[ad_1]

Welcome to the WHAT THE TRUCK?!? Newsletter presented by Frayt. In this issue, trucking market enters dog days of summer; Nikola sales numbers; Yellow talks intensify; and more.

In it for the long haul?

“We’ve steeled ourselves to operate in this market until the end of ’24 if not beyond.” — Trucker Tools CEO Kary Jablonski

Is freight getting more predictable? — While trucking rates have been more limited than an unverified Twitter account’s tweets, are there any post-Fourth of July positives?

FreightWaves’ SONAR is showing a 5% increase in average length of haul. FreightWaves’ Kyle Taylor reports, “Tender volumes for freight moving less than 250 miles have fallen about 20% over the past year while demand for loads moving more than 800 miles has only fallen 6%.”

With long-haul freight more associated with replenishment and shorter hauls with repositioning, supply chains may be healing. It also means inventory may be getting back into alignment, which in turn can help shippers to restock at more stable and predictable levels.

New additions — In a market with too many trucks, one of the biggest catalysts for getting rates back up is a drop in available capacity. Michael Rudolph reports, “Contract rates have been on a downward trend since early April, albeit one that has had its brief reversals.”

Here’s the bad news: We’re currently at a 76-cent spread between contract and spot rates. With contracts getting drawn down through aggressive negotiations, there’s still plenty of distance for those rates to fall. Oh, and according to ACT Research, we still have a record number of drivers.

If you remove the EOY jump, Rejections are now back in line with DEC levels. Jumping through 3.75% this morning to 3.82% into the holiday. Every year since 2018 rejections have fallen after July 4th so expect to see that again. Can momentum break it through 4% before it falls? pic.twitter.com/CmqiQJRbYN

— Tanner DeHart (@TannerDeHartFW) June 30, 2023

“Perhaps it’s fate that today is the Fourth of July, and you will once again be fighting for our freedom. … Not from tyranny, oppression, or persecution … but from [low spot rates]” — President Thomas Whitmore, “Independence Day”

Did the Fourth help? — Outbound tender rejects saw a nice run-up in June as we headed toward Independence Day. However, they’ve since fallen from 3.82% to 3.52%.

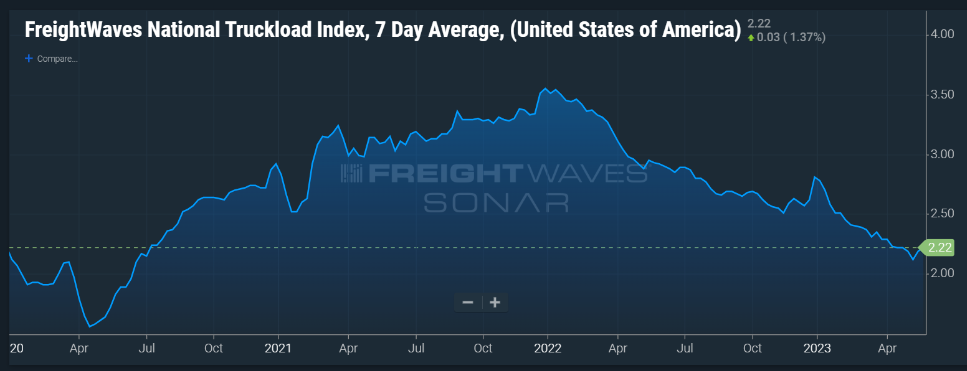

Cost of ownership — A new report by the American Transportation Research Institute says that cost to operate a truck has soared to the highest level on record: $2.25 per mile. That’s a 21% jump from 2021! The report attributes those rising costs to double-digit increases in fuel prices, purchase/lease payments, driver wages and repairs. Meanwhile, the national truckload spot rate is $2.22.

‘It is not left for the Teamsters to save this company’

Who should the government bail out?

— Dooner 🏴☠️ (@TimothyDooner) June 30, 2023

Out of control — Teamsters General President Sean O’Brien is fighting two battles at once this July as the union wages war with both UPS and Yellow. But, is it all just saber-rattling or are Teamsters really willing to stop the flow of over 20 million packages a day at UPS and cost the jobs of 22,000 workers at Yellow?

If “Do Nothing Darren” continues he will single handily destroy a once honorable company … RESIGN NOW… Our members are done making bad investments….. pic.twitter.com/8db5HACLAy

— Sean O’Brien (@TeamsterSOB) June 24, 2023

While UPS’ existence isn’t on the line in those negotiations, Yellow’s is. As FreightWaves’ Rachel Premack reports, “But O’Brien’s proclamation is shocking to some trucking insiders. Yellow really could go bankrupt, eliminating tens of thousands of unionized trucking jobs.”

“If you can’t afford gasoline, you better get the f— out of the trucking business. I think you hear Sean O’Brien saying that if you can’t afford the labor costs, you better get the f— out of the trucking business.” – Labor and employment lawyer Benjamin Dictor

Yellow is a Frankenstein’s monster of carriers that has survived more near-death experiences than Jason Vorhees. The company last received a highly scrutinized $700 million loan in 2020 that the Congressional Oversight Commission says it didn’t qualify for. On June 30, Yellow wrote to the White House asking Joe Biden to bring Yellow and the Teamsters to the negotiating table.

What do you think? Does this get resolved or is Yellow a goner? Email me.

By the numbers

Number of the week: 66 — The number of trucks Nikola sold in the second quarter. Production fell from 63 trucks in Q1 to 33 trucks in Q2.

Driver advice

New drivers coming in to the industry: keep your nose clean, your head on straight, remain accident-free for two years and the world is your oyster. https://t.co/NF7WkBQIp7

— Justin Martin (@supertrucker) July 5, 2023

Good driver shortage — While there may not be a driver shortage writ large, there most certainly is a “good driver shortage.” TruckCoinSwap’s Dominick Tullo recently tweeted about his challenges finding prospects for a driver position.

He says, “There are few CDL holders who are eligible for hire, presentable, insurable, match company culture and are willing to do the hard work.”

Why the issue? While his pay isn’t the highest, a bigger issue was half of his applicants were deemed unhirable by his insurance company due to past violations.

Justin Martin’s advice to drivers? To beat the field of drivers out there, keep your nose clean, stay out of trouble and you’ll be writing your own ticket.

WTT Friday

Episode 600 — On the 600th episode of WHAT THE TRUCK?!?, I’m celebrating with project44 founder and CEO Jett McCandless. We’ll learn all about his career journey, building project44 into a FreightTech juggernaut, what visibility actually means and how to build world-class culture.

Covenant’s VP of sustainability and innovation, Matt McLelland, shares his philosophy on trucking, sustainability, tech, career development and what carriers will look like in the 2030s.

Plus, news, weirdness and more.

Catch new shows live at noon ET Mondays, Wednesdays and Fridays on FreightWaves LinkedIn, Facebook or YouTube, or on demand by looking up WHAT THE TRUCK?!? on your favorite podcast player.

Now on demand

Fingers fly as UPS and Teamsters play blame game

Antidote for check calls; a big bet on FreightTech; and strap work

Subscribe to the show

Or simply look up WHAT THE TRUCK?!? on your favorite podcast player.

All FreightWaves podcasts can also be found on one feed by looking up FreightCasts wherever you get your podcasts.

Don’t be a stranger,

Dooner

[ad_2]

Source link