[ad_1]

In 2020, 2021 and 2022, it seemed like every day brought an announcement of a new merger or acquisition. That made sense given that it was insanely cheap to get capital and there was more than enough to go around. Fast forward to 2023 and those announcements subsided. There are still acquisitions for capacity, growth and whatever problem needs to be solved but not nearly at the rate of 2021 and 2022.

So what is in store for 2024?

Depends whom you ask but the consensus seems to be that this will be a strong year for M&A. The positive signs are the expected reduction in interest rates, demand for deals that wait for the market to turn and companies that need some transformation that can come from a sale. According to PwC’s global CEO survey, “60% of CEOs plan to make at least one acquisition in the next three years.”

There is some general concern that various geopolitical events in the world will negatively impact some deals but not enough to stop deals outright.

Brian Levy, global deals industries leader and partner at PricewaterhouseCoopers, said in its report, “Don’t let this M&A upturn take you by surprise. It’s coming, and when it does, it won’t be like ones we have seen in the past. Deal returns will be under greater pressure, and the companies that ultimately come out on top will be those that can demonstrate strategic value, are well prepared and can move fast.”

People are hungry and wanting to make the deals, borrowing money and securing capital has gotten more affordable, and the market is expected to turn in the very near future. Welcome to 2024: May the odds be ever in your favor, no matter what side of the deal you’re on.

Also, in case you want to get more details about this, register for the 3PL summit on FreightWaves.com, We have some fireside chats that go into the M&A outlook for 2024.

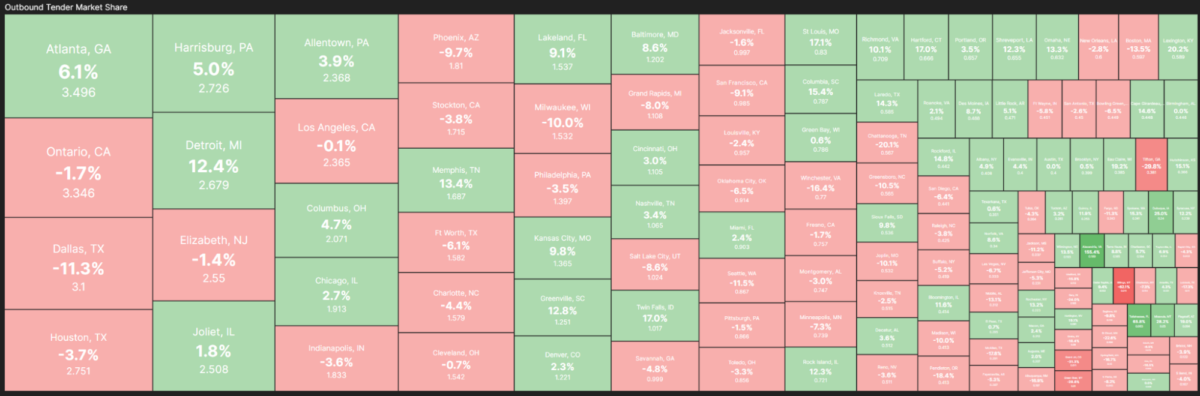

Market Check. Outbound Tender Market Share measures the number of tendered loads in individual markets in relation to total tendered load volume for the day in the U.S. All of the individual markets combine to create 100. For example, Atlanta grew 6.1% in outbound tender volume. Its current market share is 3.5% of the total U.S. market. A larger market share means the market demands more trucks and has a larger impact on freight market capacity. When market share levels change, network imbalances can show up, creating potential spot-market activity. The above chart focuses on month-over-month changes.

The major markets of Atlanta and Harrisburg, Pennsylvania, have remained relatively consistent in their increase in market share, rising 6.1% and 5%, respectively. February looks to be a continuation of January, in regard to the quiet freight market.

Who’s with whom? The chosen one incapable of being hit by the down market, RXO has at last shown it’s just like the rest of us. Finally having a not-perfect quarter did bring stock prices down 2.27% or 47 cents to $20.28. While a dip in stock price is not typically a good sign, this one did cause investors to move it to a buy stock, silver linings and such. The latest earnings certainly are not cause for concern but more a reminder that not everyone is perfect and even the untouchables can be affected by the same factors as everyone else.

After an interview with RXO Chief Strategy Officer Jared Weisfeld, FreightWaves’ John Kingston wrote, “that typically RXO has produced brokerage margins in the “midteens.” The 14.8% fourth-quarter performance was in that ballpark.”

RXO has placed itself in the perfect spot to ride out the rest of the down cycle. Personally, I’m hoping for a late spring turn in the market, but we’ll have to see what the excess capacity chooses to do.

The more you know

Borderlands: Zerio focused on technologizing global supply chain security compliance

AIT Worldwide Logistics elevates operations with LEED-Certified hub in Chicago Suburbs

Online grocer Misfits Market branches into third-party fulfillment

E-commerce fulfillment services market to observe strong growth by 2030

[ad_2]

Source link