[ad_1]

With economies cooling and COVID more manageable, the general thinking has been that companies would see the workforce shortages of the past few years subside; however, this does not appear to be the case. Post-pandemic, organizations are still struggling with labor shortages, as well as knowledge workers and the leaders they need to thrive.

With economies cooling and COVID more manageable, the general thinking has been that companies would see the workforce shortages of the past few years subside; however, this does not appear to be the case. Post-pandemic, organizations are still struggling with labor shortages, as well as knowledge workers and the leaders they need to thrive.

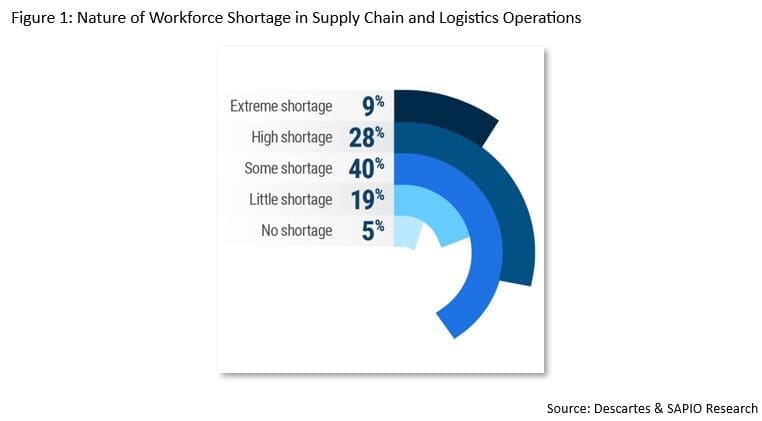

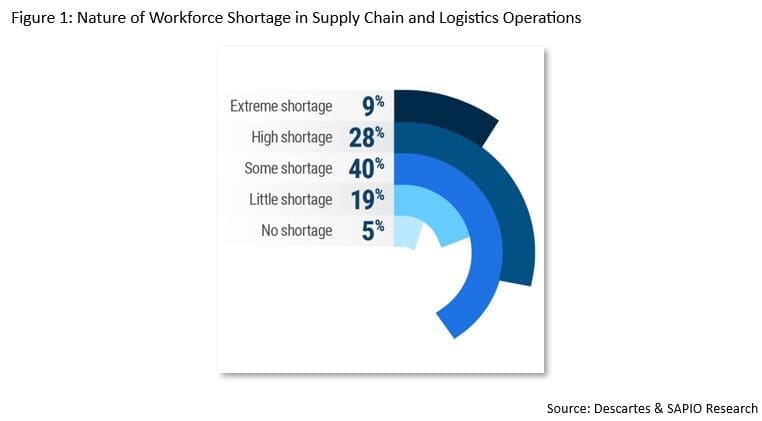

In late 2023, we conducted a survey of 1,000 supply chain and logistics decision-makers across North America and Europe across three sectors: manufacturing, distribution and retail; carriers; and logistics services providers. The goal was to understand the nature of any workforce shortages they were facing and the impact of resource constraints on their operations and business success. The results of the research report How Bad Is the Supply Chain and Logistics Workforce Challenge? is not a ‘good news’ story. The study shows that the labor shortage has not abated, with 76% of respondents indicating they are facing notable shortages. While there are structural issues (see Resource Shortage: Is the Pandemic Masking a Much Bigger Problem for Supply Chains in the Future?) that suggest shortages will persist indefinitely, here are three charts that paint the picture of—in the supply chain and logistics industry—how acute the issue is today, the areas affected most by it, and the positions that are hardest to fill.

Workforce shortages are severe and they are taking a toll on customer service.

While over three quarters of respondents indicated they are contending with notable labor shortages, 37% cited their resource constraints (e.g., drivers and warehouse workers) as high to extreme (see Figure 1). Only 5% said they were facing no shortages and just 19% characterized shortages in their organizations as little. For respondents in C-level positions, the high to extreme shortage number climbed to 46%. Even in organizations where respondents indicated they had better-than-average employee turnover, the high to extreme number rose to 44%.

Given supply chain and logistics operations are resource-intensive, it’s not surprising that workforce shortages in this area can undermine customer service performance. According to the study, 30% of respondents indicated customer service was very to extremely impacted by resource constraints while only 12% said it was not affected in any way. For companies where respondents indicated they had industry-leading business performance, the very to extremely impacted number rose to 49%. Equally insightful was the effect of management’s view of the importance of supply chain and logistics operations: when supply chain and logistics is seen as a necessary evil, customer service is significantly more impacted (51%) by labor shortages compared to when it is seen as a competitive weapon (29%).

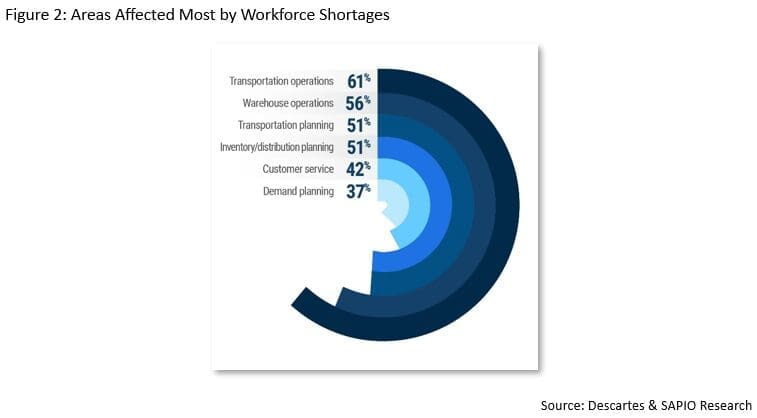

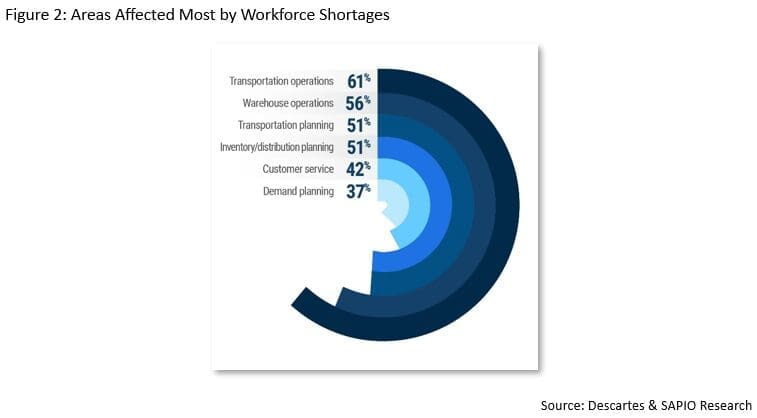

Labor-intensive transportation and warehouse operations are suffering the most.

While all facets of supply chain and logistics operations are competing for resources, how acute the issue is varies by function. Labor-intensive transportation operations (61%) and warehouse operations (56%) were the areas noted as suffering the most from resource shortages (see Figure 2). For respondents with worse-than-average employee turnover in their transportation operations, the number increased to 65%. For those with better-than-average employee turnover, the figure decreased to 57%.

In addition, many organizations rely heavily on logistics partners to execute resource-intensive warehouse and transportation operations. According to the survey, only 9% of respondents indicated that their logistics partners’ performance was not impacted by workforce shortages whereas 36% said it was very to extremely impacted.

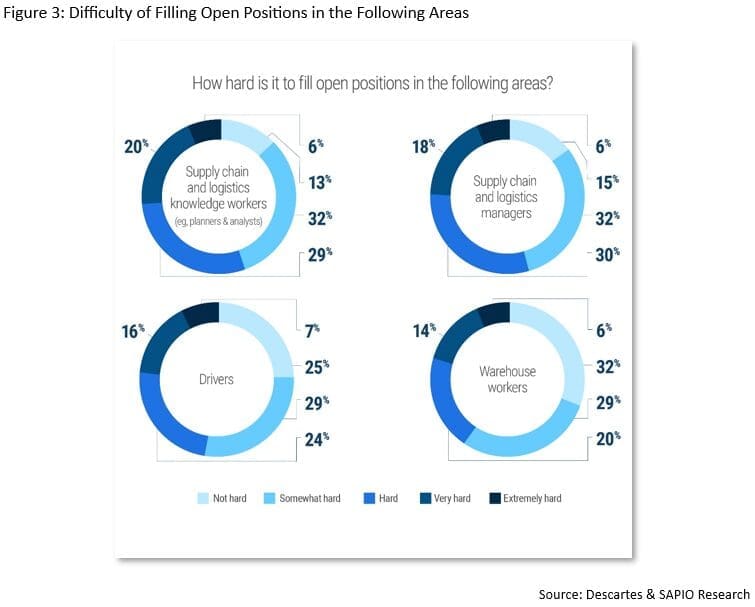

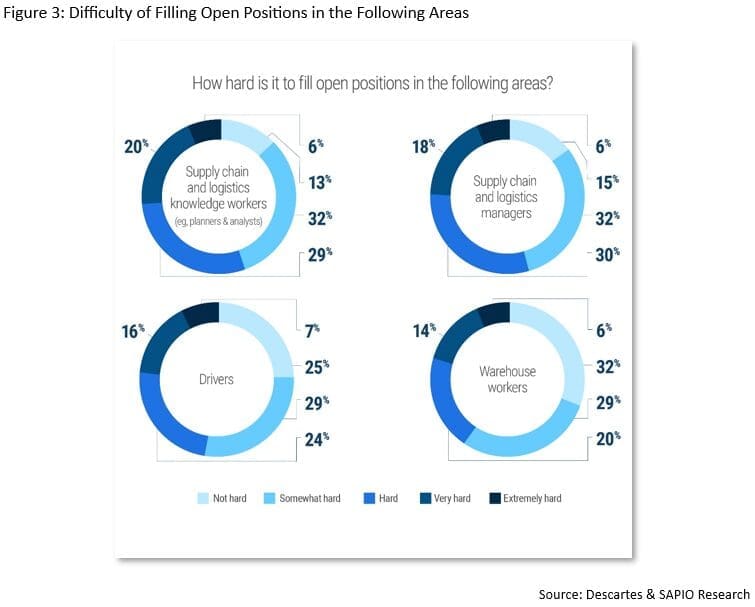

Knowledge workers are the hardest to hire and becoming more important.

Today’s high-performing supply chain and logistics operations are rich in data generated by real-time GPS-based mobile applications and advanced logistics and analytics solutions. As a result, they now require a growing number of knowledge workers in addition to a full complement of laborers. According to the survey, 55% of respondents indicated that positions for knowledge workers (e.g., planners and analysts) were the hardest to fill (see Figure 3), closely followed by 54% who said positions for managers were the most difficult. Almost one-third (32%) said replacing warehouse workers was not hard, compared to only 13% for knowledge workers. Interestingly, 26% of competitive weapon respondents characterized filling manager positions as very to extremely hard while 40% of necessary evil respondents did.

Supply chain and logistics success is driven by the quantity and quality of the workforce. Supply chain and logistics leaders need to rethink strategies for hiring and retaining workers and for using technology to help mitigate current and future labor shortages. How is your organization addressing the workforce challenge? Let me know.

As Executive Vice President, Solutions and Services, Chris Jones is primarily responsible for Descartes industry consulting and implementation services for Descartes’ solutions. With over 40 years of experience in the supply chain market, Chris has held a variety of leadership positions including: Senior Vice President at The Aberdeen Group’s Value Chain Research division, Executive Vice President of Marketing and Corporate Development for SynQuest, Vice President and Research Director for Enterprise Resource Planning Solutions at Gartner and Associate Director Kraft General Foods. Chris is a thought leader in logistics and has numerous articles and blog posts published in leading logistics and supply chain publications and online forums across the globe. He has a Bachelor of Science in Electrical Engineering from Lehigh University.

[ad_2]

Source link