced August 1st General Rate Increases that would push rates up to about $1,900/FEU.

In air cargo, major US carriers reported this week that Q2 cargo performance was below 2019 levels as demand is in a lull alongside capacity climbing on recovering passenger travel. Freightos Air index rates were at $4.29/kg for the transpacific last week, and $1.80/kg on the transatlantic, both about 40% lower than a year ago.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.

[ad_2]

Source link