[ad_1]

Old Dominion Freight Line reported a modest improvement in metrics during February but said market conditions “continue to reflect softness in the domestic economy.”

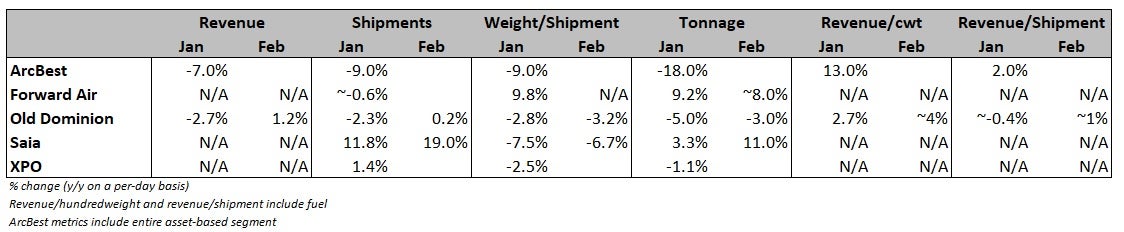

The less-than-truckload carrier saw revenue per day increase 1.2% year over year (y/y) during February, following a 2.7% decline in January. Tonnage was down 3% as a slight increase in shipments was offset by a 3.2% decline in weight per shipment. January saw a 2.3% decline in shipments while shipment weights were 3.2% lower.

January was a tougher-than-normal month for carriers as severe winter storms forced terminal closures, resulting in some shipments getting pushed to February. Old Dominion (NASDAQ: ODFL) also had an easier y/y tonnage comp in February (down 12.4% a year ago) compared to January (down 7.8%).

The carrier continues to see favorable yield results as it remains one of the most price-disciplined operators in the business. Revenue per hundredweight was 3.7% higher y/y for the first two months of the first quarter and 7.1% higher when excluding fuel surcharges.

“The increase in our LTL revenue per hundredweight was supported by a favorable pricing environment and our ongoing ability to deliver superior service at a fair price,” said Marty Freeman, Old Dominion’s president and CEO, in a Tuesday news release.

The lower shipment weights have been a contributor to the improving yield metrics.

On its fourth-quarter call at the end of January, Old Dominion said it had roughly 30% excess capacity to accommodate future volume growth. It hasn’t been adding terminals at a high clip like some of its competitors, which are seizing on an opportunity following the shutdown of Yellow Corp. (OTC: YELLQ).

Saia Inc. (NASDAQ: SAIA) reported Monday a 19% y/y jump in shipments during February, which followed a 12% increase in January. The company acquired 28 terminals from the bankrupt estate and plans to spend more than $500 million on real estate in 2024. It expects to increase door count by 12% to 14% during the year.

Old Dominion plans to leverage the $2 billion it has invested in real estate over the past decade to achieve its growth goals. The company has a track record of winning market share when the freight cycle turns positive. On the January call, it said it had outperformed market growth rates by 600 to 1,000 basis points on average in prior cycles, noting a midteens advantage during the 2021 freight boom.

“We believe our value proposition is unmatched in the marketplace, which provides us with a tremendous opportunity to win market share and produce strong, profitable growth once the macroeconomic environment begins to improve,” Freeman concluded.

The carrier has easier comps on the horizon than most of its peers. During the 2023 second quarter, it recorded midteen tonnage declines each month versus the industry, which was down only slightly.

Shares of ODFL were down 2.8% at 1:50 p.m. EST on Tuesday compared to the S&P 500, which was down 1.1%. Saia was up 3% at the time.

[ad_2]

Source link