Not all shipping sectors and shipping stocks are under pressure. Container shipping is mired in pessimism, crude and product tankers have disappointed, dry bulk is in the doldrums — but liquefied petroleum gas (LPG) shipping is bucking the bearish trend.

High-capacity, long-haul specialized tankers that carry propane and butane are known as very large gas carriers (VLGCs). VLGC sentiment was grim heading into this year, with a large increase in vessel capacity expected to pressure rates. But the market has surprised to the upside.

“Initial fears of a market downturn due to poor Chinese PDH [propane dehydrogenation] margins, the global economic outlook and new vessel deliveries were proven wrong,” said Niels Rigualt, executive vice president of commercial operations at BW LPG (Oslo: BWLPG), during a conference call Tuesday.

VLGC spot rates are now $90,000 per day and have averaged $70,000 per day year to date, double levels over the same period last year, according to Jefferies shipping analyst Omar Notka.

“Doom and gloom. That was the majority view on the VLGC market in 2023. VLGC rates, however, are the strongest since 2015,” said Oystein Kalleklev, CEO of VLGC owner Avance Gas (Oslo: AGAS), in an online post this week.

“VLGC rates continue to defy expectations,” said Clarksons Securities shipping analyst Frode Mørkedal.

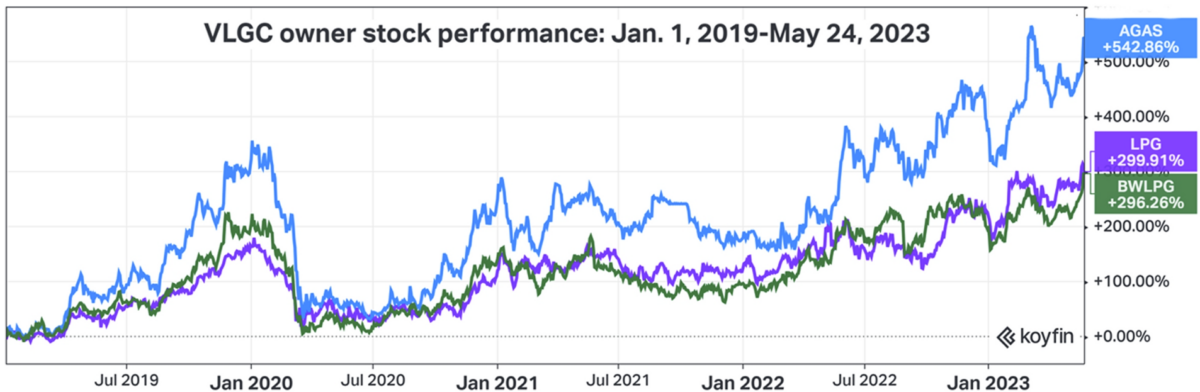

Shipping stocks in most of the other vessel segments are down year to date. Not so with the big three public VLGC owners. BW LPG, Avance and Dorian LPG (NYSE: LPG) are up 42%, 38% and 23% year to date, respectively.

In fact, these VLGC stocks have been rising for years. Since January 2019, pre-COVID, Avance is up over 540% and Dorian and BW LPG by almost 300%.

Demand and supply

Propane is used for heating, cooking, equipment fuel and feedstock for petrochemical production. A major driver of VLGC volume is demand from Asian PDH plants that use propane to create propylene. Propylene is used to produce polypropylene for plastics production.

Argus reported that two new Chinese PDH plants have already come online this year. S&P Global said six new Chinese PDH plants should come online by year-end.

Propane or naphtha can be used as feedstock. Naphtha is carried aboard product tankers. The cheaper propane is versus naphtha, the better for VLGCs and the worse for long-range product tankers. Propane is currently cheaper.

“Demand for naphtha has diminished with alternate feedstock propane prices at a discount to naphtha values since the end of February,” said Argus on Tuesday. “The shift pushed valuable ton-mile demand [demand in terms of volume multiplied by distance] into the gas-carrier segment.

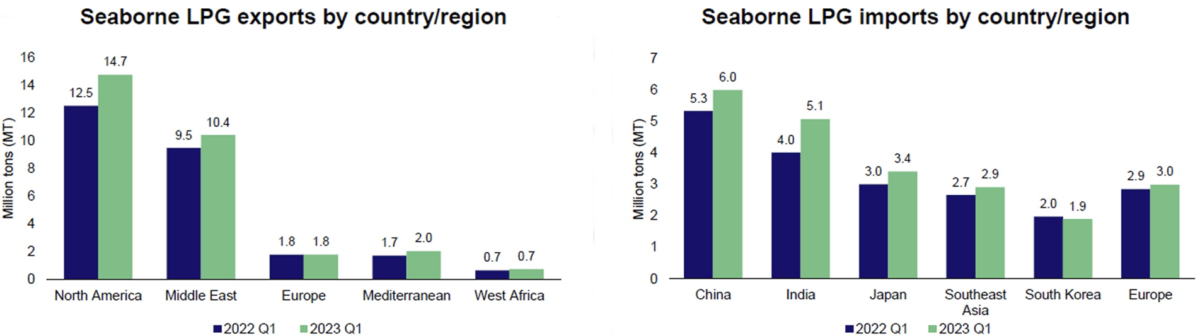

That’s a big part of the demand side of the equation. On the supply side, VLGCs primarily load in the U.S. Gulf and the Middle East. Outbound volumes are rising.

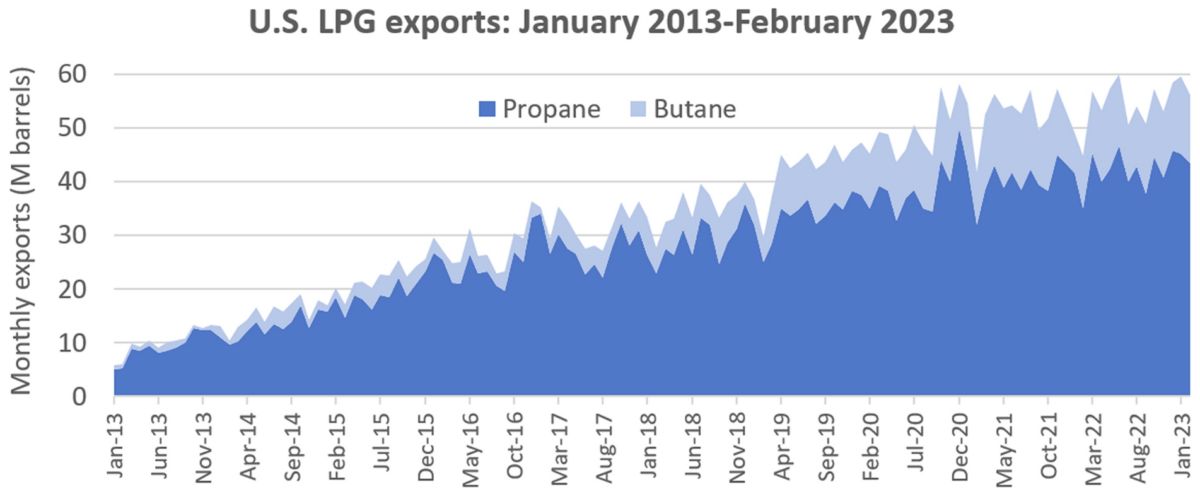

The largest driver of VLGC ton-mile demand is U.S. exports to Asia, given the longer distance versus Middle East exports. Most U.S. Gulf exports transit the Panama Canal, with some taking the longer route around the Cape of Good Hope. The good news for VLGC owners and investors: U.S. LPG exports continue to increase.

North American LPG export volumes in the first quarter were the highest on record, Dorian Chief Commercial Officer Tim Hansen said during a conference call Wednesday. He noted that “propane inventories continue to build in North America,” while “Chinese demand is absorbing a lot of ton-miles.”

BW LPG CEO Anders Onarheim noted Tuesday that “recently announced capacity expansion for U.S. LPG export terminals will enable more LPG to be shipped in the years ahead, clearly positive for our market.”

The Panama Canal factor

The more problems there are at the Panama Canal, the better it is for VLGC spot rates. Incremental ton-mile demand is driven by U.S.-Asia flows. To the extent VLGCs cannot transit the Panama Canal, they must take the longer route via the Cape of Good Hope, hiking ton-miles. To the extent they’re delayed, capacity is tied up.

VLGCs, which have a capacity of 84,000 cubic meters, were too large to transit the original canal locks. It was only after the larger locks debuted in June 2016 that they could take the shorter route to Asia via Panama.

As explained by Hansen during a conference call in February, VLGCs are smaller than other vessel types that traverse the larger locks: Neopanamax container vessels and LNG carriers.

The Panama Canal Authority can make more revenue from larger container ships and LNG carriers than VLGCs. Most of the new ships on order are Neopanamax container ships and LNG carriers, implying that future VLGC passages may be more constrained — a positive for future VLGC rates.

Meanwhile, Panama is now suffering a drought, reducing water levels in the canal and impacting transits.

“The Panama Canal is very volatile,” said Rigault. “It can jump suddenly from a couple of days of waiting time to 15 days. The water level now is very much on the low side. That means capacity of the canal will probably decrease further. So, it looks like delays and inefficiencies at the canal will continue.”

Pain still to come from orderbook?

The talk in the crude tanker and dry bulk sectors is all about how minuscule orderbooks are and how positive this is for the future supply-demand balance. According to Clarksons, capacity on order of very large crude carriers (VLCCs, tankers that carry 2 million barrels of oil) is down to just 1.4% of on-the-water capacity.

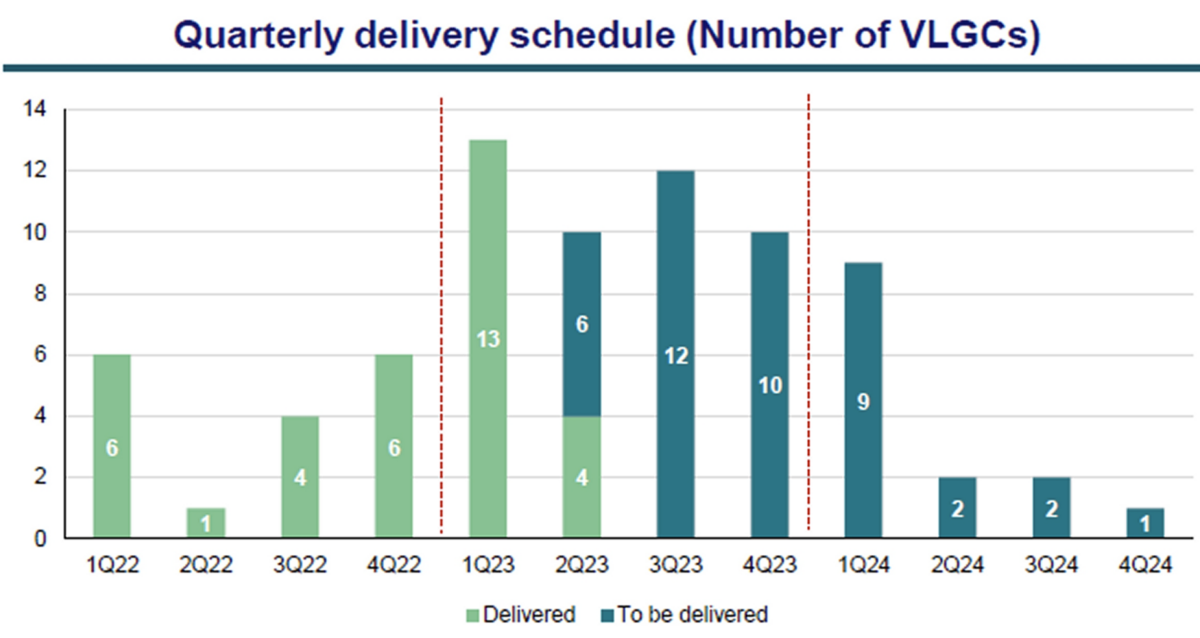

In contrast, the VLGC orderbook is high, with tonnage on order at 22% of on-the-water capacity, according to Clarksons.

The peak of VLGC deliveries is occurring this year. According to data from BW LPG, 45 new VLGCs will be delivered in 2023. Of those, 17 are already on the water.

“The bulge is in 2023 and early 2024. We will naturally see a pause after that because the shipyards are full [of orders for other ship types],” said Dorian LPG CEO John Hadjipateras.

The question for VLGC owners and investors: Is rate fallout from newbuildings still to come or does current rate strength imply that global demand can absorb new capacity and LPG rates will continue to rise as capacity growth declines going forward?

Rigault said newbuilds will be partially offset by 36 VLGCs scheduled to go into maintenance drydocks through the remainder of this year.

He added, “We can clearly see the market is a bit surprised at how well all the newbuilding deliveries have been absorbed. We can see that because the demand for time-charter coverage is increasing, with the players out there happy to fix [charters] for two to three years.”

Mørkedal of Clarksons is less optimistic. “Despite some relief from vessels in drydock, we are skeptical that ton-miles will keep pace,” he said in a client note on Wednesday. “A drop in rates seems unavoidable, barring any major disruption in the Panama Canal. The most likely scenario is a rate decline, albeit at a relatively high overall level.”

Earnings roundup

Of the three big public VLGC owners, Avance reports results on May 30, Dorian reported results Wednesday and BW LPG on Tuesday.

BW LPG reported net income was $130.7 million for Q1 2023, more than double net income of $58.4 million in the same period last year. The latest period was “the strongest quarterly performance on record,” said BW LPG.

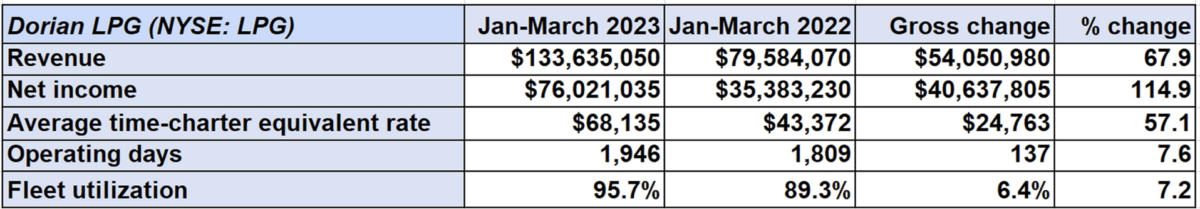

Dorian reported the highest quarterly earnings before interest, taxes, depreciation and amortization in the company’s history. Net income for January to March (its fourth quarter) was $76 million compared to $35.4 million in the same period last year. Earnings per share were $1.94, topping the consensus forecast for $1.48.

Dorian’s VLGCs earned an average of $68,135 per day, up 57% year on year.

Evercore ISI analyst Sean Morgan upgraded his rating on Dorian’s stock to “outperform” after Wednesday’s conference call. As Nokta of Jefferies put it, Dorian is “flying high, yet still under the radar.”

Click for more articles by Greg Miller

Related articles:

Future of Supply Chain

JUNE 21-22, 2023 • CLEVELAND, OH • IN-PERSON EVENT

The greatest minds in the transportation, logistics and supply chain industries will share insights, predict future trends and showcase emerging technology the FreightWaves way–with engaging discussions, rapid-fire demos, interactive sponsor kiosks and more.

[ad_2]

Source link