[ad_1]

This week’s FreightWaves Supply Chain Pricing Power Index: 25 (Shippers)

Last week’s FreightWaves Supply Chain Pricing Power Index: 25 (Shippers)

Three-month FreightWaves Supply Chain Pricing Power Index Outlook: 30 (Shippers)

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

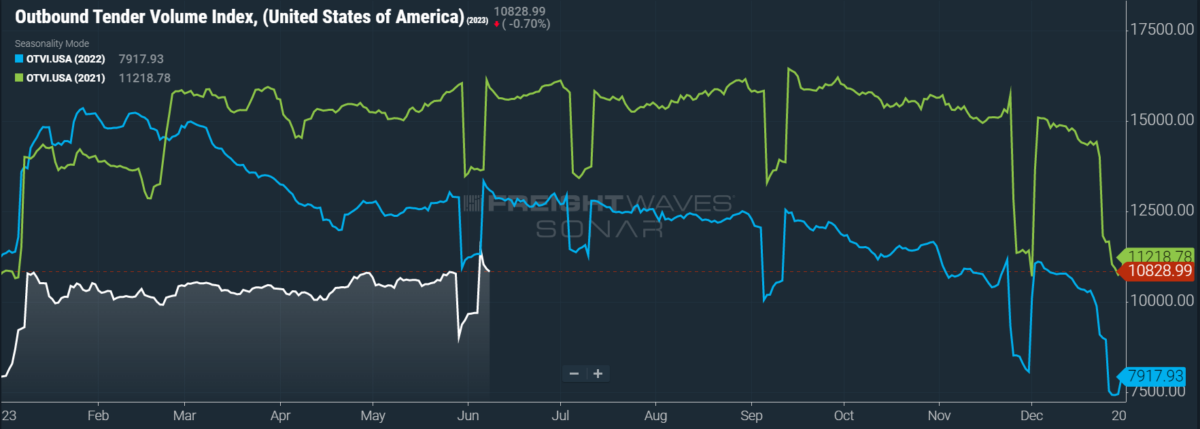

Truckload market gets 2020 vision

Freight demand returned this week with a vengeance, rising to year-to-date highs on Monday. This return to form also occurred last year, when post-Memorial Day accepted volumes rebounded to February’s peaks that prefaced March’s decline. Using 2022 as a template, then, we can expect volumes to be relatively stable until early July, with this season’s freight flow remaining roughly in line with 2020. That said, direct comparisons made against last week will be of limited use, given the holiday lull and subsequent resurgence in tender volumes.

SONAR: OTVI.USA: 2023 (white), 2022 (blue) and 2021 (green)

To learn more about FreightWaves SONAR, click here.

This week, the Outbound Tender Volume Index (OTVI), which measures national freight demand by shippers’ requests for capacity, rose 12.1% on a week-over-week (w/w) basis. On a year-over-year (y/y) basis, OTVI is down 16.7%, yet such y/y comparisons can be colored by significant shifts in tender rejections. OTVI, which includes both accepted and rejected tenders, can be inflated by an uptick in the Outbound Tender Reject Index (OTRI).

SONAR: CLAV.USA: 2023 (white), 2022 (blue) and 2021 (green)

To learn more about FreightWaves SONAR, click here.

Contract Load Accepted Volume (CLAV) is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, we see a gain of 12.4% w/w as well as a fall of 11.8% y/y. This y/y difference confirms that actual cracks in freight demand — and not merely OTRI’s y/y decline — are driving OTVI lower.

The May release of the Logistics Managers’ Index (LMI) indicated contraction in the headline index for the first time in the LMI’s six-and-a-half-year history, down 3.6 points from April to 47.6. Notable drivers of this decline were sharp drops in the Transportation Utilization (down 9.5 points to 45.5) and Transportation Prices (down 8.9 points to 27.9) subindices. These declines reinforce conclusions drawn from sustained weakness in OTRI and spot rates — namely, that there is a glut of capacity and a dearth of freight. Equally troubling is the weaker demand from upstream shippers — manufacturers and wholesalers — relative to downstream retailers. Such contraction among upstream shippers, largely attributable to their greater exposure to high interest rates, suggests that there is no tsunami of freight demand on the near horizon.

Looking to the broader economy, there are worrying signs that the labor market — the last great domino to fall before recessionary fears are completely validated — is at an inflection point. Last week, initial jobless claims surged 28,000 w/w to 261,000, well above the 235,000 expected. This latest increase marks both the highest reading since October 2021 and the largest w/w rise since July of that same year. On the flip side, however, continuing jobless claims fell to their lowest level since late February at 1.76 million. This decline could either indicate that those who are jobless are able to find new employment quickly, in which case the labor market is still worryingly hot, or that the number of jobless seeking reemployment (the labor force participation rate, in other words) has fallen.

SONAR: Outbound Tender Volume Index – Weekly Change (OTVIW).

To learn more about FreightWaves SONAR, click here.

Of the 135 total markets, 110 reported weekly increases in tender volumes, albeit facing very easy comps.

Texas’ Fort Worth market has risen to special prominence over the past few months, accounting for nearly 2% of outbound tender market share. [For comparison’s sake, top markets like Atlanta and Dallas account for less than 4% of market share each.] By sheer number of employees, the transportation and warehousing sector is by far the most prominent in Fort Worth, though the market has a significant footprint in aerospace and aviation manufacturing.

By mode: As with the overall OTVI, the index’s modal variants benefited from easy comps on a w/w basis. The Van Outbound Tender Volume Index (VOTVI) swelled 12.7% w/w, while the Reefer Outbound Tender Volume Index (ROTVI) jumped 19.1% w/w. The Pacific Northwest and the Great Plains are seeing reefer volumes heat up, thanks in large part to potatoes. Per U.S. Department of Agriculture data, over 500 million pounds (or 250,000 tons) of potatoes moved in reefers over the past 30 days.

How long will it last?

Tender rejections have yet to dip down to mid-May’s all-time low, but they are close. According to the LMI’s aforementioned Transportation Utilization subindex, this weakness in rejection rates is not likely to see a reversal anytime soon. In fact, when surveyed about their six-month outlook for this subindex, respondents collectively gave a reading of 50.0 — indicating neither contraction nor expansion, but perfect stability. That this softness could persist in a trough for the next two quarters is far from comforting, to say the least.

SONAR: OTRI.USA: 2023 (white), 2022 (blue) and 2021 (green)

To learn more about FreightWaves SONAR, click here.

Over the past week, OTRI, which measures relative capacity in the market, fell to 2.77%, a change of 19 basis points (bps) from the week prior. OTRI is now 569 bps below year-ago levels, with y/y comparisons becoming only more favorable as the year progresses.

SONAR: WRI (color)

To learn more about FreightWaves SONAR, click here.

The map above shows the Weighted Rejection Index (WRI), the product of the Outbound Tender Reject Index — Weekly Change and Outbound Tender Market Share, as a way to prioritize rejection rate changes. As capacity is generally finding freight this week, no regions posted blue markets, which are usually the ones to focus on.

Of the 135 markets, 58 reported higher rejection rates over the past week, though 45 of those saw increases of only 100 or fewer bps.

To learn more about FreightWaves SONAR, click here.

By mode: As though they were on a roller coaster, flatbed rejections are again trending downward, matching the poor signals broadcast from the industrial sector. The Flatbed Outbound Tender Reject Index fell 399 bps w/w to 11.32%. Dry van rejection rates are similarly pitiable, as the Van Outbound Tender Reject Index (VOTRI) slumped 29 bps w/w to 2.45% — near VOTRI’s record low of 2.3%. Reefers, meanwhile, offered a slim ray of sunshine to the market. The Reefer Outbound Tender Reject Index (ROTRI) jumped an impressive 150 bps w/w to 4.65%. To no one’s surprise, the highest ROTRIs were seen in markets with the biggest gains in reefer volumes: that is, in the Pacific Northwest and Great Plains.

Spot rates find an even keel

Is it too premature to shed the cynicism surrounding spot rates? Perhaps, but it is nevertheless nice to see spot rates stabilize rather than deteriorate further. Spot rates should also be untroubled by higher diesel prices over the next month or so, given the spectacular failure of Saudi Arabia to goose oil prices higher after OPEC+’s June meeting. While the oil market was put in concrete shoes by traders’ recessionary jitters, the fundamentals of supply and demand will eventually come back to tip oil prices (and thus prices of distillate fuels like diesel) higher — possibly as soon as late Q3 of this year.

SONAR: National Truckload Index, 7-day average (white; right axis) and dry van contract rate (green; left axis).

To learn more about FreightWaves SONAR, click here.

This week, the National Truckload Index (NTI) — which includes fuel surcharges and other accessorials — rose 1 cent per mile to $2.26. Rising linehaul rates were the sole culprit behind this week’s slim gain, as the linehaul variant of the NTI (NTIL) — which excludes fuel surcharges and other accessorials — rose 1 cent per mile w/w to $1.64.

Even contract rates, which took a major blow in mid-April followed by another in mid-May, saw a measure of stability. Contract rates, which exclude fuel surcharges and other accessorials like the NTIL, still face difficult comps on a y/y basis: The end of Q2 2022 saw contract rates reach their highest level in a data set that stretches back to 2017. Nevertheless, contract rates — which are reported on a two-week delay — rose 2 cents per mile w/w to $2.41.

To learn more about FreightWaves SONAR, click here.

The chart above shows the spread between the NTIL and dry van contract rates, revealing the index has fallen to all-time lows in the data set, which dates to early 2019. Throughout that year, contract rates exceeded spot rates, leading to a record number of bankruptcies in the space. Once COVID-19 spread, spot rates reacted quickly, rising to record highs on a seemingly weekly basis, while contract rates slowly crept higher throughout 2021.

Despite this spread narrowing significantly over the first few weeks of the year, tightening by 20 cents per mile in January, it has continued to widen again. Since linehaul spot rates remain 80 cents below contract rates, there is still plenty of room for contract rates to decline — or for spot rates to rise — in the coming months.

To learn more about FreightWaves TRAC, click here.

The FreightWaves Trusted Rate Assessment Consortium (TRAC) spot rate from Los Angeles to Dallas, arguably one of the densest freight lanes in the country, continues to distance itself from April’s floor. Over the past week, the TRAC rate rose 3 cents per mile to $2.08 — still a far cry from its year-to-date high of $2.39. The NTID, which has stabilized around $2.27, is handily outpacing rates from Los Angeles to Dallas.

To learn more about FreightWaves TRAC, click here.

On the East Coast, especially out of Atlanta, rates continue to rally, outpacing the NTID. The FreightWaves TRAC rate from Atlanta to Philadelphia rose 2 cents per mile w/w to $2.69. This current bull run, which started at the end of April, is making north-to-south lanes in the East far more attractive than West Coast alternatives.

For more information on FreightWaves’ research, please contact Michael Rudolph at mrudolph@freightwaves.com or Tony Mulvey at tmulvey@freightwaves.com.

The post No cure for the summertime blues appeared first on FreightWaves.

[ad_2]

Source link