Foreign container lines were widely blamed for stratospheric freight rates during the supply chain crisis. President Joe Biden proclaimed last June he was “viscerally angry” at the “rip-off,” clenching his fist and saying he felt like “popping someone,” presumably a foreign container-line executive.

As the shipping lines took the heat for raking in billions amid the pandemic, another group of foreign-owned container shipping companies quietly raked in record sums outside the publicity glare: the container-ship lessors, otherwise known as tonnage providers.

Shipping lines own about half their fleets and rent the rest. The supply chain crisis was not just the greatest period in history for shipping lines, it was the greatest period in history for the shipowners that rented the tonnage to the liner companies.

The more ships the liner companies could get their hands on, the more money they could make off cargo shippers. Liners were desperate for ships in 2021-2022 and tonnage providers could dictate the terms, forcing charter durations to years beyond what liner companies wanted and jacking up rates to historic highs. At one point, some ships were renting for six figures per day.

Now that the dust has settled, tonnage providers are far less exposed than shipping lines to the pullback in import demand. They’re heavily shielded by their charters through 2024. Not only did they completely avoid public and political backlash during the boom, but their post-boom earnings will stay stronger for longer.

Danaos orders more newbuildings

The second-largest publicly listed tonnage provider, Greece’s Danaos Corp. (NYSE: DAC), recorded aggregate net income of $1.8 billion in 2020-2022. Danaos owns a fleet of 68 container ships plus eight under construction, with total capacity of 476,293 twenty-foot equivalent units.

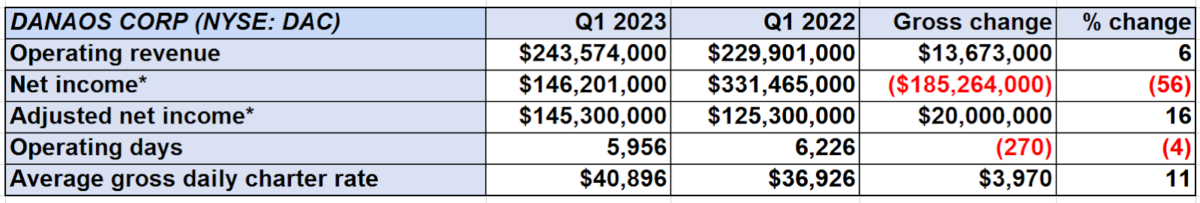

On Monday, Danaos reported net income of $146.2 million for the first quarter of 2023. Adjusted earnings per share came in at $7.14, topping the consensus forecast of $6.22.

Danaos’ earnings were inflated by a dividend from its stake in liner company Zim (NYSE: ZIM) in Q1 2022. Excluding the earlier Zim gain (it no longer owns Zim shares), Danaos’ Q1 2023 adjusted net income was up 16% year on year. Operating revenues were up 6%.

That’s a stark contrast to what’s happening with first-quarter shipping line profits, which have plunged by 60% to 95% year on year.

Most shipping line contracts with cargo shippers last only one year. Virtually all of the freight contracts signed at inflated rates during the boom have now expired.

Most of the tonnage providers’ boom-inflated vessel contracts with container lines were signed for multiple years’ duration. The upside is still firmly in place. Furthermore, tonnage providers are having no trouble signing fresh charter contracts with liners (at lower yet still profitable rates) despite a flood of newbuilding deliveries.

As of February, Danaos had 93% of its capacity sold out for 2023 and 64% sold out for 2024. As of Monday, it was 97% covered for this year and 73% covered next year. Its average charter duration is 3.2 years.

Danaos booked an additional $380.7 million in contracted revenue over the past three months. That included $262 million for three-year charters for six newbuildings to be delivered in the second half of 2024. (Two have 7,100-TEU capacity, four have 7,200-TEU capacity; all are methanol-fuel-ready.)

The company is so confident in future prospects that it just signed contracts for two additional 6,000-TEU newbuildings — without charters attached and without financing in place. One is due for delivery in Q4 2024, the other in Q2 2025.

Danaos’ shares rose 4.6% on Tuesday as the broader market fell and the Dow dropped over 300 points.

Costamare’s container segment ‘remains robust’

Atlas Corp., owner of Seaspan, was previously the largest U.S.-listed tonnage provider. It was taken private by buyers Fairfax Holdings, company insiders and ocean carrier ONE, and delisted in March. The largest U.S-listed tonnage provider now is Greece’s Costamare (NYSE: CMRE). It owns 71 container ships with aggregate capacity of 524,000 TEUs.

Costamare, unlike Danaos, is a mixed-fleet operator. It also owns 43 dry bulk vessels and is the lead investor in a leasing platform that covers multiple shipping segments.

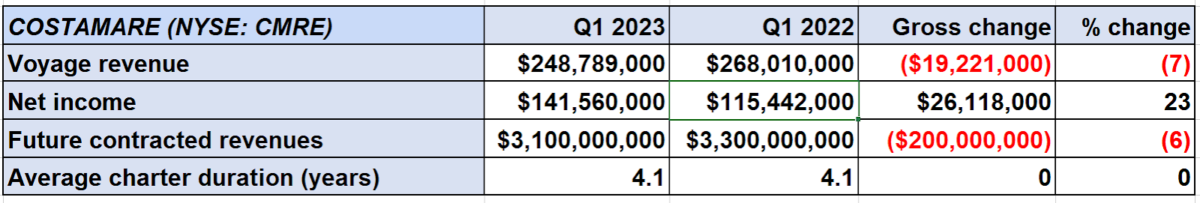

Costamare now has 98% of its container-ship capacity booked for this year and 86% for next year. The average TEU-weighted duration of its charters is 4.1 years.

On Monday, Costamare reported net income of $141.6 million for Q1 2023 versus $115.4 million in Q1 2022. Adjusted earnings per share came in at 38 cents, just above the consensus forecast for 36 cents.

Costamare’s results were “impacted by the softer dry bulk environment … [but] the container segment remains robust, more than offsetting losses from the dry bulk segments,” said Nokta.

According to Stifel analyst Ben Nolan, Danaos’ dry bulk fleet “has been a drag to performance,” whereas its container-ship fleet “continues to pay out impressive levels of cash flow on relatively long-duration contracts.”

Container-ship charter rates “have fallen off materially” from boom-era highs, but Costamare has an “extremely favorable glide path” courtesy of “its pandemic-related contract extensions,” said Nolan.

Charter market rises off the bottom

The container-ship charter market has defied negative expectations. It has risen off the bottom since March, despite a record wave of newbuildings entering the market and a continued fall in average freight rates.

The Harpex index, which measures global charter rates, is down 74% from the all-time high reached in March 2022. But it’s up 17% from March lows and is over double levels in mid-May 2019, pre-COVID.

“The orderbook remains the principal threat to the market,” acknowledged Costamare CFO Gregory Zikos on Monday’s conference call with analysts. Even so, he noted that “charter rates are on a rising trend with high demand across the board, while fixture periods are increasing in duration.”

Danaos CEO John Coustas said on Tuesday’s call, “The charter market has improved due to the very limited supply of charter-free vessels as well as the impact of speed reductions as charterers seek to comply with CII [environmental] regulations.”

Coustas expressed little concern about the company’s five 13,082-TEU ships on charter to South Korea’s HMM at $64,918 per day that come up for renewal next year. Those vessels have options for three-year extensions at $60,418 per day that would need to be declared starting in Q4 2023.

“We are not really concerned, because there are very few, if any, ships of that size available in 2024,” said Coustas.

“We are already in contact with a number of liner companies about the employment of these ships. So, we will definitely have something fixed as soon as there is more clarity on whether the existing charterer is going to exercise the options.”

Click for more articles by Greg Miller

Related articles:

Future of Supply Chain

JUNE 21-22, 2023 • CLEVELAND, OH • IN-PERSON EVENT

The greatest minds in the transportation, logistics and supply chain industries will share insights, predict future trends and showcase emerging technology the FreightWaves way–with engaging discussions, rapid-fire demos, interactive sponsor kiosks and more.

[ad_2]

Source link