[ad_1]

Weekly highlights

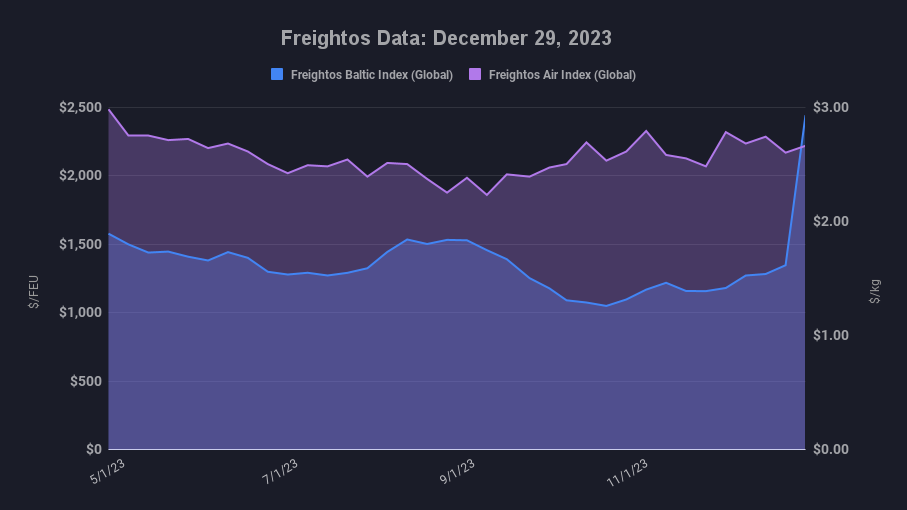

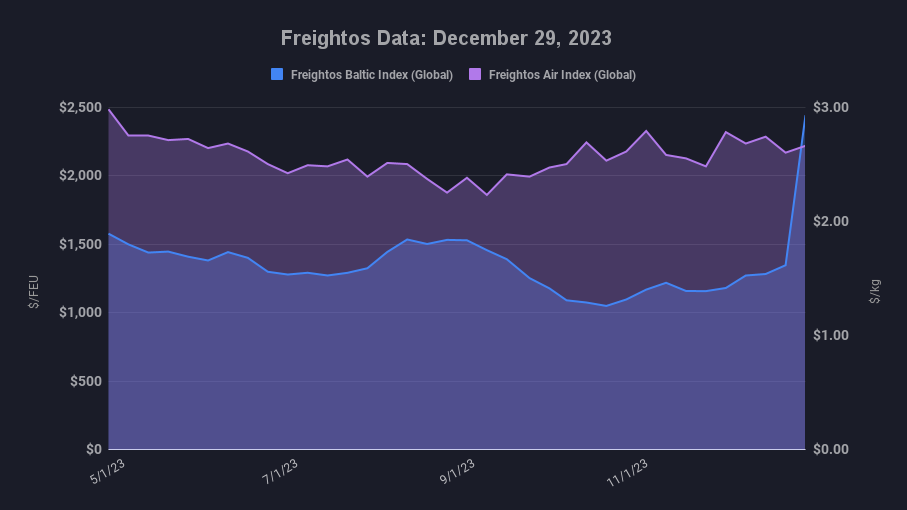

- Asia-US West Coast prices (FBX01) increased 63% to $2,713/FEU.

- Asia-US East Coast prices (FBX03) climbed 55% to $3,900/FEU.

- Asia-N. Europe prices (FBX11) increased 151% to $4,042/FEU.

- Asia-Mediterranean prices (FBX13) increased 108% to $5,175/FEU.

- China – N. America weekly prices stayed level at $5.85/kg

- China – N. Europe weekly prices fell 25% to $2.98/kg.

- N. Europe – N. America weekly prices fell 13% to $1.82/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Even with the US-led international naval task force in place, Houthi attacks on commercial vessels continued last week including a missile attack and attempted hijacking of a Maersk container ship on Saturday.

Saturday’s attempted hijacking – significant because Maersk was one of two carriers to recently announce it would reroute back through the Suez Canal – marked an escalation. The US response sunk three Houthi boats approaching the Maersk ship, reportedly killing ten. International tensions are rising as the UK is considering targeting Houthi positions in Yemen and Iran moved a warship to the Red Sea on Sunday, stating that Iranian naval vessels have periodically been in the Red Sea “”to secure shipping lanes, repel pirates, among other purposes since 2009.” Houthi missile attacks have continued into the New Year even after US and UK responses.

Most container carriers are continuing to divert their vessels away from the Red Sea even with the force patrolling. Maersk and CMA CGM had resumed some Red Sea sailings as of late last week, and announced that they would gradually return in full when possible. But following the attack on Saturday, Maersk suspended all its Red Sea transits until further notice.

The longer voyages for diverted services mean longer lead times for importers and some threat of port congestion if updated schedules can’t be maintained and multiple vessels arrive at once, though so far there have not been reports of backlogs. The excess capacity that carriers were contending with before the Red Sea disruptions will now be activated to use more ships than usual per service to try and keep up with departure schedules and keep containers moving.

Some carriers are shortening the “free time” N. American import containers are allowed to sit at destination ports in attempts to speed up the return of empty containers and avoid equipment shortages at Asian origin ports, as empty containers will now take longer to get back to export hubs.

The diversions are also causing ocean rates to spike.

Asia – N. Europe rates have increased 173% compared to just before the diversion announcements, to more than $4,000/FEU. Asia – Mediterranean prices have doubled to more than $5,000/FEU. These rates are more than double prices in January 2019. CMA CGM announced Asia – Mediterranean rates will increase to more than $6,000/FEU on January 15th. Carriers have also announced surcharges ranging from $500 to as much as $2,700 per container which could push the all-in prices paid by shippers even higher.

Rates to N. America’s East Coast have climbed 52% to $3,900/FEU, 30% higher than in 2019. Some carriers have added significant surcharges for India – N. America containers, and $500/FEU surcharges for all Asia – N. America shipments starting in mid-January, though surcharge announcements for N. America have not been widespread so far. Prices to the West Coast have also increased sharply, climbing more than $1,000 per container to $2,713/FEU, possibly reflecting some anticipated shift in demand to the West Coast to avoid the increased transit time to the East Coast.

With surcharges, if all-in prices reach the $5k – $8k per container range for these major ex-Asia tradelanes, those rate levels would be 2.5 to 4 times above normal levels for this time of year.

But compared to the pandemic years, carriers have the available capacity to address diversions and longer voyages. The additional costs and capacity taken up by the longer transits are pushing rates up significantly, but even at $5,000 – $8,000/FEU, Asia – N. Europe and Mediterranean prices would be 45% – 65% lower than their $14k/FEU pandemic peak in late 2021, and 65% – 75% lower compared to the Asia – N. America East Coast peak of $22k/FEU.

In air cargo, some analysts are expecting the delays in ocean freight to lead to some shift of more urgent volumes to sea-air services or air cargo alternatives. So far there have not been reports of any significant air cargo bump, though. Freightos Air Index rates for Asia – N. America have remained level, while Asia – N. Europe prices decreased last week, to their lowest level since August of last year at about $3.00/kg.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.

[ad_2]

Source link