A Wednesday report from ACT Research showed the trucking cycle may be “approaching [a] turning point.” All five components of ACT’s For-Hire Trucking Index showed improvement from a carrier’s perspective during August, with volumes logging a large turnaround.

ACT’s volume index jumped 12.3 percentage points to 54.4 on a seasonally adjusted basis from July to August.

A reading above 50 indicates growth while one below 50 implies contraction. The report was quick to caution that the measure is one of breadth, with a large number of fleets seeing an increase but not necessarily a pronounced one.

“So, we wouldn’t suggest this means the freight downturn is over, but it is a considerable ‘green shoot’ that suggests the retail inventory destock is playing out,” said Tim Denoyer, vice president and senior analyst at ACT.

August produced the highest reading for the volume index since early 2022 and a level well above the mid-30s to mid-40s readings displayed throughout the spring. Inventory levels approaching a better balance and a reduction in import declines to the West Coast were cited as contributors.

“Additionally, consumers remain a surprising economic upside, even in the face of sustained high, if moderating, inflation, and are reverting to more goods spending after the service spending boom coming out of the pandemic,” Denoyer said. “Though, still-high inflation and decreasing savings are headwinds to future consumer spending.”

ACT’s capacity index was in modest contraction territory for a second straight month at 48.9. The data set was down one point seasonally adjusted from July.

Those surveyed included mostly large, for-hire fleets. However, the report noted that Class 8 tractor sales remain near all-time highs, which is indicative of capacity being added by private fleets as well as small carriers buying secondhand equipment from larger fleets.

With better volumes and a modest contraction in capacity, the supply-demand balance index jumped 13.4 points to 55.6 in August on a seasonally adjusted comparison. This was the first reading above 50 in 18 months.

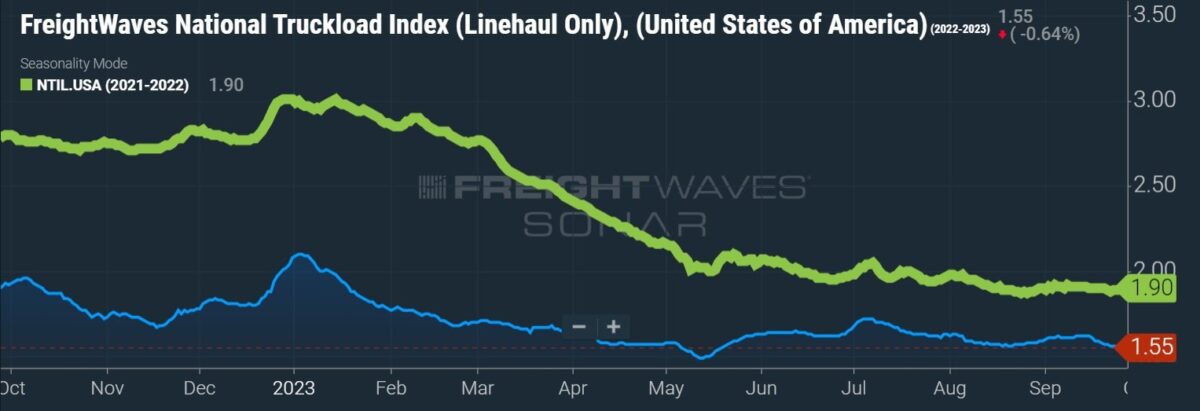

Truck pricing remained under pressure during the month at 39.3. The report noted a “less worse” trend as the index improved 2 points from July and continued to improve from the record low of 30.5 in April. ACT expects a soft pricing environment to linger in the near term.

“Though growth in private fleets may be delaying the recovery in rates, the trucking market appears to be past the nadir, and the improved supply/demand balance this month suggests more less worse results to come,” Denoyer said.

Other findings from the report showed fleet productivity (measured as miles per tractor) increased 6.1 points seasonally adjusted to 53.6 in August. However, 56.4% of survey respondents said they would be buying new equipment in the next three months, which could weigh on the metric. Buying intentions were roughly 7 points below the prior-year level as many of the big, for-hire fleets have largely caught up on their replacement cycles, which were extended during the pandemic.

“We expect fleet ordering intentions to subdue as contract rates are under severe pressure and pent-up demand is fading following capacity constraints the last two years,” Denoyer said.

The driver availability index remained elevated at 59.5 during August. The loosening in the driver labor market was in part credited to spot-market-dependent operators leaving for more stable working conditions at larger fleets.

“Driver availability also remains extraordinarily good for the diverse group of for-hire fleets in our survey,” Denoyer said. “In our view, this probably isn’t enough yet to turn the tide in the spot market, but the market rebalancing is progressing and this should be a good leading indicator of better times ahead.”

More FreightWaves articles by Todd Maiden

NOVEMBER 7-9, 2023 • CHATTANOOGA, TN • IN-PERSON EVENT

The second annual F3: Future of Freight Festival will be held in Chattanooga, “The Scenic City,” this November. F3 combines innovation and entertainment — featuring live demos, industry experts discussing freight market trends for 2024, afternoon networking events, and Grammy Award-winning musicians performing in the evenings amidst the cool Appalachian fall weather.

[ad_2]

Source link