Zim, the world’s 10th-largest container line operator, has sunk into the red as its boom-era contract coverage has crumbled under the weight of falling spot rates.

The Israel-based company reported first-quarter results Monday that were much worse than expected, causing a double-digit plunge in its share price in quadruple average trading. Shares (NYSE: ZIM) were down as much as 17%.

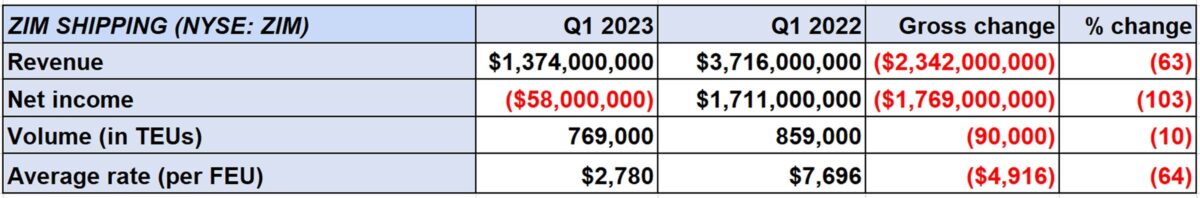

Zim reported a net loss of $58 million for the first quarter of 2023 compared to net income of $1.71 billion in Q1 2022. The analyst consensus was for earnings per share of 18 cents. Zim wasn’t even close. It posted an adjusted net loss of 50 cents.

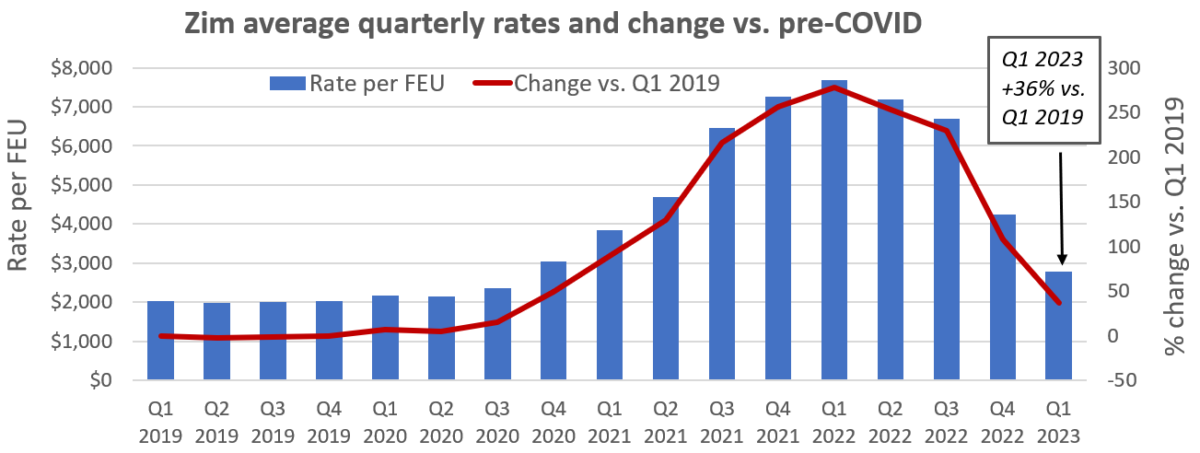

Average freight rates sank to $2,780 per forty-foot equivalent, down 64% year on year and 35% sequentially versus the fourth quarter.

Rates were still up 36% versus Q1 2019, pre-COVID. But even so, Zim’s net loss was over twice as large in the latest period; net losses were $24.4 million in Q1 2019.

On a positive note, Zim still has an extremely large cash cushion to fall back on during the downturn, courtesy of windfall profits during the pandemic. It has total liquidity of $3.5 billion following the payout of its latest dividends, compared to $240 million pre-COVID. No dividends will be paid for the first quarter, given the loss.

Average rates fall faster than competitors’ rates

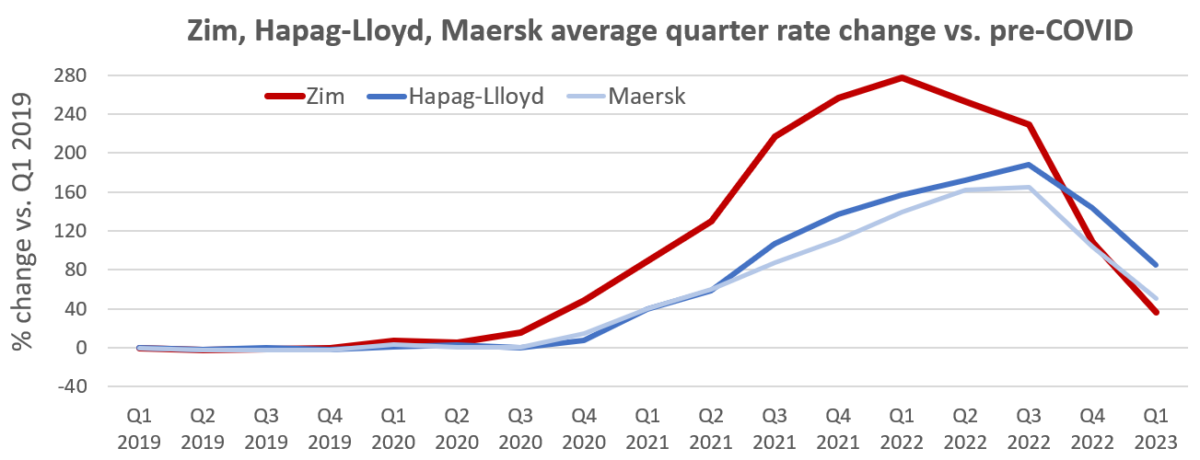

Zim is more exposed to the spot market and has a higher percentage of its capacity in the trans-Pacific than larger ocean carriers such as Maersk and Hapag-Lloyd.

This allowed Zim to outperform its rivals during the boom via higher average rates (including contract and spot). But it’s now paying the price for that strategy. Its average rates and earnings are declining faster than those of more contract-focused and geographically diversified carriers.

Maersk and Hapag-Lloyd’s earnings and average rates didn’t peak until Q3 2022. Zim’s peaked much earlier, in Q1 2022.

Other carriers continued to post strong results through the first quarter of this year, buoyed by high rates on one-year contracts that ran from May 1, 2022, to the end of last month. Maersk posted net income of $2.3 billion in the first quarter; it had a net loss of $656 million in Q1 2019. Hapag-Lloyd reported net income of $2 billion in the first quarter, 19 times profits in Q1 2019.

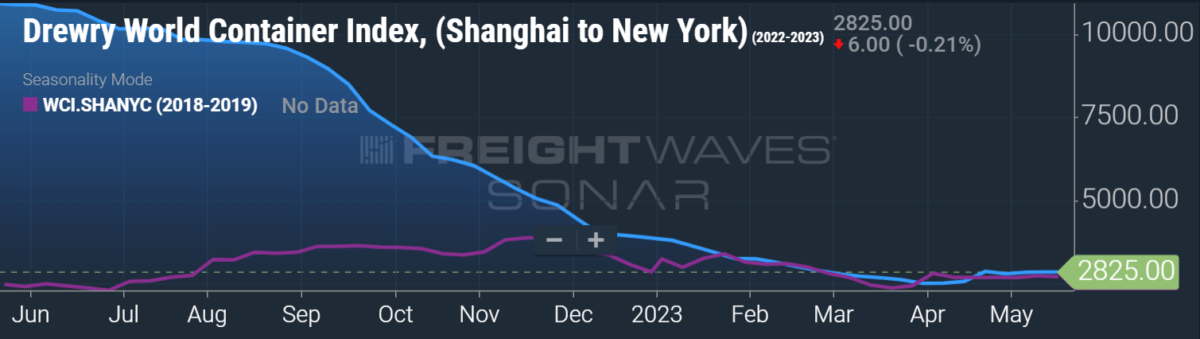

Trans-Pacific spot rates fell below contract rates starting Q3 2022, but carriers such as Maersk and Hapag-Lloyd claimed shippers continued to honor most of their contracts.

Maersk and Hapag-Lloyd executives said they did not reset high 2022 annual rates lower in midcontract to placate customers in the face of falling spot rates. They reported average rates and earnings that supported those comments.

CFO: Zim ‘fully exposed to the spot market’

“You have two types of rates. One is spot, the other is contract,” said Hapag-Lloyd CEO Rolf Habben Jansen on a call last August. “A contract means you commit yourself to a certain rate. There’s always a risk that during some periods, the spot rate is lower.

“But that’s no reason to say, ‘OK, we will lower the contract rate. That would mean the contract rate is a combination of a [fixed] rate and a downward adjustment if the spot rate is lower. If you do that, there’s no reason to have contracts anymore. It wouldn’t make any sense. That’s why we have two types of rates.”

Zim clearly has a different view.

The company’s CFO, Xavier Destriau, confirmed on a call in November that the company’s May 2022-April 2023 trans-Pacific contracts were reset lower in an effort to maintain long-term customer relationships.

Just how much Zim renegotiated those contracts became clear on Monday’s conference call. Destriau disclosed that the upside from legacy 2022 contracts was already completely wiped out in the first quarter.

“The decline in Q1 revenues was driven by our disproportionate exposure to the trans-Pacific trade and the absence of 2022 contract revenue tailwinds,” he said. “We do not benefit from any contract rates we may have secured last year on the trans-Pacific trade lane, so we are largely already today fully exposed to the spot market.”

Zim pins hopes on hypothetical H2 bounce

Zim reaffirmed its full-year guidance on Monday, a decision Jefferies analyst Omar Nokta dubbed “surprising.”

That guidance calls for full-year earnings before interest, taxes, depreciation and amortization of $1.8 billion to $2.2 billion and earnings before interest and taxes of $100 million to $500 million. Even before Monday’s big Q1 earnings miss, the company’s guidance was above analyst consensus for EBITDA of $1.55 billion and an EBIT loss of $95 million.

Zim executives had little positive to say about the second quarter during Monday’s call, implying that all or virtually all of the gains they predict would have to come in the second half.

“Our underlying assumption [is for] improved freight rates and growth in volume driven by the end of the destocking cycle, with improved results in the second half compared to the first half,” said Destriau.

But this assumption remains theoretical. Zim doesn’t see an actual demand rebound yet. “Demand is still weak,” the CFO acknowledged. “The beginning of the second quarter was very much a continuation of the market environment that prevailed over the first quarter.”

Zim took contract pain earlier than competitors

The silver lining of Zim’s failure to hold the line on 2022 contracts is that it does not face the large second-half step down in contract rates that several other carriers do.

Maersk CEO Patrick Jany said during his company’s conference call that Q1 2023 “will represent the peak quarter of the year. The progressive erosion of contract rates toward spot levels will be the main element determining profitability in the next quarters.”

In other words, as Maersk’s new trans-Pacific contracts kick in, average freight rates, including both contract and spot components, will decrease as the year progresses.

Not so with Zim. It doesn’t face sequential pressure from the replacement of legacy contracts because it already lost the benefit of those contracts before the year began. Consequently, it doesn’t assume Q1 will be the peak of 2023, as Maersk does.

“We should not expect additional headwind in the quarters to come [from lower contract rates] as we already no longer had any tailwind supporting our revenue in the first quarter of 2023,” said Destriau.

New trans-Pacific contracts still not signed

Meanwhile, the current contract season does not sound like it’s going smoothly for Zim. Contract talks should have been done by now. They aren’t.

The carrier is targeting 50% contract coverage in the trans-Pacific, as in prior years. However, it has more contract volume to fill in 2023 because its newbuildings deployed in its Asia-East Coast service have higher capacity.

“Contract negotiations are still ongoing as we speak,” admitted Destriau. “They are taking longer. Some of our customers are still holding on [before] committing and agreeing to a rate.”

He explained, “Most of the trade lanes we’re currently operating in are generating revenue that does not allow us to absorb costs. We think that spot rates on most of the east-west trade lanes are not sustainable in the long term.”

Zim will not sign loss-making contract rates in line with current spot rates. “We are not doing that, which explains why we are not yet, at this time of year, fully finalized when it comes to agreeing with our customers on volume and rate commitments for the next 12 months,” said Destriau.

“It is precisely because some of our customers are pushing for rates below the minimum level we are willing to go — that is why it’s taking a little bit longer. We do not intend to lock ourselves into loss-making cargo.”

Click for more articles by Greg Miller

Related articles:

Future of Supply Chain

JUNE 21-22, 2023 • CLEVELAND, OH • IN-PERSON EVENT

The greatest minds in the transportation, logistics and supply chain industries will share insights, predict future trends and showcase emerging technology the FreightWaves way–with engaging discussions, rapid-fire demos, interactive sponsor kiosks and more.

[ad_2]

Source link