[ad_1]

Renewable natural gas, battery-electric and hydrogen-powered trucks all target fleets switching from diesel ahead of coming regulations requiring costly additional emissions after-treatment. Which alternative will win? Possibly all of them.

Back in 2018, Anheuser-Busch placed an initial order for up to 800 Nikola fuel cell trucks. Ever so slowly, that is becoming a reality.

After numerous missteps and setbacks, Nikola produced 42 hydrogen-powered fuel cell trucks in the last three months of 2023. Of 35 delivered to dealers, most customers ordered them in ones and twos. The $450,000 trucks qualify for $240,000 vouchers from the state of California.

Longtime Nikola supporter Biagi Brothers took 10 for operations in Southern California. It hopes to apply some of its remaining 10 vouchers to add five or six more by the end of the year.

“We wanted to get in on the incentive funds,” Gregg Stumbaugh, Biagi corporate equipment director, told me. “With the $240,000 grants from California, the truck ends up being cheaper than a diesel.”

Biagi is a longtime third-party dedicated freight hauler for Anheuser-Busch with 90-100 Class 8 day cabs serving the beverage maker.

Crushed aluminum cargo

The 10 Nikola fuel cell trucks each haul 9,000 pounds of empty beer cans . They travel 145 miles from Ontario, California, to Anheuser-Busch’s Van Nuys production facility several times a day. Like the Frito-Lay snacks cubing out trailers hauled by Tesla battery-electric Semi trucks, Biagi is starting with light loads for the fuel cell trucks.

Why not haul beer?

“We’ve loaded the truck with beer — 81,600 pounds — and driven over the [Interstate 5] Grapevine. We have to be selective on what applications we use it for,” Stumbaugh said.

Biagi helped test the road worthiness during development of the Nikola fuel cell electric vehicle (FCEV). It ran two-truck pilots in 2022 and 2023. They have plenty of oomph. But the roughly 25,000-pound weight of the tractor, a 13,000-pound trailer and 9,000 pounds of empties is enough for now. A typical load of beer weighs in at 47,000 pounds. The math doesn’t work.

“Two things have to happen,” Stumbaugh said. “The truck has to get lighter or the weight allowance has to go up to at least 85,000 pounds.” Since neither is likely soon, the beer loads will move on the 22 diesel trucks Biagi deploys out of Van Nuys.

Is CNG about to have a moment?

The Nikola FCEV production units replaced some of Biagi’s 16-18 compressed natural gas (CNG) powered trucks. They have been switched to other uses.

Biagi is quoting an order of 10 trucks with regular production of the Cummins X15N natural gas engine by midyear. Kenworth delivered the first X15N-equipped T680 on Feb. 20 to UPS, a longtime CNG user.

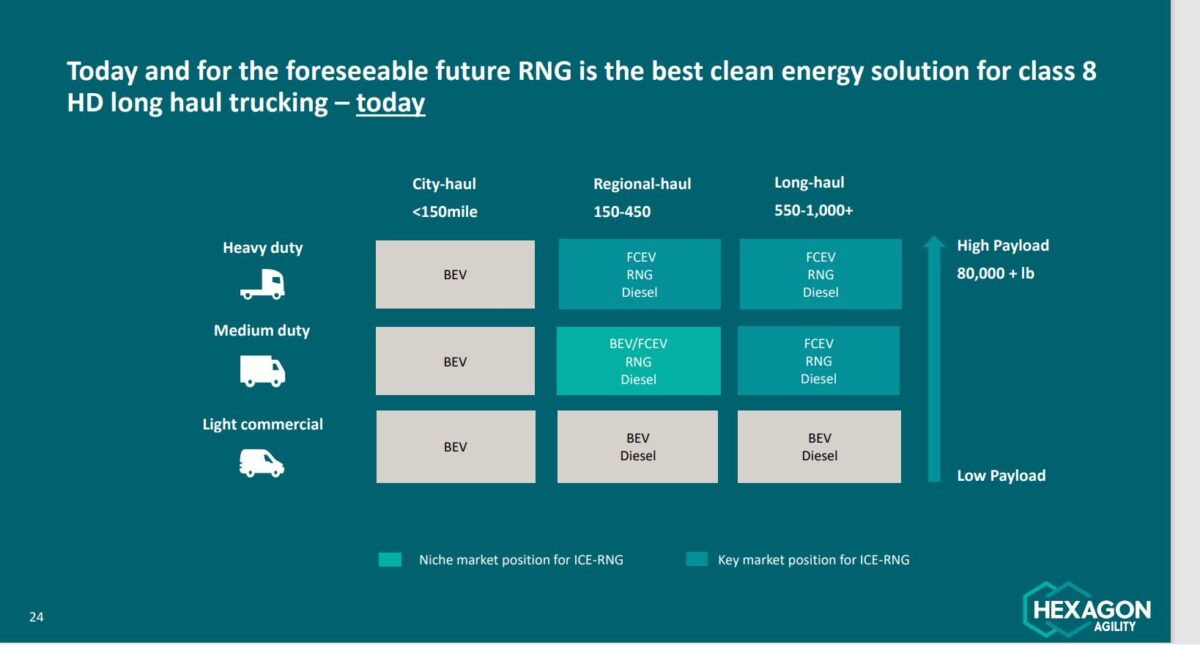

Running on renewable natural gas (RNG), smog-forming nitrogen oxide emissions should fall below expected Environmental Protection Agency standards set to take effect in 2027, according to Greg Bippus, executive vice president of sales and systems development at natural gas tank and system developer Hexagon Agility.

Diesel trucks will need a second after-treatment system to meet the proposed standards, he said.

Cummins projects fivefold increase in new engine option

Though compressed natural gas (CNG) tractors cost more than diesel units, the return on investment is a relatively quick 18 months. CNG fuel costs less than diesel. When renewable natural gas (RNG) made from dairy waste and other organic matter is used, the emissions profile can result in negative net carbon emissions.

RNG infrastructure is growing. Clean Energy Fuels Corp. is opening two new fueling stations. One is near Dallas Fort Worth International Airport. The other in south Dallas is close to Interstates 45, 35 and 20 adjacent to dozens of distribution centers. Clean Energy has more than 600 RNG fueling stations.

Cummins projects a fivefold increase in the take rate for its X15N big bore engine. It is capable of 400-500 horsepower and 1,450-1,850 pound feet of torque. It expects to make 3,000 X15N engines this year. The company sees a potential 10% penetration of the Class 8 market compared to a historical take rate of 1% to 2%.

“This is an engine that has been used over a million miles in China already,” Bippus said. “So this is a technology that’s advanced, that’s mature. And when you look at today’s heavy-duty truck fleet, 97% of all heavy-duty trucks going down the road today are still diesel. So when you talk about 10% of a 300,000-to-350,000-unit market, it’s quite significant for us.”

Hexagon is building a 113,000-square-foot addition to its plant in Salisbury, North Carolina, where it will make CNG tanks, augmenting production in Lincoln, Nebraska.

For marketing purposes, Cummins on Thursday rebranded its next-generation fuel-agnostic B6.7, X10 and X15 engines as HELM, a loose acronym for Higher Efficiency. Lower emissions. Multiple fuels.

Electric truck infrastructure advances with NFI depot opening

With the possible exception of the Tesla Semi, battery-electric trucks are not ready for regular long-haul use. But they are solidifying their place in port drayage. After months of delays, NFI Industries on Tuesday showed off its new — and heavily subsidized — electric truck charging depot in Ontario.

NFI uses about 90% electric trucks for drayage runs from California’s Inland Empire to the ports of Los Angeles and Long Beach. Two runs require about 220 miles of driving range, easily accomplished by its Class 8 Freightliner eCascadia and Volvo VNR Electrics.

Its battery-electric fleet collectively has accumulated more than 2 million miles, eliminating the equivalent of 307,692 gallons of diesel fuel while avoiding 3,415 metric tons of greenhouse gas emissions.

Generous incentives benefit NFI and Schneider

NFI and Schneider received significant incentives for 50 trucks each from the Joint Electric Truck Scaling Initiative, which received $27 million in funding from the California Air Resources Board and the California Energy Commission. Schneider opened a smaller electric depot in El Monte in June.

The NFI installation eventually will use 7 megawatts of electricity to direct-charge as many as 38 trucks at a time at up to 350 kilowatts. A solar-powered microgrid will add 1 megawatt of stationary power to the site to reduce charging at peak times.

Briefly noted …

The MirrorEye Camera Monitor System from Stoneridge that replaces bulky side mirrors will be featured on Volvo’s new VNL over-the-road Class 8 truck in 2025.

Workhorse Group has added its fifth dealer partner in California to sell its lineup of battery-electric commercial step vans and chassis.

Navistar has begun fleet deliveries of the S13 integrated powertrain in its International LT Series, its last internal combustion engine program.

S&P Global Mobility reports the U.S. commercial vehicle market grew 14% in 2023 with Class 6 leading the way at 18%.

Startup electric infrastructure provider Voltera has invested $150 million to bring its number of charging sites to 21, with plans to double that by the end of 2024.

Range Energy has $23.5 million in new funding to accelerate its work on customer pilots of its electric-powered trailers.

Kodiak Robotics is working with Martin Brower to use human-supervised autonomous trucks to haul quick service restaurant food between Dallas and Oklahoma City.

Truck Tech episode No. 56: Is natural gas the next big thing — again — in truck fuel?

That’s it for this week. Thanks for reading and watching. Click here to get Truck Tech via email on Fridays. And catch the latest in major events and hear from the top players on “Truck Tech” at 3 p.m. Wednesdays on the FreightWaves YouTube channel.Your feedback and suggestions are always welcome. Write to [email protected].

[ad_2]

Source link