[ad_1]

Weekly highlights

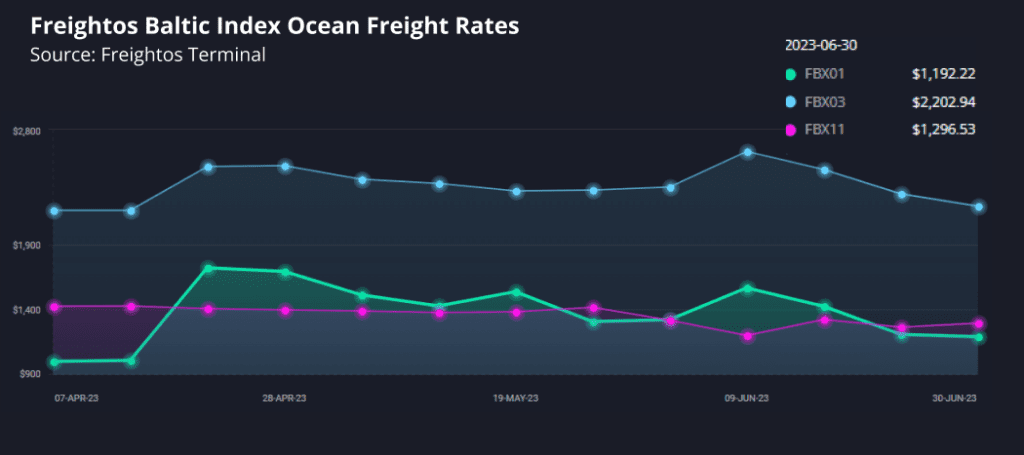

Ocean rates – Freightos Baltic Index:

- Asia-US West Coast prices (FBX01 Weekly) dipped 1% to $1,192/FEU. This rate is 84% lower than the same time last year.

- Asia-US East Coast prices (FBX03 Weekly) decreased 4% to $2,203/FEU, and are 78% lower than rates for this week last year.

- Asia-N. Europe prices (FBX11 Weekly) increased 2% to $1,297/FEU, and are 88% lower than rates for this week last year.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Members of Canada’s ILWU port worker union have been on strike since July 1st, shutting down operations at the ports of Vancouver and Prince Rupert and putting pressure on port operators to come to an agreement on terms for a new contract.

Negotiations that continued during the first days of the strike have now stalled. Though there are some reports of building backlogs, other measures show little signs of congestion just yet as carriers may be diverting cargo to alternate ports.

Freightos Terminal data for Shanghai – Vancouver show container rates have gone unchanged since the strike started. A prolonged shutdown and significant enough diversions could push rates up at alternate ports. And while the US’s ILA port worker union has pledged not to handle diverted cargo, business groups in Canada are urging the government to issue a back to work order.

In the meantime, transpacific rates decreased slightly last week and – as back in early July 2019 prices had already started to climb on a peak season increase in demand – rates are now more than 20% below 2019 levels to both coasts.

Asia – N. Europe prices ticked up 2% last week to about $1,300/FEU, just below 2019 levels. Maersk announced a significant rate hike up to $1,900/FEU planned for the end of July on this lane.

But with minimal volume growth on the ex-Asia lanes so far, and not a lot of optimism for a big peak season surge in demand just yet, rate increases will likely only succeed if carriers manage capacity much more strictly than they did for June’s unsuccessful transpacific GRI attempt. This task is all the more challenging given the new larger vessels now entering the market and carriers stuck with long-term chartered capacity leased during the pandemic.

Asia – Mediterranean rates were steady at $2,188/FEU last week. Prices on this lane have decreased 11% since the end of May, but this decrease is likely a function of carriers adding capacity to the region as rates to Mediterranean ports have remained quite elevated even as prices on other lanes plummeted. Even with the recent decrease in rates, prices are still 24% higher than in 2019 as demand has proved resilient.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.

[ad_2]

Source link