[ad_1]

2023 was a challenging year for ocean carriers, especially those that have spot exposure. They have seen significant slashes to revenue and profitability.

Zim Integrated Shipping (NYSE: ZIM), a carrier with more spot exposure than some of the other large ocean carriers, saw a 61% year-over-year reduction in third-quarter revenue, and earnings before interest and taxes fell by $1.77 billion to a loss of $213 million. The Freightos Baltic Daily Index from China to the North American west coast in the third quarter was down 69% y/y.

Ocean spot market pricing was in decline for well over two years as the Drewry World Container Index – Global Composite peaked in September 2021 and then declined until October 2023, before stalling out the declines as ocean spot rates reached pre-pandemic levels.

The conflict in the Red Sea created by Houthi rebels firing on cargo vessels allowed ocean carriers to reap the benefits amid the sense of urgency and chaos. This created an environment that hadn’t been experienced since mid-2022, where ocean carriers were able to invoke a level of pricing power.

In the first six weeks after the Houthi attacks began, the Global Composite Index from Drewry increased by 170% to $3,732.70 per twenty-foot equivalent unit, which is the highest level the index has seen since September 2022. Likewise, the Freightos Baltic Daily Index – Global showed an increase from the beginning of December through the middle of January.

These rapid increases in spot rates will create a short windfall for carriers with the spot exposure, more than offsetting any increases in costs associated with rerouting around the Cape of Good Hope as opposed to navigating the Suez Canal. Ocean carriers that lean heavier into the contract market will likely not see boosts in a similar fashion as the increases in spot rates are unlikely to create significant or sustained upward pressure on contract pricing, but that won’t deter carriers from trying to generate more revenue.

Hapag-Lloyd announced a “Peak Season Surcharge” that began on Jan. 21 until further notice for $480 per TEU and $600 per forty-foot equivalent unit.

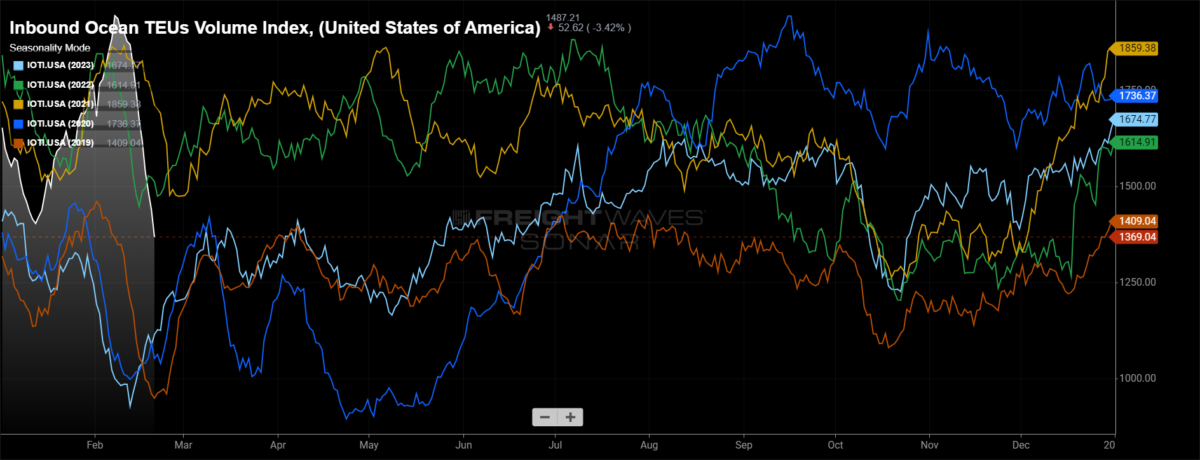

Ocean carriers are able to better deploy capacity for fluctuation to improve pricing conditions, but demand has to be there to justify long-term rate trends. Volumes from all global ports to the U.S. reached elevated levels as the pre-Lunar New Year pull forward was one of the strongest on record.

To learn more about FreightWaves SONAR, click here.

The Inbound Ocean TEUs Volume Index in SONAR reached one of the highest levels of all time ahead of the Lunar New Year holiday. The growth in volume from a year-over-year perspective is a signal that rate increases were appropriate given higher demand and that ocean carriers have reduced capacity.

With the Lunar New Year underway, the questions that are to be answered in coming weeks are how strong is demand following the holiday, and does it provide the footing needed to keep spot rates elevated into the stronger shopping periods of late March and early April?

To learn more about FreightWaves SONAR, click here.

Since the beginning of February, global spot rates have suffered declines. While those declines are not severe, they are an indication that the pricing power experienced throughout January is coming to a close. The Drewry World Container Index – Global Composite has dropped by 6% since its near-term peak of $3,964.18 per FEU in the week of Jan. 25. The Freightos Baltic Daily Index – Global, is down a little over 1% during the same period.

With the Red Sea conflicts continuing and ocean carriers scheduling routes to continue around the Cape of Good Hope well into April, the recovery from the Lunar New Year will be pivotal for the direction in which ocean container spot rates move in the coming months.

The inventory correction cycle is largely in the rearview mirror, but with inventory running at healthier levels, shocks to the supply chain, whether from the demand side or the capacity front, can create pricing environments that change rapidly.

[ad_2]

Source link