[ad_1]

Weekly highlights

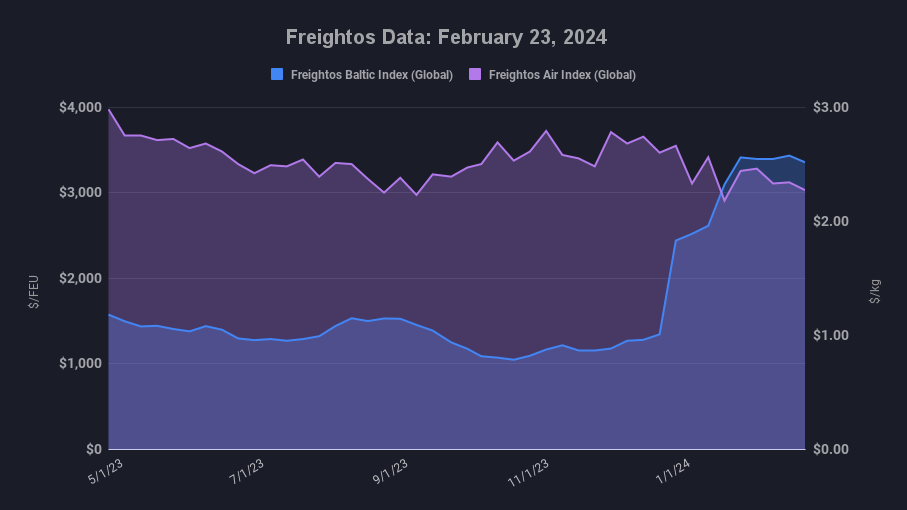

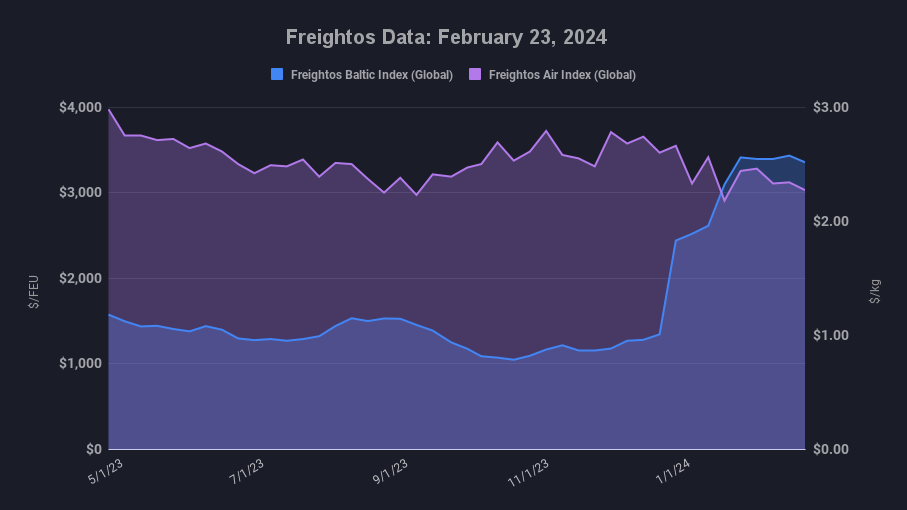

- Asia-US West Coast prices (FBX01 Weekly) fell 2% to $4,809/FEU.

- Asia-US East Coast prices (FBX03 Weekly) fell 1% to $6,709/FEU.

- Asia-N. Europe prices(FBX11 Weekly) fell 1% to $4,553/FEU.

- Asia-Mediterranean prices(FBX13 Weekly) fell 10% to $5,224/FEU.

- China – N. America weekly prices increased 32% to $4.8/kg

- China – N. Europe weekly prices fell 8% to $2.74/kg.

- N. Europe – N. America weekly prices fell 1% to $2.02/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Despite assessments that US and UK strikes have significantly degraded Houthi capabilities, Red Sea attacks – including a missile strike on a bulk carrier that resulted in an oil spill – have continued.

US and UK strikes on Houthi positions continued last week as well, and the US Federal Maritime Commission is considering implementing maritime sanctions on Yemen as an additional measure. For vessels still transiting the Red Sea, insurance premiums continue to rise.

Ocean rates were stable overall last week over the tail end of the Lunar New Year holiday period, and the Red Sea diversions are keeping prices elevated though they have begun to come down from their peaks.

Asia – N. Europe rates of $4,553/FEU are down 17% from their mid-January high, and Asia – Mediterranean prices of $5,224/FEU are 23% lower than a month ago. Rates from Asia to N. America have also started to ease slightly.

Though post-LNY backlogs may be keeping rates at these elevated levels for now, prices are likely to decline from the current levels as ocean freight enters its slow season in the coming weeks.

And while rates should still remain above normal levels as long as diversions continue and carriers pass on higher costs, the European Shipping Council estimates that ocean rates and surcharges for Red Sea diversions are far outstripping these increased costs faced by carriers. This assessment, together with pessimistic outlooks for European ocean volumes this year, also points to the likelihood of ocean prices coming down from current levels.

The diversions’ impact on capacity, equipment availability and ocean prices for non-Red Sea lanes may have reached its peak as well. Transatlantic rates have increased 54% since mid-December to $1,862/FEU last week. But carriers may not be expecting diversions and market conditions to allow rates to climb much more, as some are postponing additional planned surcharges.

In air cargo, though rates out of Asia and the Middle East were level or easing on most lanes last week, Freightos Air Index data shows China – N. America prices rebounded to $4.80/kg, about its level in mid- January. This climb may reflect some increase in demand from shipments that did not get moved before Lunar New Year.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.

[ad_2]

Source link