Cargojet, an all-cargo airline that operates a domestic express network in Canada for customers such as Amazon and DHL Express, on Monday said reduced flying in response to a slowdown in shipping and tight cost management during the second quarter helped maintain profit margins that were better than analysts expected.

The company’s adjusted earnings before interest, taxes and accounting measures slid 8.4% to $57.7 million ($74.3 million Canadian). A nearly 10% reduction in expenses, led by a $17.6 million drop in fuel spend, helped prevent the bottom line from falling more.

The company contained costs by reducing flight activity within its domestic network, overtime, training, excess inventory and use of temporary employees. Cargojet (TO: CJT) said aircraft utilization fell 5.9% during the quarter because of weaker demand.

The cost initiatives pushed profit margins to 35.4% compared to 32.9% in the same 2022 period despite sales falling 15% to $156 million.

“We’re getting rid of overspending that was done to meet the COVID demands, which would be considered in today’s terms a waste. So the waste portion is going because there is no panic about COVID,” President and CEO Ajay Virmani said in a briefing call with analysts, referring to the unprecedented spike in airlift interest when the pandemic upset global economic patterns. “And sometimes it takes awhile because of [existing] commitments and certain other market considerations.”

Lower fuel surcharges were a key factor behind the revenue drop, but lower fuel costs also helped prop up earnings. The cost of jet fuel was about $1 per liter versus $1.50 per liter a year ago.

Direct expenses, excluding fuel, fell $4 million or 6.1% during the quarter.

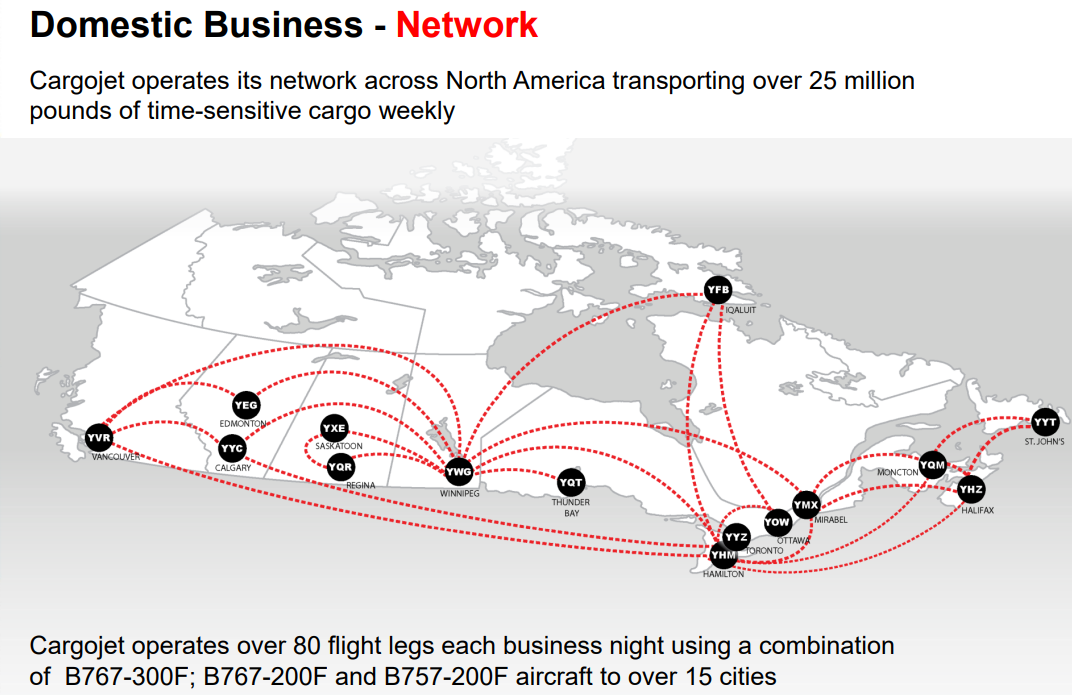

The airline was able to gain operating efficiency by consolidating volumes on a single plane and temporarily adding an intermediate stop on two daily flights between its base in Hamilton, Ontario, and Edmonton, Alberta, and between Calgary, Alberta, and Vancouver, British Columbia, CFO Scott Calver said. Direct flights will resume once volumes return.

Having pilots trained to fly both 757s and 767s gives Cargojet flexibility to substitute smaller aircraft that are less expensive to operate or use a larger aircraft if consolidating volumes from two flights into one, Carver added. Fewer flights had the secondary benefit of reducing fees for landing, navigation and airport services.

A $1.3 million reduction in crew costs is mostly the result of Cargojet now operating its own flight simulator and not having to spend for third-party training and associated travel. Calver said those efficiencies are permanently built in now.

Revenue from the domestic overnight network fell 8.2% but on an absolute basis only decreased a point because the second quarter of 2022 was skewed by an increase in dedicated international flights for DHL that fed the domestic network, said Chief Strategy Officer James Porteus.

Cargojet, which operates 37 Boeing 757 and 767 cargo aircraft, also provides charter services on a trip basis. Revenue in that category dipped 4% to $19.7 million year over year, but Porteus said charter demand remains strong — above the normal run rate of $11 million to $15 million — noting that the carrier has already operated three relief flights to Maui in the past week under contract with the U.S. Federal Emergency Management Agency to support recovery from the devastating wildfires on the Hawaiian island.

The airline has more aircraft and pilots to operate these one-time flights because of the reduced amount of flying in the domestic express network, which runs on a nighttime schedule. Normally, aircraft are only available for immediate rental during the day or on weekends. Porteus said he expects ad hoc charter demand to continue through the second half of the year.

Management reiterated that the company’s business model, in which three quarters of revenue comes from long-term contracts with express operators and other customers, will enable Cargojet to weather the current downturn better than other cargo operators. Strategic partnerships with Amazon, DHL, UPS, Canada Post and Purolator have minimum volume guarantees.

The cost discipline and low debt ratios allow the company to maintain a slightly larger fleet than currently required, which will enable it to “grab new growth opportunities as the market turns” upward again, Virmani said. Cost cuts are in areas that don’t impact service, such as negotiating better credit terms with suppliers and cutting $68 million in spare parts inventory by 15%, but the company is still hiring pilots and maintaining head count for mechanics and dispatchers, he explained.

“We’re not here to cut so deep that our growth gets impacted,” Virmani insisted.

Fleet expansion slowed

The company is also taking a defensive stance toward capital expenditures in response to the freight recession that has reduced e-commerce sales and packages throughput in its network. Earlier this year, it announced plans to sell three used Boeing 777-300 passenger jets, originally purchased as feedstock for freighter conversions, to maintain financial flexibility and match fleet size with demand. Management on Monday said it had sold one of the aircraft for a $1.5 million loss and intends to sell two small Beechcraft aircraft, valued at $63 million, that were purchased to transport crews where needed in Canada.

Cargojet is working to finalize the sale of two additional 777s. The sales were delayed by hail damage that required repairs, said Calver.

The airline is holding on to reservations for production slots at Israel Aerospace Industries, which was supposed to convert the 777s, so it can quickly resume expansion plans if demand improves. Executives in May said there is no change to the order with U.S. startup Mammoth Freighters for four Boeing 777-200 passenger-to-freighter conversions.

Previous guidance for $149 million to $167 million in capital spending for maintenance and growth was unchanged, but Cargojet estimates investments will rise to $223 million to $260 million next year.

Virmani projected Cargojet’s business will pick up by the end of the year as consumers rebalance discretionary spending, which is currently tilted toward services and leisure activities, to include more goods purchases, aided by lower inflation.

A positive sign in Amazon’s earnings this month was that North American retail sales increased 11% year over year. Volume growth in the Americas only fell 2.4% year over year. Also, Amazon in July generated record sales for Prime Day, which normally serves as a springboard for a strong peak shipping season for upcoming shopping events and holidays.

Amazon CEO Andrew Jassey said on a call with analysts that customers are interested in faster delivery,” which favors providers like Cargojet. “We have a lot of data that shows when we make faster delivery promises on a detail page, customers purchase more often, not just a little higher, meaningfully higher,” he said.

Porteus said Amazon business has begun to creep back up in Canada, especially since Cargojet recently started operating a new 40,000-square-foot cargo terminal at Vancouver International Airport for Amazon. That has enabled Cargojet to add a direct flight out of its base in Hamilton to Vancouver with one of two Amazon-provided 767s.

E-commerce growth in Canada and the rest of the Americas also bodes well for Cargojet’s future growth. Major customer DHL, for example, is targeting more expansion in Latin America.

“We continue to view Canada’s low e-commerce adoption rates versus other developed nations as a positive driver of volume longer-term,” James McGarragle, equity analyst for RBC Capital Markets, wrote in a client note.

Underappreciated

The revenue reduction on a percentage basis was far better than recorded by most passenger airlines that transport cargo, including those with dedicated freighter divisions, but slightly below peers that fly on a dedicated basis for Amazon and other express carriers. Those aren’t highly accurate comparisons because the various business models are so different, but they provide a general sense of how Cargojet stacks up. Air Transport Services Group, which also benefits from aircraft leasing in addition to transportation revenue, saw revenue increase 4% during the three-month period. Fellow Amazon partner Sun Country Airlines, which has a significantly smaller freighter operation than Cargojet, said cargo revenue increased 18%, which it attributed to more available aircraft after completing maintenance last year.

Meanwhile, American, Delta and United Airlines saw cargo revenue fall 37% to 40% year over year. Air Canada said cargo revenue fell 24%. The decline in Cargojet’s flight hours on a percentage basis is actually less than at FedEx and UPS.

Cargojet’s operating profit is on track to double from 2019, but Virmani complained that the stock price is nearly flat since then because the company is unfairly associated with carriers in the general air cargo market.

The fear of a recession and general cargo trends “are scaring people away … but I want to remind everybody that we’re not in the same market. We’re a well-diversified company that has an overnight network of pay-to-play contracts with built-in escalations for [inflation],” along with packaged leases for operating aircraft and charters. “So painting everybody with the same brush is a bit unfair and uncalled for,” he said.

Cargojet shares closed Monday trading at $74.52, up 7.2%, on the Toronto Stock Exchange.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

Twitter: @ericreports / LinkedIn: Eric Kulisch / [email protected]

RECOMMENDED READING:

New Air Canada freighters help offset declines in cargo revenue

Cargojet postpones more 777 freighters, tightens belt as shipments slow

NOVEMBER 7-9, 2023 • CHATTANOOGA, TN • IN-PERSON EVENT

The second annual F3: Future of Freight Festival will be held in Chattanooga, “The Scenic City,” this November. F3 combines innovation and entertainment — featuring live demos, industry experts discussing freight market trends for 2024, afternoon networking events, and Grammy Award-winning musicians performing in the evenings amidst the cool Appalachian fall weather.

[ad_2]

Source link