Freight transportation markets inched closer to equilibrium in August, according to data compiled in the Logistics Managers’ Index (LMI).

The Tuesday report displayed a reading of 60.5 for transportation capacity during the month, which is still well into expansion territory but the slowest growth rate logged since April 2022. The subindex was 5.1 percentage points lower than in July.

The impact from less-than-truckload carrier Yellow’s exit was not quantified in the report. The carrier was operating 12,700 tractors at the end of last year.

A reading above 50 indicates expansion while one below 50 signals contraction.

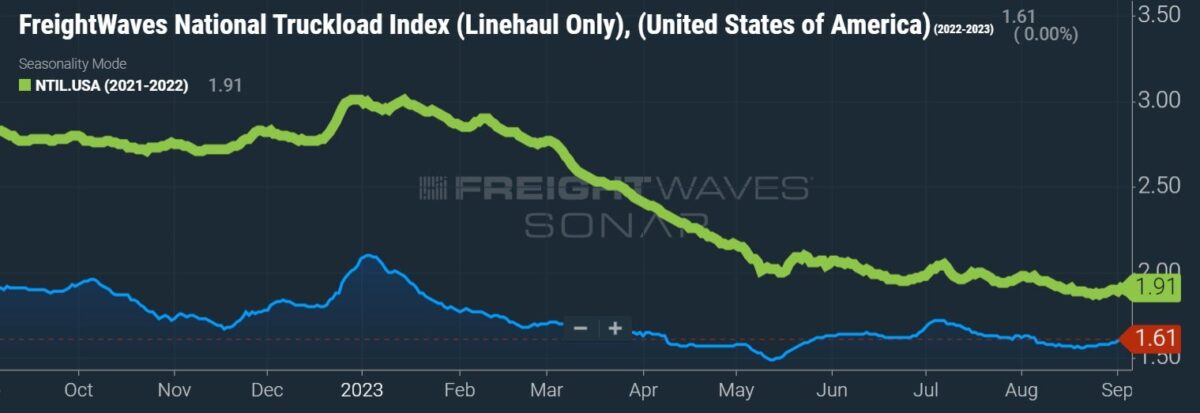

Transportation utilization (50) increased 8.2 points in August and moved out of contraction territory for the first time since April. Transportation prices (42.9) continued to decline but at a slower pace. The pricing subindex improved 7.3 points from July to the highest reading since last September.

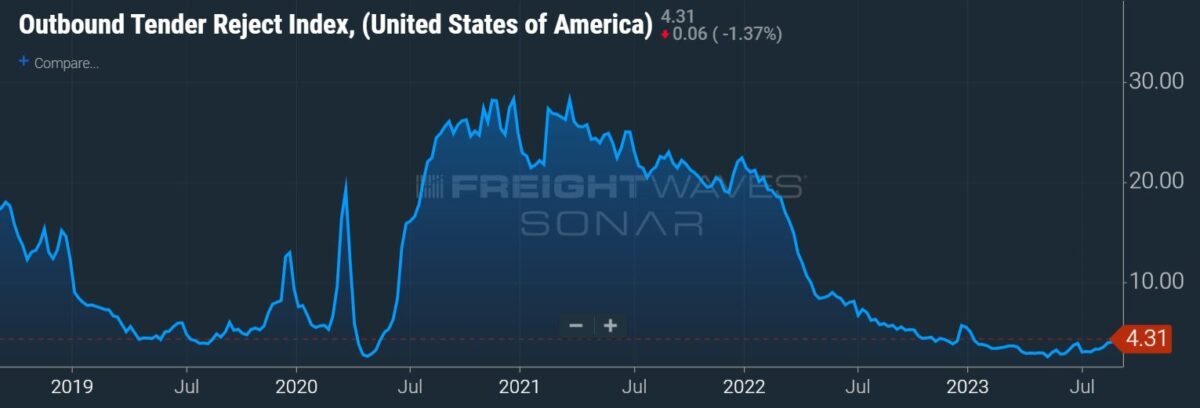

“Transportation markets are nowhere near a full recovery to the levels we saw from Summer 2020 to early 2022, but it is possible we are now seeing concrete steps moving out of the freight recession,” the report said.

Supply chain professionals were asked to predict where various components of the LMI would stand one year from now. The group returned a bullish reading of 65.3 for transportation prices.

Inventory levels (47.9) contracted again but at a rate that was 6 points slower than in July. The slowing of inventory drawdowns pushed inventory costs (69.1) and warehousing prices (63.4) higher.

Aggregate logistics costs, which include inventory costs and warehouse and transportation prices, increased 18.6 points in the month to 175.3 (150 is a neutral level for the index). This was the highest level since February but well below the March 2022 peak of 271.3.

The report noted that many retailers and wholesalers have redeployed just-in-time inventory strategies following the pandemic as demand for goods has cooled. These firms have been able to lower supply chain costs by carrying reduced merchandise levels. However, the forward-looking expectation from the group is for inventories to expand again within the next year. The one-year estimate for the inventory levels subindex was 54.3.

The report showed warehouse utilization (57.8) remained in expansion territory even as new facilities continue to come on line. This was the highest level for the subindex since March, when many firms were still working off excess inventories from the fourth quarter.

Warehouse capacity (60.8) expanded for a seventh straight month. The subindex broke 60 for the first time in June and has stayed above that level since.

The overall LMI (51.2) expanded for the first time in four months.

The LMI is a collaboration among Arizona State University, Colorado State University, Florida Atlantic, Rutgers University and the University of Nevada, Reno, conducted in conjunction with the Council of Supply Chain Management Professionals.

More FreightWaves articles by Todd Maiden

NOVEMBER 7-9, 2023 • CHATTANOOGA, TN • IN-PERSON EVENT

The second annual F3: Future of Freight Festival will be held in Chattanooga, “The Scenic City,” this November. F3 combines innovation and entertainment — featuring live demos, industry experts discussing freight market trends for 2024, afternoon networking events, and Grammy Award-winning musicians performing in the evenings amidst the cool Appalachian fall weather.

[ad_2]

Source link