[ad_1]

Weekly highlights

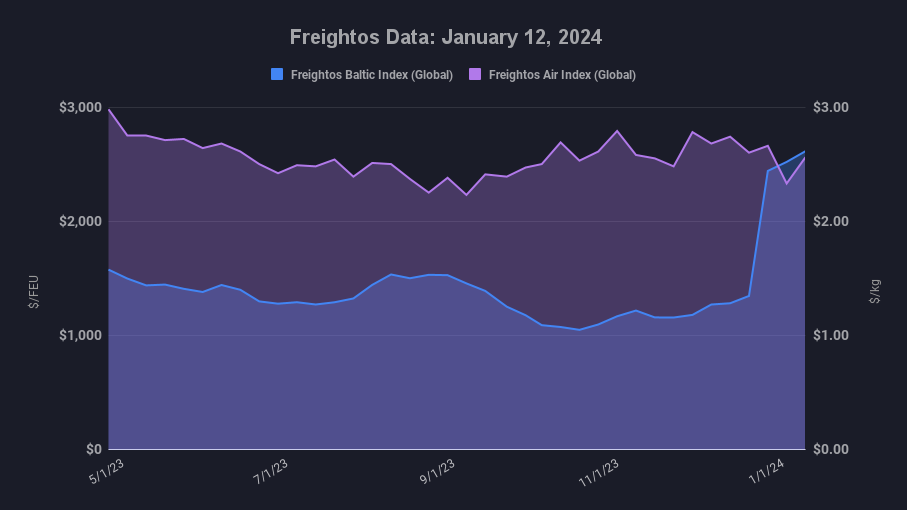

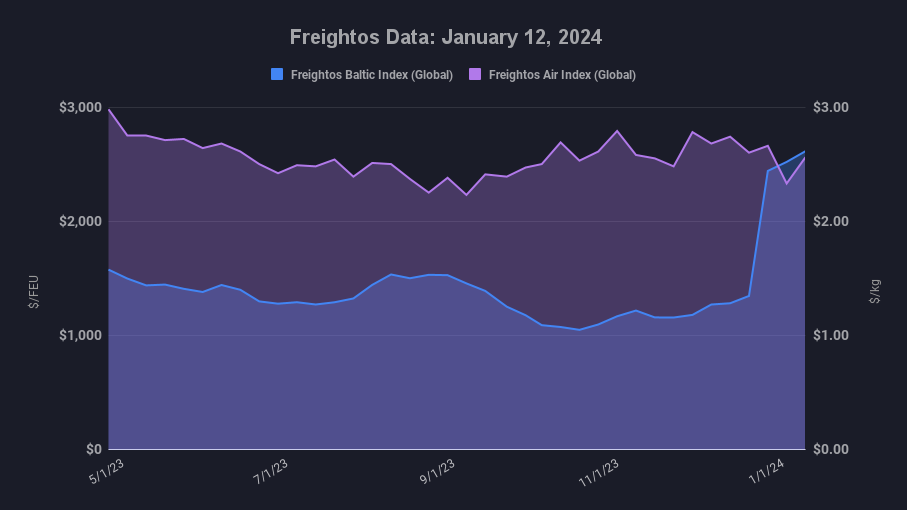

- Asia-US West Coast prices (FBX01 Weekly) fell 5% to $2,588/FEU.

- Asia-US East Coast prices (FBX03 Weekly) climbed 7% to $4,278/FEU.

- Asia-N. Europe prices (FBX11 Weekly) increased 8% to $4,757/FEU.

- Asia-Mediterranean prices(FBX13 Weekly) increased 5% to $5,440/FEU.

- China – N. America weekly prices decreased 8% to $5.36/kg

- China – N. Europe weekly prices increased 91% to $3.55/kg.

- N. Europe – N. America weekly prices increased 2% to $1.84/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Despite US and UK strikes on Houthi positions in Yemen, attacks on Red Sea traffic continued this week, both on US naval assets and commercial vessels.

The majority of container carriers continue to divert away from the Suez Canal while the safety threat persists, and demand is increasing with Lunar New Year just three weeks away. As such, shippers have started to face some empty container shortages and are seeing available space getting tight at some Asian origin ports due both to increasing demand and to delayed departures and arrivals resulting from the longer transits and disrupted schedules.

Some carriers are adding Asia – Europe sailings to address the current supply imbalance, and others – despite overall fleet growth – are chartering additional capacity to accommodate the longer routes.

Ocean rates ex-Asia ticked up last week, but daily rates as of Monday for Asia – Mediterranean containers had increased by more than $1,000 to about $6,700/FEU as mid-month GRIs start to be introduced. Asia – N. Europe and N. America rate increases are expected to push prices up significantly this week as well.

The disruptions and demand increases are putting enough pressure on prices that some shippers with long term ocean contracts are also facing surcharges and others may not be seeing all the containers moved. Some carriers have also temporarily suspended long-term Asia – N. Europe contract negotiations as the market is in flux.

Equipment shortages and a possible lack of space are likely to be at their worst in the next couple weeks, due to pressure to get volumes moved before LNY, and this demand increase is likely playing a role in the degree to which rates are currently climbing.

Unlike during the pandemic though, when a sustained surge in volumes overwhelmed ports and caused congestion that just kept getting worse, carriers – especially post-LNY – should be able to establish a new routine that will keep containers flowing and avoid significant congestion. So, when the market enters its typical lull after LNY, transit times will remain longer but should become more predictable, and it is likely that prices will subside somewhat as well, though they will likely remain elevated until Red Sea traffic resumes.

Likewise in air cargo, experts continue to expect some ex-Asia shipments to shift from ocean to air to avoid delays ahead of the holiday. Freightos Air Index rates for China to N. Europe rebounded last week to $3.55/kg, back to their late December level, but remain below the $4.50/kg mark seen in mid-December, while China – N. America rates decreased 8% to $5.36/kg.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.

[ad_2]

Source link