[ad_1]

As we approach the end of the first half of 2023, trans-Pacific eastbound spot rates are nearing their year-to-date lows, marking a critical level for ocean carriers.

In conjunction with various factors such as the “bullwhip effect” impacting inventories at major U.S. importers, and a shift in consumer spending patterns, U.S. importers are expected to exercise extreme caution in bringing in new volumes during the second half. This cautious approach, coupled with a weakening global macroeconomic backdrop, intensifies the risks of declining containerized import volumes.

This weakening demand coupled with an excess of vessel capacity is likely to exacerbate the downward pressure on spot rates for this key bellwether trade lane, making a “new” bottom very possible in the second half of 2023 very possible.

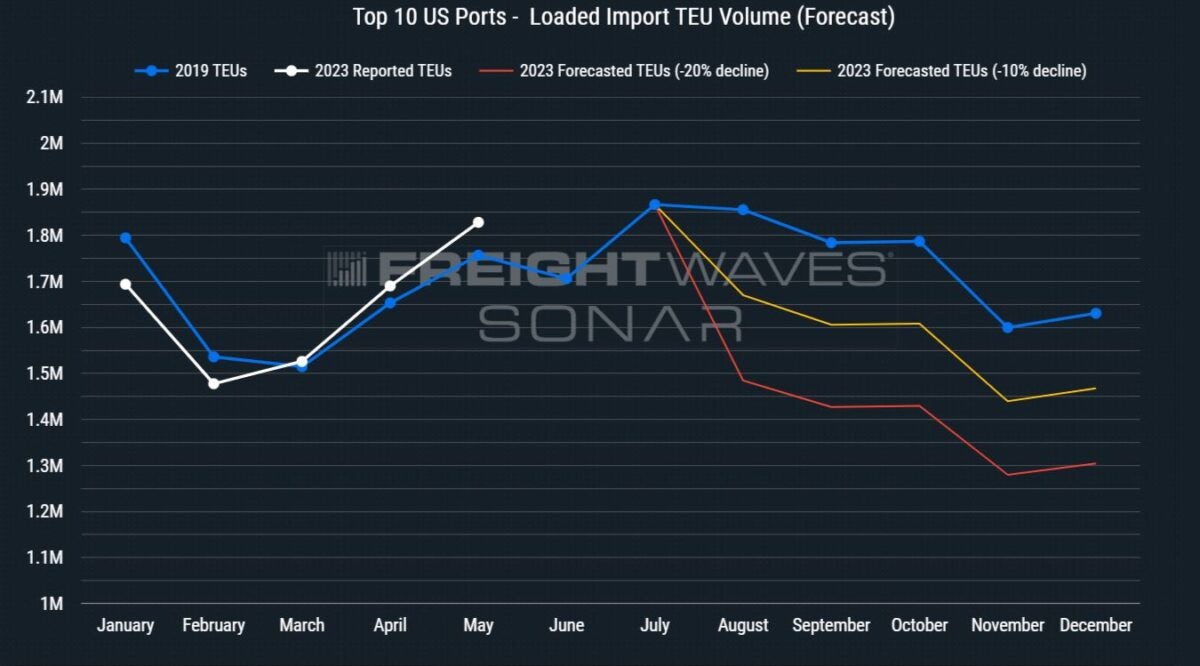

As we covered at the beginning of June in the article US import demand positioned to find a new bottom in 2023, ocean container bookings during the first half of 2023 have consistently followed the trajectory of 2019 levels. This trend is projected to persist until early Q3, after which we are likely to see a departure from 2019 levels as import volumes seek a “new” bottom. This shift in volumes to the downside could result in a substantial decline, with import twenty-foot equivalent units possibly experiencing a drop of 10% to 20% below the levels observed in the second half of 2019. The chart above illustrates the estimated monthly decrease in loaded import TEUs, ranging from 10% (depicted in orange) to 20% (depicted in red) across the top 10 U.S. ports.

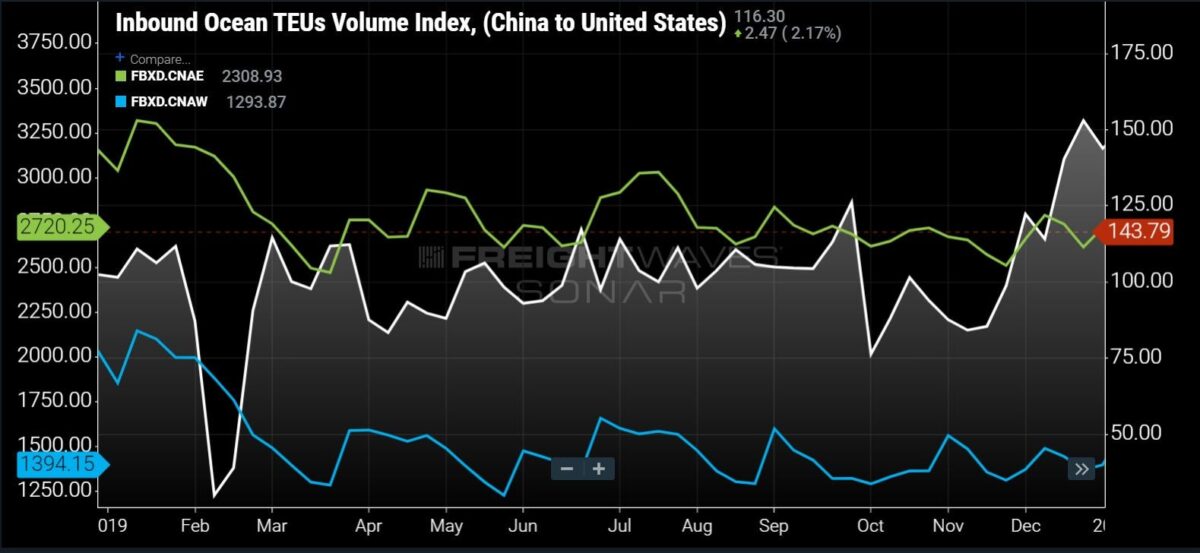

Given our pessimistic outlook for U.S. containerized import volumes, it is highly probable that ocean container spot prices will also experience a “new” bottom. To gain insights into the potential behavior of container spot rates for the remainder of 2023, we can refer to the 2019 container volumes from China to the U.S. as a proxy. As we can see in the chart below, throughout 2019, container volumes between China and the U.S. remained relatively stable, with no significant increase during peak season. As a result, the ocean container spot rates between China/East Asia and the U.S. West Coast ranged from $1,250 to $1,500, while rates from China/East Asia to the U.S. East Coast fluctuated between $2,500 and $3,000 for the entire year, following initial declines in Q1. These figures are based on the Freightos Baltic Index.

Should our projections for the second half of 2023 materialize and result in declining volumes, the possibility of ocean container spot rates reaching new lows becomes plausible. As demonstrated in the chart below, the April 15 general rate increase (GRI) for 2023 has established a pricing range for ocean container spot rates. Presently, rates fluctuate between $1,000 and $1,700 for shipments from China/East Asia to the U.S. West Coast, while rates from China/East Asia to the U.S. East Coast hover between $2,000 and $2,700, based on data from the Freightos Baltic Daily Index.

If volumes were to remain relatively stagnant for the remainder of the year, it is reasonable to expect that ocean container spot rates may mimic their behavior from the latter half of 2019 and stay within this range. However, given our projected volume declines, unless ocean carriers effectively manage supply-side capacity, the downward pressure on spot rates will be significant. Consequently, the likelihood of discovering a new pricing floor for ocean container spot rates is increasingly high.

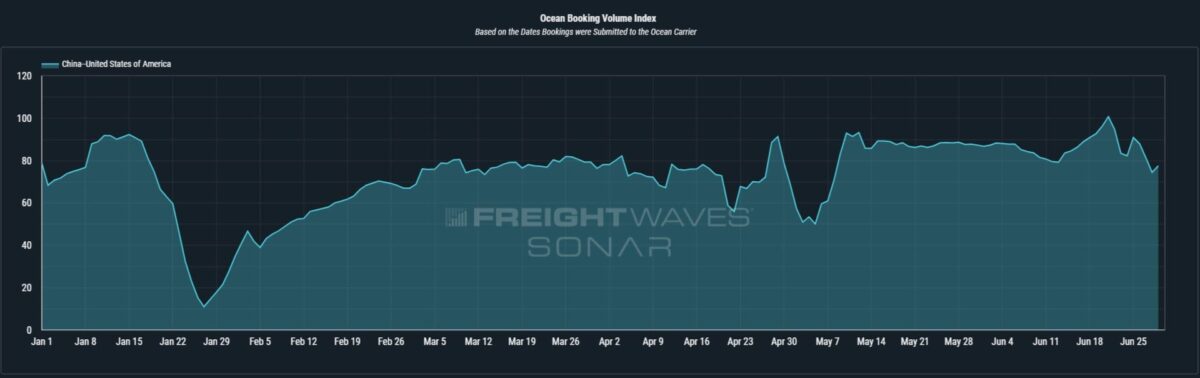

As we explained in detail in a previous article, Bullwhip effect cracking US imports’ peak season (again), softening consumer demand and shifts in consumer spending patterns are expected to have a detrimental impact on ocean container volumes and U.S. import demand during the second half of 2023. Retailers across various sectors have been highlighting the changes in consumer spending behavior, coupled with prevailing macroeconomic headwinds. Moreover, the TEU volume index is likely to have already reached its peak after the dragon boat festival, indicating a potential decline ahead.

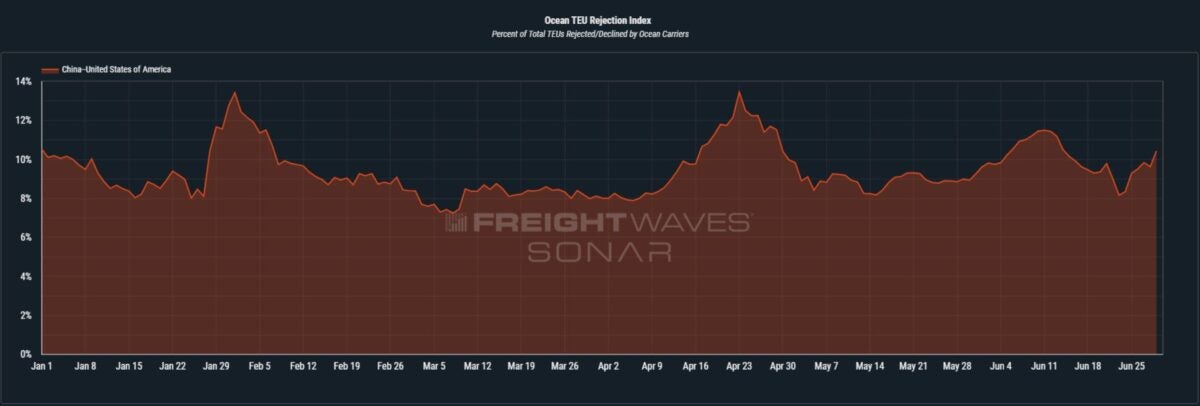

While the bookings index in the chart above is displaying warning signs of the potential start of the decline in future TEU volumes, TEU rejection percentages (in the chart below) remain relatively steady, meaning that capacity is loose and having no trouble accommodating current levels of TEU volumes. This combination is a recipe for significant downward pressure on spot rates, which will likely (and swiftly) erode any GRIs implemented moving forward.

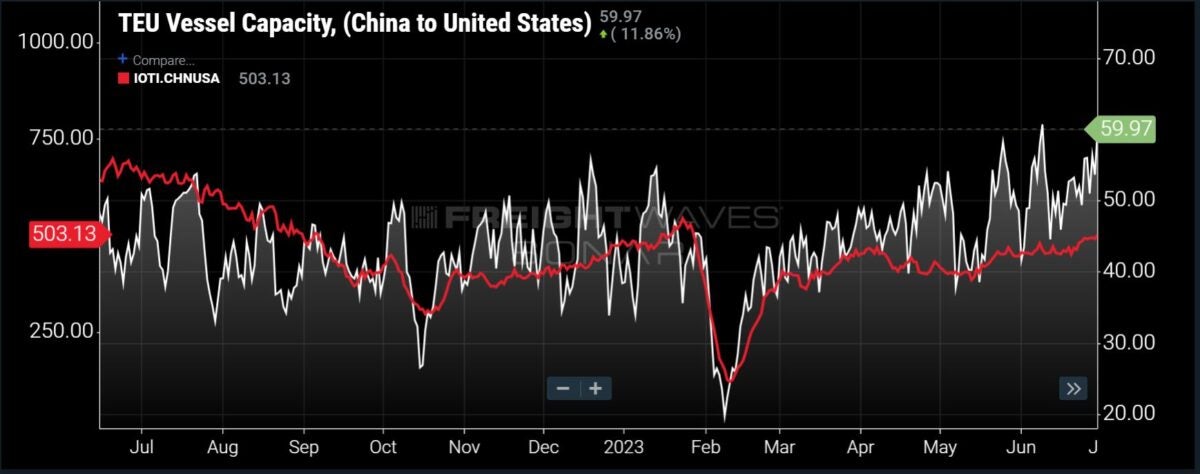

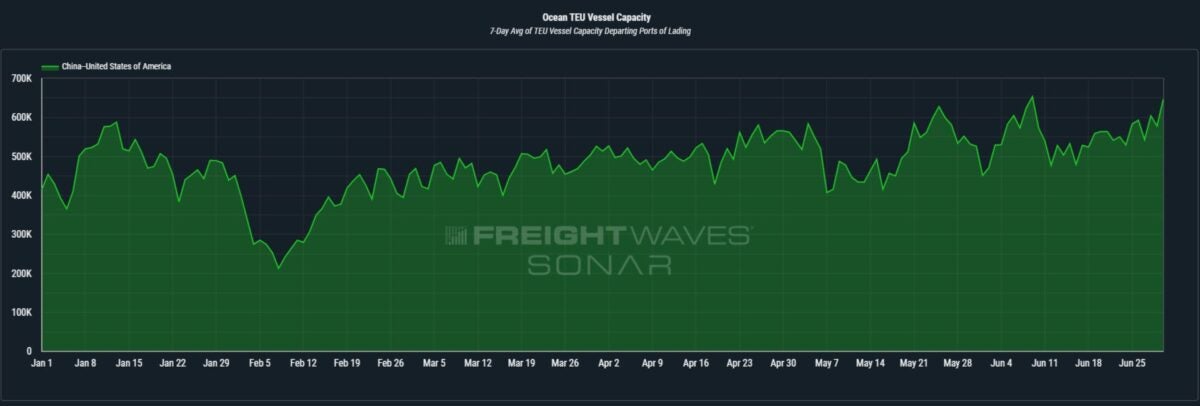

The supply side of the equation is also poised to intensify this downward pressure on spot rates on the trans-Pacific. As we can see in the chart below from SONAR’s Container Atlas, vessel capacity from China to the U.S. is experiencing an upward trend. This highlights the obvious disparity, and steadily increasing imbalance, between supply and demand. With new capacity being introduced throughout the remainder of 2023, while U.S. containerized import volumes continue to decrease, the problem is further exacerbated for ocean carriers and their spot rates on the trans-Pacific eastbound.

Altogether, this scenario heading into the second half of 2023 has the potential to trigger a price war among ocean carriers as they strive to gain market share during this downcycle. Consequently, it may lead to heightened tensions within existing ocean carrier alliances, resulting in significant disruptions and reorganization within the industry. The disruption of the current alliance structure could erode any stabilizing influence they may have had on spot rates, leading to a decline in their ability to maintain GRIs effectively.

[ad_2]

Source link