[ad_1]

Weekly highlights

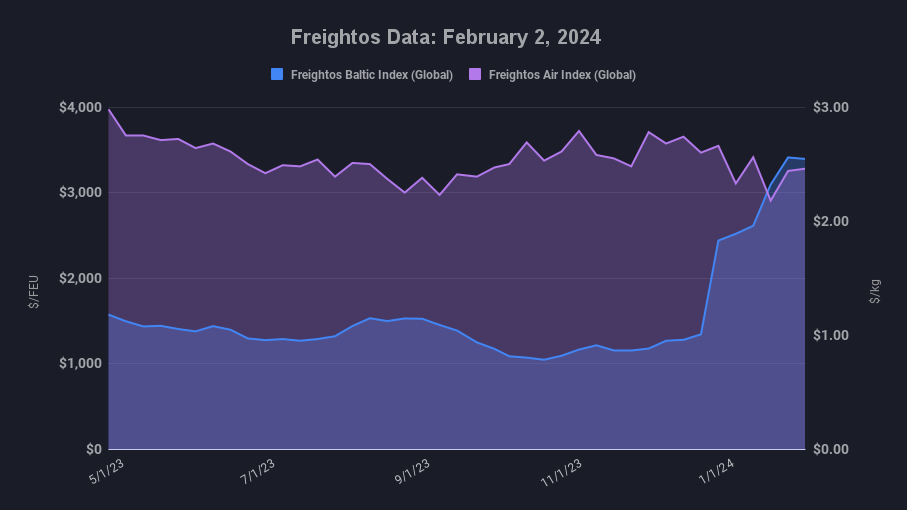

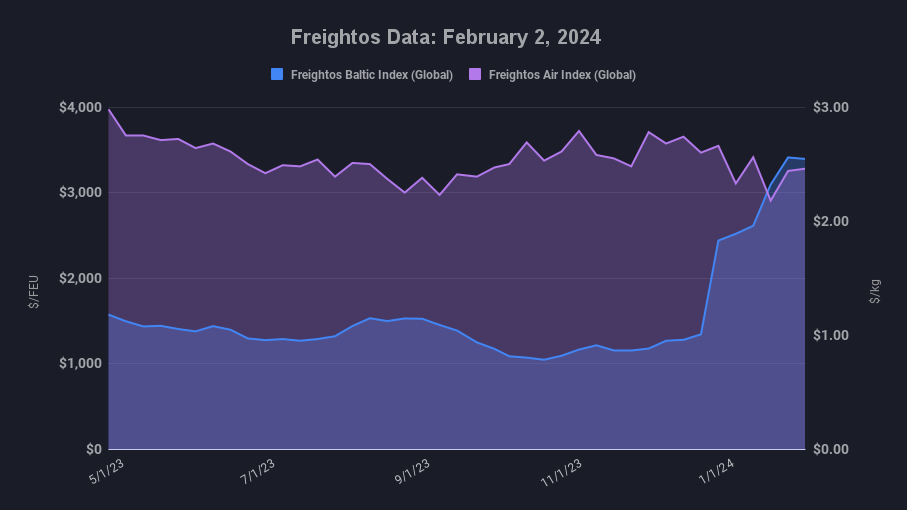

- Asia-US West Coast prices (FBX01 Weekly) increased 7% to $4,367/FEU.

- Asia-US East Coast prices (FBX03 Weekly) increased 4% to $6,373/FEU.

- Asia-N. Europe prices (FBX11 Weekly) fell 7% to $5,097/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) fell 4% to $6,212/FEU.

- China – N. America weekly prices increased 14% to $6.06/kg

- China – N. Europe weekly prices fell 1% to $3.12/kg.

- N. Europe – N. America weekly prices increased 4% to $2.06/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Tensions continue to rise in the Middle East, with ongoing US and UK strikes on Houthi targets in Yemen, continued Houthi attacks on Red Sea traffic, deadly Iran-backed attacks on US sites in the region, and US retaliations in Syria and Iraq.

But With the majority of container carriers already avoiding the Red Sea, these further escalations in geopolitical conflicts are unlikely to have an additional impact on the container market.

Pressure from pre-Lunar New Year demand for ocean freight is easing, and carriers continue to make progress in adjusting networks and activating excess capacity to adapt to the longer journeys. These factors are leading to improvements in space and equipment availability at Asian export hubs, smooth operations at most major ports and few signs of congestion.

This easing of demand and operations challenges is likewise leading to less pressure on ocean rates. Asia to N. Europe and Mediterranean prices declined slightly last week to $5,000/FEU and $6,200/FEU respectively. Asia to N. America ocean rates increased 7% to the West Coast last week, past $4K/FEU and 4% to the East Coast to the $6k/FEU level.

Though demand may increase somewhat after the holiday lull, rates are likely to decline by late February or early March as ocean freight enters its slow season and carriers will have had time to fully adjust capacity and networks on the diverted lanes. Prices should be expected to remain higher and transit times longer than normal until Red Sea traffic resumes.

Disruptions to ocean freight has led to some shift to air cargo as reflected in increased air volumes on some lanes recently. Freightos Air Index data show China – N. America air cargo rates climbed 14% last week to $6.06/kg, and are slightly higher than in early December. While China – N. Europe prices dipped last week, Middle East – to N. Europe prices are still 20% higher than in mid-January, possibly reflecting some ocean to sea-air shift. Air cargo demand should also ease as LNY begins and Red Sea-driven air demand should subside as well as ocean operations continue to stabilize.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.

[ad_2]

Source link