[ad_1]

Weekly highlights

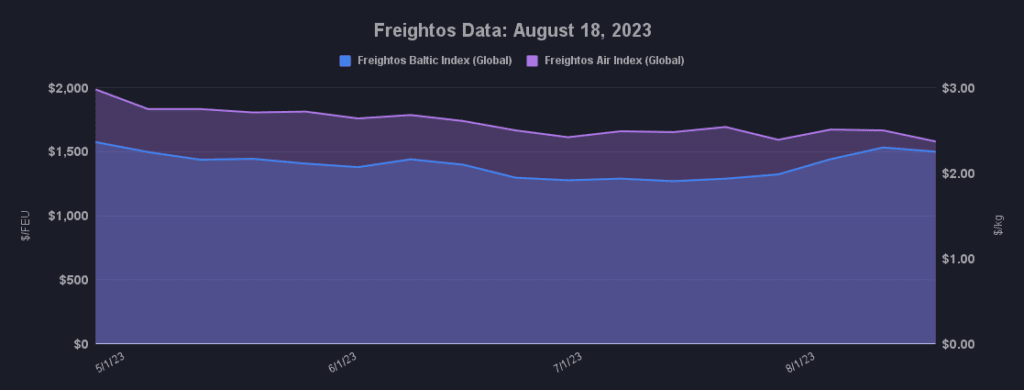

Ocean rates – Freightos Baltic Index:

- Asia-US West Coast prices (FBX01 Weekly) ticked up 1% to $1,936/FEU.

- Asia-US East Coast prices (FBX03 Weekly) climbed 3% to $2,991/FEU.

- Asia-N. Europe prices (FBX11 Weekly) fell 5% to $1,708/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) fell 3% to $2,327/FEU.

Air rates – Freightos Air index

- China – N. America weekly prices increased 7% to $3.81/kg

- China – N. Europe weekly prices were level at $3.00/kg.

- N. Europe – N. America weekly prices fell 1% to $1.74/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Low water levels driving weight restrictions and reductions in daily Panama Canal transits has created a backlog of about 150 ships waiting – some for more than a week – for passage.

This number leveled off last week, and though the congestion is causing significant delays for many bulk vessels, container ship traffic – most of which moves via scheduled transits booked well ahead of time and given priority over other types of vessels – has not faced significant disruptions. Reports of shippers diverting containers to the West Coast or via the Suez have been minimal, though ships unable to book ahead must bid for available slots and can pay as much as $1 million for a slot, adding extra costs and some time waiting.

In terms of the impact on freight rates, some carriers introduced surcharges for containers moving through the canal when the first restrictions were announced in June. But even with those and the additional restrictions that started at the end of July, rates to the East Coast have increased less than those to the West Coast.

Spot rates have increased about $600/FEU to both coasts since mid-July, with West Coast rates currently at $1,936/FEU and East Coast prices at $2,991/FEU. But this climb represents a 47% increase for West Coast rates and only a 26% increase for East Coast prices. Likewise, East Coast rates are only 12% higher than August 2019 levels, while West Coast prices are 46% higher than pre-pandemic.

Reports of nearly full transpacific vessels, and carriers limiting contracted shippers to their allocations, indicate that capacity is about matching current demand levels – which have increased steadily since June – and is pushing rates up. Analysis showing that carriers are removing less capacity than in July suggests that the demand increase is playing a significant role in the successful August General Rate Increase, though other measures have August’s blank sailings about even with July.

But the persistence of capacity management measures during what is likely the peak of this year’s peak season, and the fact that new vessels will continue to enter the market, point to the general state of overcapacity in the market and the possibility that we may be reaching this year’s rate peak too.

As such, some congestion caused by canal restrictions is an additional factor reducing capacity somewhat and helping carriers push rates up, but – barring additional significant canal restrictions – the worst of the impact could likely occur in the near term and ease as demand subsides.

Some shippers via the Panama Canal will likely experience delays in receiving shipments, but with excess capacity available in the market – and more coming soon – there should be enough slack and alternatives, if necessary, to keep rates from reaching extreme heights.

Asia – N. Europe rates dipped 5% last week, but at $1,708/FEU remain 31% higher than in July, as carriers increase capacity reduction measures to hold on to the GRI gains even as new capacity will continue to enter this lane too.

Transatlantic rates dropped sharply this week as capacity added to the lane over the course of the year has outstripped declining demand. Carriers have announced September GRIs alongside increases in blanked sailings to try and push rates back up to profitable levels, with current rates of $1,308/FEU 25% below 2019 levels.

The air cargo charter market is likewise facing overcapacity challenges, with some carriers grounding freighters until a hoped-for rebound in December. Freightos Air Index data show transpacific rates increased 7% last week to $3.81/kg, with Asia – Europe prices stable at $3/kg and transatlantic rates ticking down 1% to $1.74/kg.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.

[ad_2]

Source link