[ad_1]

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

A break in the clouds

After an eventful January in which carriers benefitted from unseasonal tightness caused by severe winter storms, I argued that freight markets were showing signs of a lasting recovery. I took pains to clarify that this recovery was not going to be a roller coaster of unstoppable growth, that it was instead a gradual rebalancing of market dynamics. Even with that caveat, the recent performance of tender rejections and spot rates has been more disappointing than I expected — as will be discussed below.

But before moving onto the doom and gloom, I want to restate my bull case for the coming months. Even as carriers’ pricing power deteriorated, freight demand was consistently robust throughout February. Looking forward to the months ahead, there is still significant room for growth as Chinese imports hit the West Coast in the coming weeks. The early stages of produce season are forecast to see yearly growth in Texas and Florida, helped in part by El Niño’s weather patterns. Activity in the construction sector will be aided by federal funds allocated to manufacturing, transportation infrastructure and energy infrastructure, while homebuilders project an even better year ahead than the already-busy 2023.

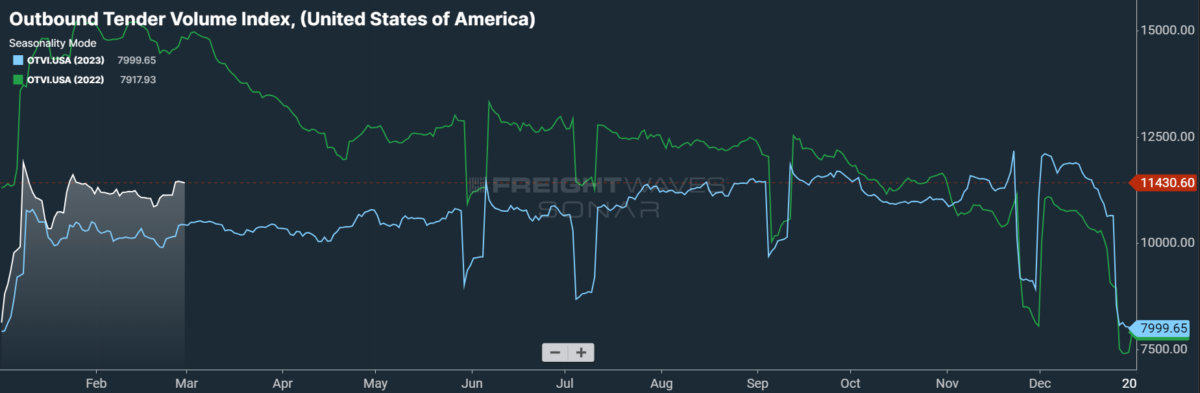

SONAR: OTVI.USA: 2024 (white), 2023 (blue) and 2022 (green)

To learn more about FreightWaves SONAR, click here.

This week, the Outbound Tender Volume Index (OTVI), which measures national freight demand by shippers’ requests for capacity, is up 3.38% week over week (w/w). On a year-over-year (y/y) basis, OTVI is up 11.71%, though such y/y comparisons can be colored by significant shifts in tender rejections. OTVI, which includes both accepted and rejected tenders, can be inflated by an uptick in the Outbound Tender Reject Index (OTRI).

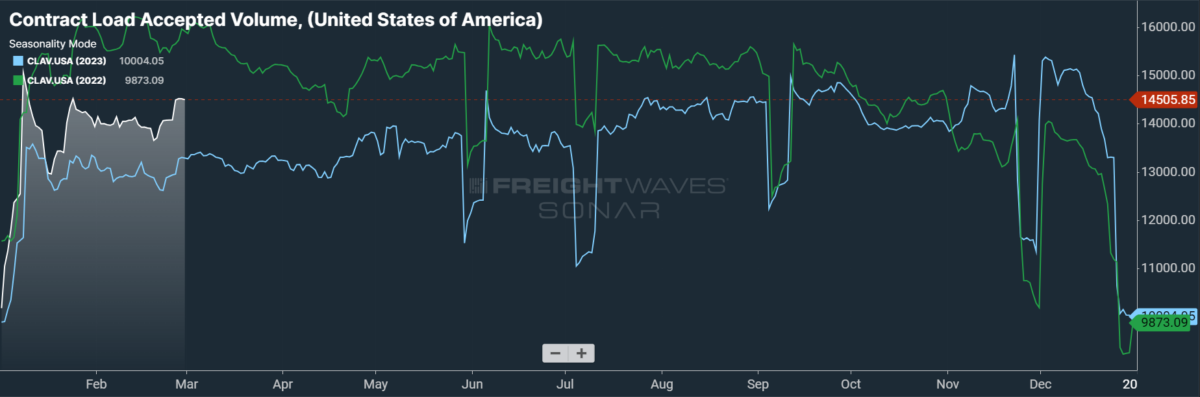

SONAR: CLAV.USA: 2024 (white), 2023 (blue) and 2022 (green)

To learn more about FreightWaves SONAR, click here.

Contract Load Accepted Volume (CLAV) is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, we see a rise of 4.09% w/w as well as one of 9.15% y/y. This positive y/y difference implies that actual freight flow is recovering from this cycle’s bottom.

As stated above, there are many reasons to be hopeful about the near-term future of truckload demand. Freight activity was sustained in late January and February by high import volumes. The Port of New York and New Jersey recently reported that January 2024 was the third-busiest start to the year on record, lagging behind only the incredible growth of 2021 and ’22. Meanwhile, on the opposite coast, the Port of Los Angeles — the busiest port in the U.S. — saw its second-best January this year, surpassed only by 2022.

Couple this growth with the fact that import bookings from China to the U.S. set record highs in the first two weeks of February (that is, in the run up to Lunar New Year) and that these bookings were made roughly 42 days before the shipments arrive on U.S. shores, late March and early April should be incredible months for truckload markets near West Coast ports.

There are other positive signs for activity beyond maritime volumes, however. Bank of America’s Truckload Demand Indicator for shippers hit its second-highest level in 80 weeks at the end of February, up 13% y/y. This particular index surveys demand over the next three months, though shippers are even more bullish over the next six to 12 months. That said, many of the shippers surveyed note that they have yet to see “the exodus of trucking companies” normally witnessed at this point in the cycle, with excess capacity remaining a headwind towards rebalancing the market.

Finally, flatbed demand in particular should be buoyed by growth in construction and manufacturing. The S&P Global US Manufacturing PMI saw its headline index rise from 50.7 in January to 52.2 in February, indicating more rapid expansion. S&P Global stated that manufacturers saw the steepest growth in new orders since May 2022, with demand rising from customers both foreign and domestic. “After a long spell of reducing inventories to cut costs,” wrote Chris Williamson, chief business economist at S&P Global Market Intelligence, “factories are now increasingly rebuilding warehouse stock levels, driving up demand for inputs and pushing production higher at a pace not seen since early 2022.”

Meanwhile, homebuilders are notably optimistic about their lots in 2024. Economists speaking at the National Association of Home Builders’ recent International Builders’ Show stated consensus expectations of 5% y/y growth in single-family housing starts, forecasting two or three Federal Reserve rate cuts of 25 basis points each in the latter half of the year. Bank of America analysis is even more bullish, expecting a 20% y/y rise in single-family starts over the first quarter and a 9% y/y gain for 2024 in total.

Where have all the truckers gone?

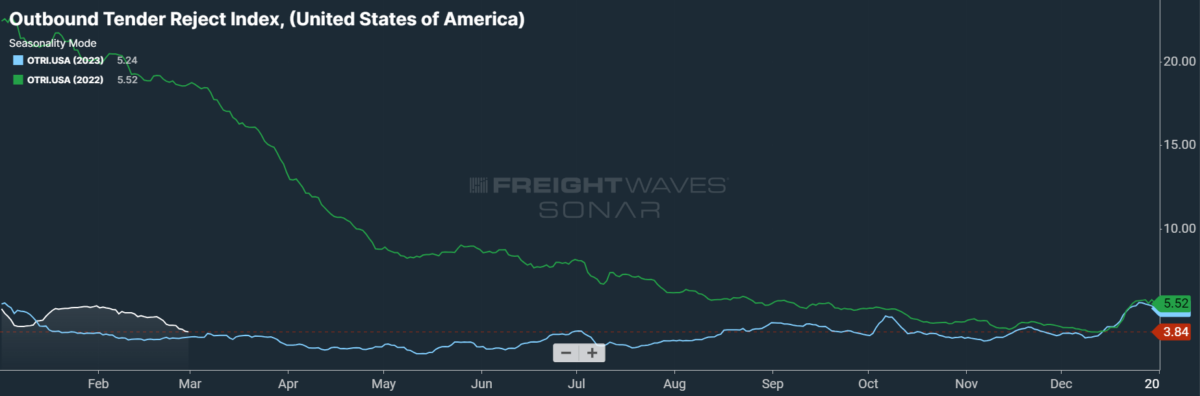

There are good reasons to feel hopeful about the future of freight demand in 2024, but the Pricing Power Index did not fall to 35 this week without cause. After treading above 5% for much of January and some of February, OTRI has since depreciated to sub-4% levels. While these movements are relatively minor on the grand scale of things, the direction is key here. A rising OTRI can be an inflationary force to spot rates if it tracks above 7% — give or take — or if it makes rapid gains over a short period of time. But while OTRI was indicative of capacity trickling out of the market, it is no longer.

SONAR: OTRI.USA: 2024 (white), 2023 (blue) and 2022 (green)

To learn more about FreightWaves SONAR, click here.

Perhaps the strangest thing about capacity in this cycle is how it differs from the data. Many economists have noted the apparent discrepancy between government data on the labor market, which is incredibly strong, and the numerous reports of mass layoffs reaching a number of industries.

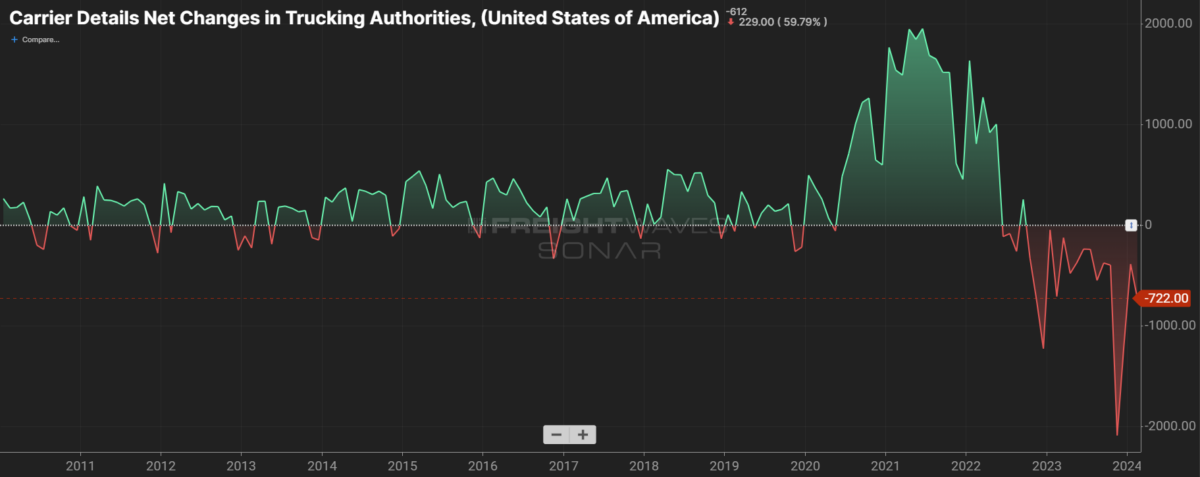

Yet the trucking industry not only has its fair share of newsworthy layoffs and bankruptcies, it also has the data tracking carriers leaving the market. Federal Motor Carrier Safety Administration data on the net changes of carrier authorities (below) shows that a greater number of carriers have left the industry than have entered in every month since October 2022 — despite the fact that many owner-operators tend to let their authorities quietly expire rather than bother with official revocation.

SONAR: CDNCA.USA

To learn more about FreightWaves SONAR, click here.

The net losses of authorities are not insignificant, either: Before the current cycle, the month in which the largest number of carriers left the industry without replacement was November 2016, which saw a net loss of 329 authorities. More than six times that number vanished in November 2023, which posted a net loss of 2,087 authorities.

As stated previously, this data does not even capture the full scope of the capacity runoff taking place. FMCSA requirements state that interstate carriers must renew their authorities every two years. Since it is not uncommon for carriers to exit the industry only temporarily — that is, only until the next upturn occurs — many of those leaving don’t bother with official revocation. Instead, they either renew their authorities if the industry is booming or else let it expire quietly. This behavior implies a lag of up to two years for the FMCSA to effectively measure the amount of capacity runoff.

The longest shortest month

February was simply abysmal for small carriers primarily exposed to the spot market. Over the course of the month, fuel-inclusive spot rates fell by a national average of 21 cents per mile. Many of the nation’s largest carriers have also weighed in on 2024’s bid season for contract rates: Werner Enterprises, with understatement characteristic of corporate businesses, said that this year’s round of contract negotiations was “very competitive.” That said, some shippers have stated that their new rates will not go into effect until as late as April, while other contract rates are indexed to data from the broader economy — such as the inflation-tracking Consumer Price Index — and so are less vulnerable to market dynamics of the trucking industry.

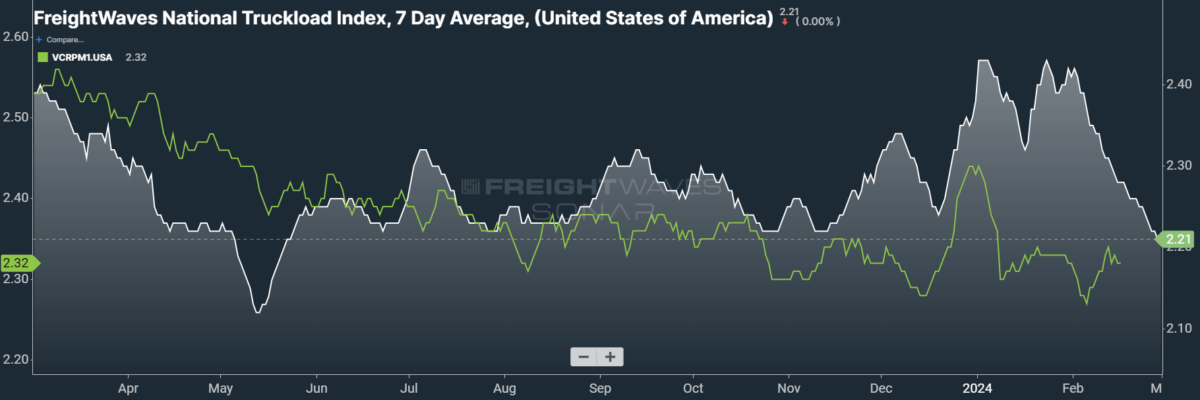

SONAR: National Truckload Index, 7-day average (white; right axis) and dry van contract rate (green; left axis).

To learn more about FreightWaves SONAR, click here.

This week, the National Truckload Index (NTI) — which includes fuel surcharges and other accessorials — fell 4 cents per mile to $2.21. Sliding linehaul rates were wholly responsible for this week’s loss, as the linehaul variant of the NTI (NTIL) — which excludes fuel surcharges and other accessorials — fell 4 cents per mile to $1.58.

Contract rates, which are reported on a two-week delay, have recovered somewhat from a dip in early February. Nevertheless, they are tracking close to 2021 levels from before the rate bonanza of this current cycle. By the start of Q2, there will be a more definite answer as to how this bid season impacted carriers. For the time being, contract rates — which exclude fuel surcharges and other accessorials like the NTIL — are unchanged on a weekly basis at $2.33 per mile.

To learn more about FreightWaves SONAR, click here.

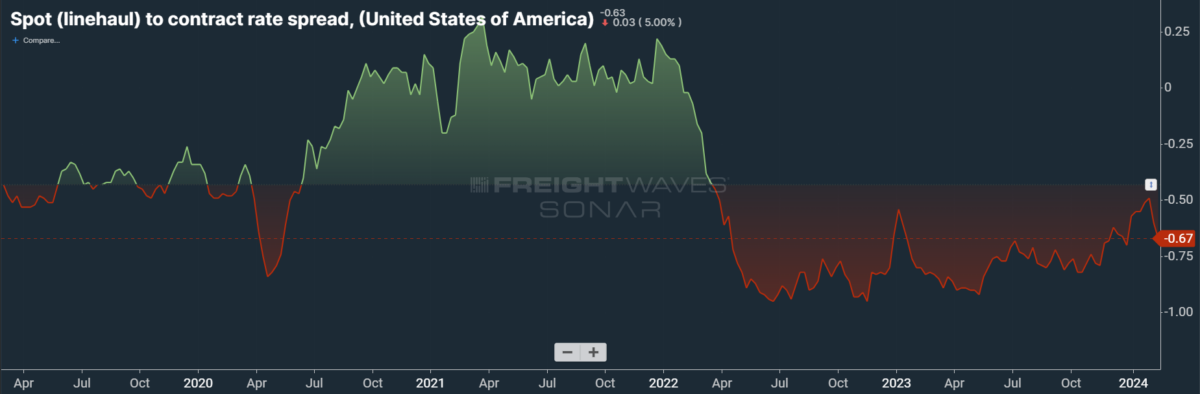

The chart above shows the spread between the NTIL and dry van contract rates, revealing the index has fallen to all-time lows in the data set, which dates to early 2019. Throughout that year, contract rates exceeded spot rates, leading to a record number of bankruptcies in the space. Once COVID-19 spread, spot rates reacted quickly, rising to record highs seemingly weekly, while contract rates slowly crept higher throughout 2021.

Over the course of 2023, this spread averaged 10 cents lower than in 2022, indicating that contract rates had yet to come into balance with the market’s fundamentals of carriers’ supply and shippers’ demand. These lopsided fundamentals were more appropriately reflected in spot rates, which are highly reactive to shifting market conditions. As linehaul spot rates remain 67 cents below contract rates, marked signs of rebalancing are beginning to appear, though there is still room for contract rates to decline — or for spot rates to rise — in the first half of 2024.

For more information on FreightWaves Research, please contact Michael Rudolph at [email protected] or Tony Mulvey at [email protected].

[ad_2]

Source link