[ad_1]

Unwinding the powertrain business at Hyliion Holdings was uncomfortable, especially for 175 employees who lost their jobs in November. But the leaned-out startup is making some progress in its pivot to energy distribution through a fuel-agnostic power generator.

Whether the plan is sufficient to generate revenue and perhaps attract a buyer for the once high-flying special purpose acquisition company are the big unknowns.

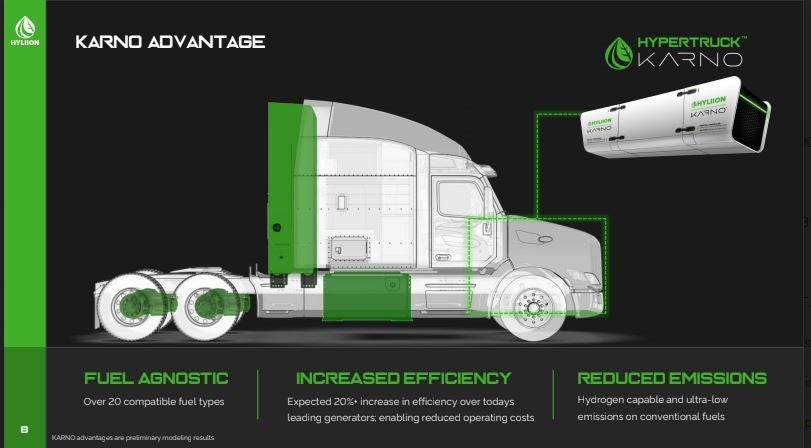

The Karno generator, which Hyliion purchased from GE in August 2022 for its since-canceled Hypertruck ERX, qualifies for $40,000 in incentives this year under the Inflation Reduction Act. The system is more expensive than diesel but cheaper than a fuel cell, CEO Thomas Healy told me this week. He declined to specify the price.

Hyliion has attracted nascent customer interest in the technology that has been facetiously compared to Doc Brown’s flux capacitor in the “Back to the Future“ movie trilogy.

Cost discipline makes 2nd chance possible

That Hyliion has the resources to try another business line comes from practicing financial discipline. By guarding a large part of the $560 million in proceeds from its reverse merger with Tortoise Acquisition Corp. 3 ½ years ago, Hyliion has a second chance that some profligate SPAC-backed startups squandered.

Had Hyliion pursued the Hypertruck ERX, it would have burned through its cash hoard at a faster clip.

“Our decision around [exiting] powertrain was more focused on the major shifts happening in all electrification,” Healy said. “Volumes aren’t at levels that anyone was expecting.”

Slowdown in electric truck adoption

A court challenge delaying California’s Advanced Clean Fleets rule contributes to some rethinking on electric trucks. The Minnesota Trucking Association this month released a report cautioning fleets to adopt a “go slow” approach on regional and long-haul electric trucks.

The Hypertruck addressed the long-haul challenge by pairing a natural gas generator with an electric powertrain that would convert natural gas to electricity on board and allow 1,000 miles between fill-ups.

But the first-generation Hypertruck proved complex and expensive. The price topped $400,000 after a yearlong delay in getting parts and paying up to get small quantities during the pandemic. Fleets liked the Hypertruck enough to order ones and twos, but not enough to make it profitable.

Healy saw Karno as an advanced generator for the next-gen Hypertruck. Hyliion retains intellectual property that could be used later. Or it could be sold or licensed to bring in cash.

“Over time, we will look to reduce how much IP coverage we have just from a cash conservation standpoint,” Healy said. “You don’t need as much if you’re not in that business. We’ll keep the parts that we see as really relevant.”

Rethinking Karno’s application

The idea of Karno as a stand-alone electric generator was always in the back of Healy’s mind. Now it is front and center.

If it proves reliable, Karno could become a staple to make electricity for the growing number of electric truck infrastructure developers. Bringing power to warehouses and capturing and converting flare gases from oil and gas fields and landfills are other uses.

“The EV charging space is one we’re heavily pursuing,” Healy said. “The problem we’ll run into is the volume they’re looking for. It is a lot of power for our early production. We don’t want to be solely dependent on that market because of how much volatility we’ve seen in that space.”

3 applications for Karno technology

Well-heeled infrastructure developers like TerraWatt Infrastructure, Forum Mobility, WattEV, Zeem Solutions and Voltera could augment utility-provided grid power with Karno technology.

One developer — Healy would not say which — told him its original thinking around Karno would be to use it while waiting for full grid energizing of a site, then move it to another site. Now it is thinking of keeping it in one place and ordering a second Karno for the additional site.

Hyliion successfully tested Karno in converting flare gas to electricity in the Permian Basin. Backup power for data centers is another potential market. A successful Karno could push legacy players like Cummins, Generac, Caterpillar and Kohler.

“We can pose a real competitive threat to the incumbent players if we can execute on the generator as we think we can,” Healy said.

Activist board drives Hyliion actions

Hyliion began 2024 with $291 million in capital and expects to invest $40 million in Karno development this year. Its board of directors hasn’t set a deadline, but it wants to see revenue and a path to gross margin. Or it wants the company’s cash returned to shareholders. The stock price Wednesday hovered around $1.38. Before the merger in October 2020, it traded above $50.

“We expect that the reduction in expenses associated with the wind-down of our powertrain segment will result in approximately a 70% reduction in cash burn this year compared to last,” Healy told the one analyst who dialed into the company’s Q4 earnings call on Valentine’s Day.

In a highly unusual move for a pre-revenue company, Hyliion repurchased $20 million of its own stock in Q4 because shares were trading at one-third the value of just its cash and investments. The same board that held Healy accountable to make the ERX viable or drop it encouraged the share repurchase.

Since that time, two high-profile board members — former U.S. Transportation secretaries Andrew Card and Elaine Chao — have left the board.

Is Cummins waiting in the wings?

The presence of Cummins Inc. on the board and in management is noteworthy.

Former Meritor — now part of Cummins Inc. — CEO Jay Craig chairs the board; former Cummins President Richard Freedland is a director. And Hyliion earlier this month hired Govindaraj “Govi” Ramasamy as its chief commercial officer. He spent the previous 17 years at Cummins in power generation.

Hyliion has both worked with and been challenged by Cummins. The two worked together to certify Cummins’ 12-liter natural gas engine for the Hypertruck. But the California Air Resources Board granted only one year of emissions certification.

Cummins is discontinuing the 12-liter engine. To keep going with the Hypertruck, Hyliion would have had to certify the 15-liter natural gas version going into production this year.

With robust horsepower and torque ratings, Cummins’ 15-liter natural gas offering — the first of several fuel-agnostic offerings that includes a hydrogen version in 2027 — is attracting heavy fleet interest. Jose Samperio, Cummins vice president of on-highway products, told me in October the 15-liter could reach 10% market share where natural gas offerings historically command 2%.

As for Karno, it could be a nice fit for Cummins, which makes a lot of diesel-powered generators and has a growing data center business. But expect Cummins to allow Hyliion to pay for Karno’s development and validation before getting out its checkbook.

“The definition of being a public company is you’re always for sale,” Healy said. “But it’s not something that we’re actively pursuing at this time.”

Stay tuned.

A walkaround of Torc Robotic’ headquarters, where it all began

That’s it for this week. Thanks for reading and watching. Click here to get Truck Tech via email on Fridays. And catch the latest in major events and hear from the top players on “Truck Tech” at 3 p.m. Wednesdays on the FreightWaves YouTube channel. Your feedback and suggestions are always welcome. Write to [email protected].

Discounted tickets for the Future of Supply Chain on June 4-5 in Atlanta are yours for the taking. Get ’em today.

[ad_2]

Source link