[ad_1]

Knight-Swift President and CEO David Jackson steps down

On Tuesday, Knight-Swift President and CEO David Jackson stepped down to be succeeded by Chief Financial Officer Adam Miller. FreightWaves’ John Kingston writes, “The change follows multiple quarters of depressed results, largely due to a prolonged freight recession, but also as the company’s third-party insurance venture has been operating at a loss. The business, which brokers liability coverage to small carriers, has suffered from unfavorable claims developments and has struggled to collect premiums from carriers during the downturn.”

Under Jackson’s tenure, the company completed many mergers and acquisitions, beginning with Knight Transportation acquiring Swift Transportation for $6 billion, the largest merger in U.S. trucking history. Knight-Swift then began an expansion into LTL in 2021 by acquiring AAA Cooper Transportation in July for $1.35 billion and MME in December. The most recent large acquisition was U.S. Xpress in March 2023 for $808 million, adding 7,200 tractors and 14,400 trailers to the Knight-Swift fleet.

The impact of Jackson’s decision to step down remains unclear. Satish Jindel, founder and president of ShipMatrix, told FreightWaves, “I expect this change would lead to greater attention and speed for KNX’s investment in LTL, which has been slow after acquiring AAA Cooper Transportation in July 2021 and MME for $150M in December 2021.”

Morgan Stanley analyst Ravi Shanker said on Tuesday: “We do not believe this change was precipitated by the discovery of bad news at USX or any other factor that would derail KNX’s current earnings trajectory. We believe the sudden and extreme step of a CEO change could be viewed by the Street as the Board showing urgency to put KNX back on a path to normalized EPS, which will be viewed as a positive.”

Shelley Simpson named CEO at J.B. Hunt

On Thursday, J.B. Hunt announced the appointment of Shelley Simpson as CEO of the company. She will also join the board of directors. Simpson has been J.B. Hunt’s president since August 2022. Before becoming president, Simpson had a decades-long career at J.B. Hunt. FreightWaves’ John Kingston writes, “In 2007, she was a founder of in-house brokerage Integrated Capacity Solutions and became its president. Simpson was named chief marketing officer in 2011 and head of the truckload segment in 2017. In that role, she led the launch of J.B. Hunt 360, the company’s digital platform. Human resources came under Simpson’s direction in 2020.”

There will also be a shift toward newer board members being added who do not have a J.B. Hunt background.

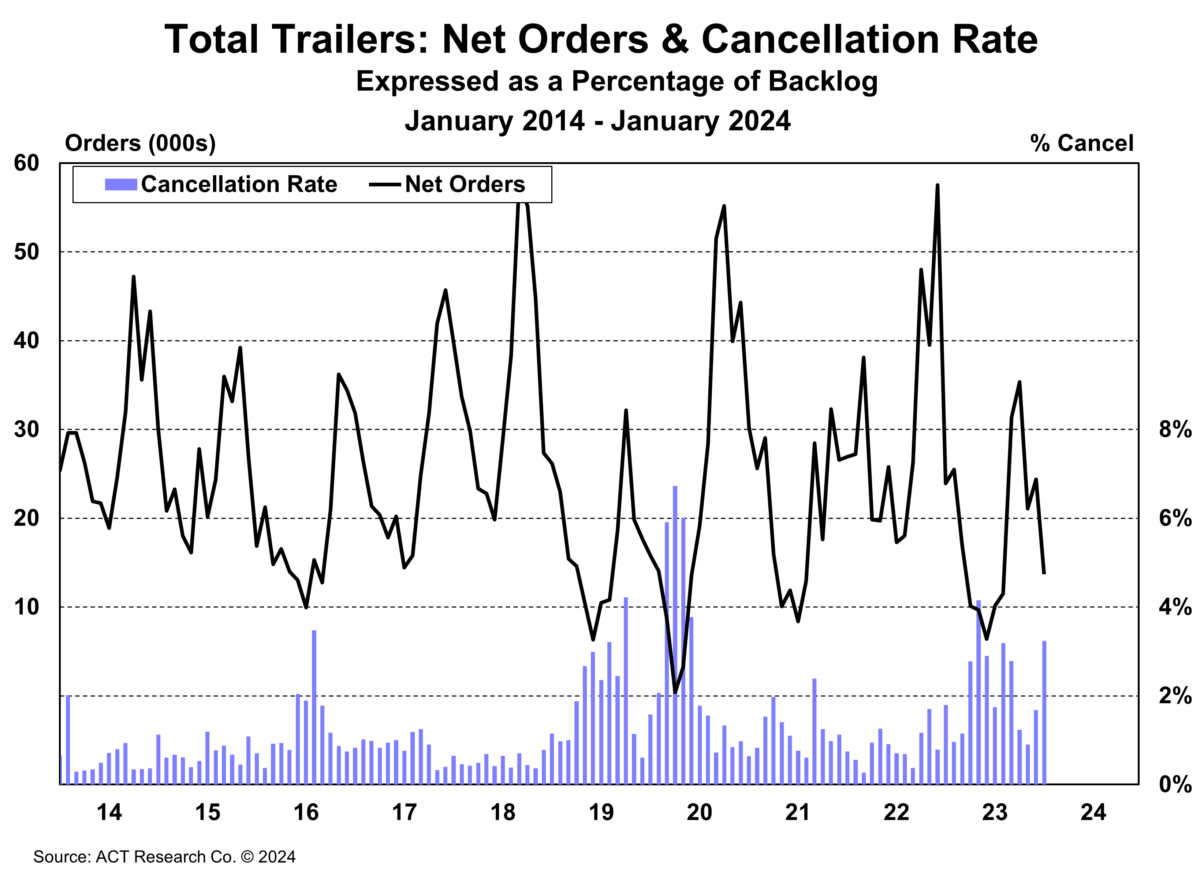

Market update: January trailer cancellations rise as orders fall

Recent trailer order and cancellation data from ACT Research points to higher declines in both categories as fleets cut equipment spending in the face of weak freight rates. January net trailer orders came in at 13,700 units, down 43% year over year and 10,700 units lower than December. Trailer cancellations also rose to 3.2% compared to 1.7% in December. Looking at order changes in detail, Jennifer McNealy, director-CV market research and publications at ACT Research, said in the report, “On a seasonally adjusted basis, dry van orders contracted 55% y/y, with reefers down 37%, and flats 34% lower compared to January 2023.”

For cancellations, changes in energy markets may be a factor. Mcneally added, “Digging down into cancellations, several markets led the way, including dry vans at 4.2% of backlog and lowbeds at 1.5%. Clearly, with markets swimming in capacity, no one needs a higher trailer-to-tractor ratio. Additionally, both tank categories reported high cancels this month, with liquid at 3.7% and bulk at 10.2%. We continue to believe recent oil price weakness may bear most of the culpability there.”

Part of the reason for lower equipment orders and higher cancellations may be that fleets have largely finished upgrading their assets after being delayed from pandemic-related supply chain and labor backlogs. Schneider President and CEO Mark Rourke noted on the company’s Q4 earnings call, “Our CapEx guidance range of $400 million to $450 million is down fairly considerably from a year ago because of the catch-up with the OEMs and the age of fleet.” J.B. Hunt noted a similar sentiment. Nick Hobbs, executive vice president, president of contract services and COO at J.B. Hunt, said on the Q4 earnings call, “We have cleaned out our older equipment and feel our fleet is refreshed and in good position heading into 2024.”

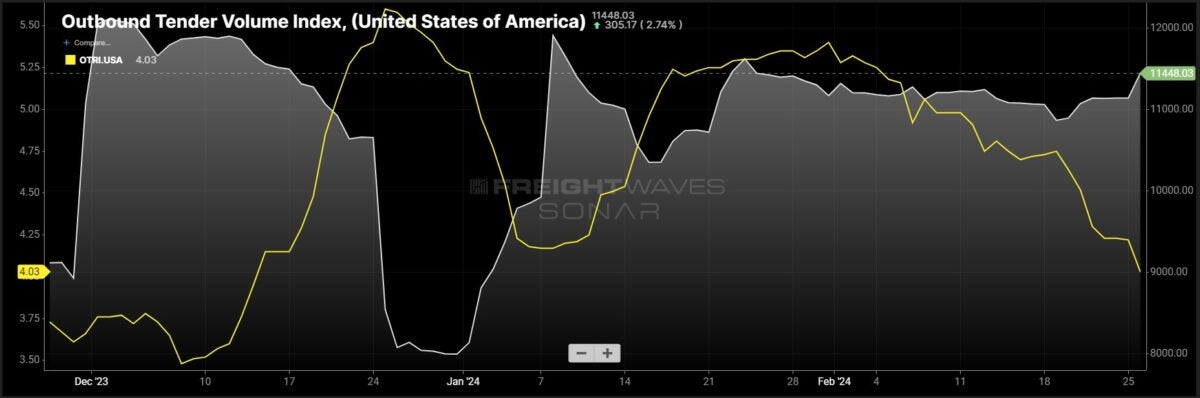

FreightWaves SONAR spotlight: Outbound tender volumes jump

Summary: Outbound tender volumes climbed in the past week while outbound tender rejection rates continued their monthlong decline. OTVI rose 579.01 points or 5.3% w/w from 10,869.02 points on Feb. 19 to 11,448.03 points. In spite of stronger contracted volumes, tender rejection rates continued to fall, by 72 bps w/w from 4.75% on Feb. 19 to 4.03%. The current outbound tender volume level is the highest since the last week of January.

For shippers, the improving tender compliance is a positive sign as they start moving into spring, when volumes traditionally pick up from the beginning of produce season. The challenge for carriers remains utilization and balancing customer tender compliance needs if any ad hoc or pop-up business is offered by shippers. Given declining tender rejection rates, incumbent carriers will feel additional pressure to maintain service levels, with carriers further down the routing guide soliciting for additional volumes before attempting to secure loads on the spot market.

The Routing Guide: Links from around the web

Bills in Wisconsin, Indiana could reduce nuclear verdicts against carriers (FreightWaves)

Deadline nears for filings as Werner seeks review of nuclear verdict (FreightWaves)

BMO’s Q1 earnings show more credit deterioration in trucking industry (FreightWaves)

ATRI calls on carriers to share operational costs (Trucking Dive)

Trucking bankruptcies fuel ‘hyper-competitive’ insurance marketplace (Insurance Business Mag)

Morgan Stanley cuts earnings expectations amid surging insurance costs (FreightWaves)

Like the content? Subscribe to the newsletter here.

[ad_2]

Source link