[ad_1]

Morgan Stanley trimmed estimates Thursday ahead of earnings season. The firm sees the second quarter of 2023 as the point of “peak pain” for trucking companies and likely the bottom of the cycle.

“The quarter began with most companies reporting on 1Q calls that there was virtually no spring seasonal pickup and while this improved somewhat going into the end of the quarter, the lift was likely too little, too late to save the quarter,” said Ravi Shanker, Morgan Stanley (NYSE: MS) transportation equities analyst.

He cut numbers for most of the carriers he follows by double-digit percentages, lowering his Knight-Swift (NYSE: KNX) second-quarter forecast by 35% following the company’s negative pre-announcement on Wednesday.

In a news release announcing the close of the U.S. Xpress acquisition, Knight-Swift warned its consolidated operating margin would likely be down 1,100 to 1,200 basis points year over year (y/y) in the quarter due to “persistently soft demand,” which weighed on volumes and pricing.

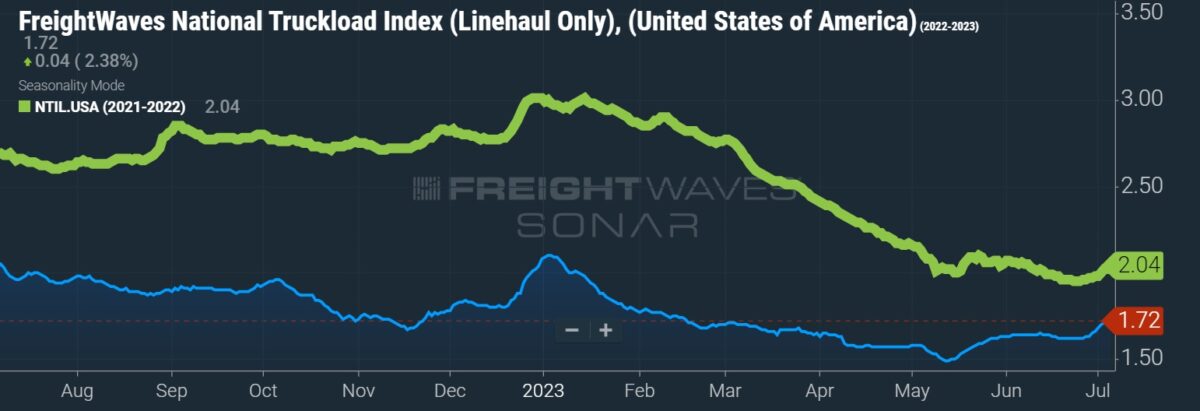

Shanker noted some improvement in the data recently and said if the trend continues over the next couple of weeks and into the heart of earnings season (the end of July), management teams will likely “sound more confident in underwriting a 2H restocking driven upcycle, though the magnitude of the bounce may still be TBD.”

He believes the second quarter likely reflects “the storm before the calm,” as spot rates hadn’t really improved and negative contract rates negotiated in the 2023 bid season were implemented on a larger number of carrier accounts. Shanker said aggressive cost savings likely helped stave off some margin degradation but concluded “this quarter is not going to be pretty.”

Regarding the stocks, he said TL companies could fare well if the back-half outlook from management teams is constructive. However, less-than-truckload names, which are priced for perfection (up 43% year to date) will likely see less forgiveness from investors if tonnage updates for June and July are soft.

Shanker believes “LTL stocks may have the most to lose this earnings season.”

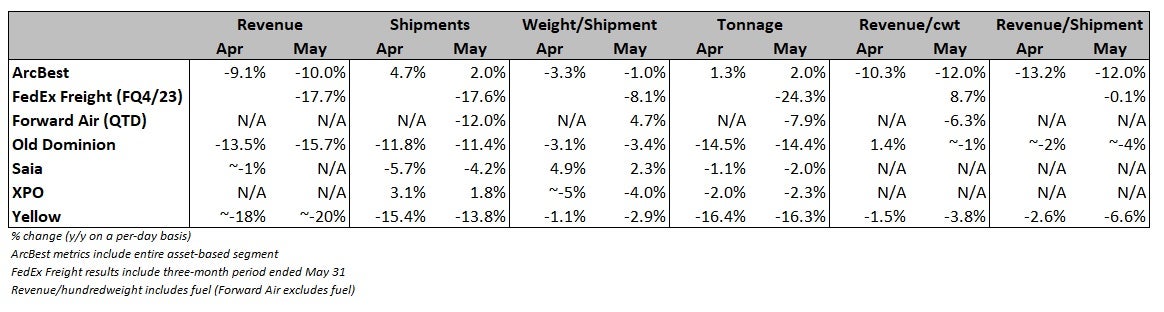

Intraquarter updates issued by carriers a month ago were a bit of a mixed bag, but most did see some sequential improvement in tonnage trends during the second quarter. Additionally, the y/y tonnage comps ease through the summer and get much easier in the fourth quarter, compared to a year ago when the industry was logging large y/y declines.

| Company: | Sequential Q2 tonnage growth rates (implied) |

| ArcBest | 7.4% |

| Forward Air | 6.9% |

| Old Dominion | -2.3% |

| Saia | 8.6% |

| XPO | 2.7% |

| Yellow | 0.0% |

Shanker said the 3PLs are likely in for a challenging quarter, with a tougher second half on the horizon if spot rates rise. Higher spot rates would force brokers to pay up for capacity compared to their contractual agreements where rates are off y/y by high single to low double digits. Additionally, 3PLs with forwarding units will see pressure as the space unwinds from a period of inflated earnings, as air and ocean rates ballooned during the pandemic.

All in, Shanker is calling for 18 of the 21 companies he follows to miss earnings estimates for the period.

More FreightWaves articles by Todd Maiden

[ad_2]

Source link