[ad_1]

TFI International seeks to spin off flatbed carrier Daseke in 2025

Canadian transport and logistics provider TFI International announced on its Q4 earnings call plans to spin off Daseke as a separate company sometime in 2025. Daseke has a fleet of around 4,500 tractors and 11,000 flatbed and specialized trailers and is the largest flatbed provider in North America. Describing the strategy that began with TFI acquiring Daseke in December 2023, Colin Campell of Trucking Dive wrote, “First, acquire to add scale and density. Then, separate out different businesses into pure-play companies to eliminate the dreaded ‘conglomerate discount’ described by both TFI and XPO executives.”

TFI management is confident of a smoother preparation and transition compared to their acquisition of UPS Freight for $800 million back in January 2021. On the call, TFI President and CEO Alain Bedard contrasted buying UPS Freight with buying Daseke. “UPS Freight was a very difficult deal to do because it was a carve-out and the company was not making any money. The OR was about 110, the fleet was a disaster, et cetera, et cetera. … Daseke is a different story. I mean, Daseke will run a sub-90 OR within six to 12 months in my mind.”

Another change envisioned with the spinoff is moving away from dry van freight and doubling down on specialized equipment. Bedard said, “We don’t want to be in the van world. A year and a half ago, we sold CFI to Heartland, OK, because we didn’t want to be in the van, but we really like specialty truckload, the flatbed operation, the tank and all that. We do really well.”

CVSA International Roadcheck’s 2024 focus revealed

The Commercial Vehicle Safety Alliance (CVSA) recently announced its focus list for inspections for the annual International Roadcheck May 14-16. During the three-day event, CVSA-certified inspectors conduct compliance, enforcement and educational initiatives targeting motor carriers and focused on vehicle and driver safety. This is the largest targeted enforcement program of commercial vehicles in the world. On average, 15 trucks and motor coaches are inspected every minute in North America during the 72-hour event. The event has a large impact in the spot market, with many small fleets and owner-operators opting to park their vehicles and not haul loads until the event concludes, for fear of additional scrutiny and potential negative safety scores.

The two focuses of the 2024 event are tractor protection systems and identification of controlled substances or alcohol possession. The CVSA notes tractor protection systems consist of “a tractor protection valve, trailer supply valve and anti-bleed back valve. All valves should be properly tested during a driver’s trip inspection and an inspector’s roadside inspection.”

Controlled substance and alcohol possession is the other focus, with the CVSA expressing significant concern due to a rise in the number of prohibited drivers from the Federal Motor Carrier Safety Administration’s Drug & Alcohol Clearinghouse. Inspectors will observe drivers for signs of alcohol or controlled substance use, examine the cab and trailer for controlled substances, and conduct a query in the clearinghouse for U.S. inspections to determine if the driver is prohibited by the clearinghouse list.

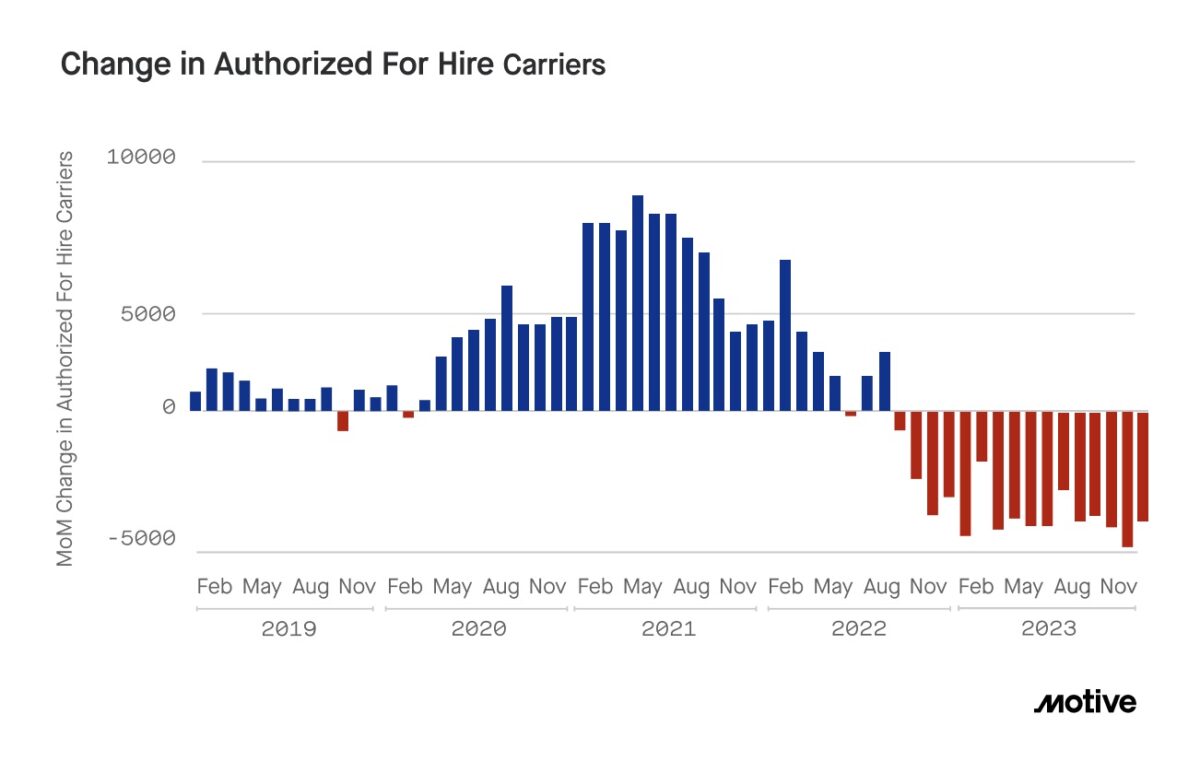

Market update: Motive February data shows slower contraction and some stabilization

On Tuesday, ELD and telematics provider Motive released its February Economic Report, which highlighted a slowing of freight market contraction with potential stability on the horizon. Contractions in the trucking market slowed in January, with the report noting “20% fewer carriers leaving the market and new carrier registrations rising 22% compared to December.” Motive itself believes new carrier registrations are expected to continue throughout 2024 with the potential to outpace new carrier entrants by at least 10% compared to 2019 levels.

The report also highlights changes in Motive’s Big Box Retail Index, which measures trucking visits for the top 50 retailers in the U.S. While January retailer visits were up 2% year over year, a few sectors saw rapid growth. The report notes, “Grocery and superstore retailers saw a 14.8% increase compared to 2023, home improvement saw a 14% year-over-year rise, and warehouses for department stores, apparel, and electronics saw a 5.9% jump. Discount retailers and wholesalers saw a modest decrease in visits, 1.8% fewer year-over-year.”

The recent increases in the Big Box Retail Index were attributed to a return to more predictable re-stocking patterns compared to shipper restocking behavior from most of 2023. Retailers dealt with excessive inventory, and uncertain consumer demand led to fewer retail and warehouse visits in 2023. For January 2024, this trend seems to be easing.

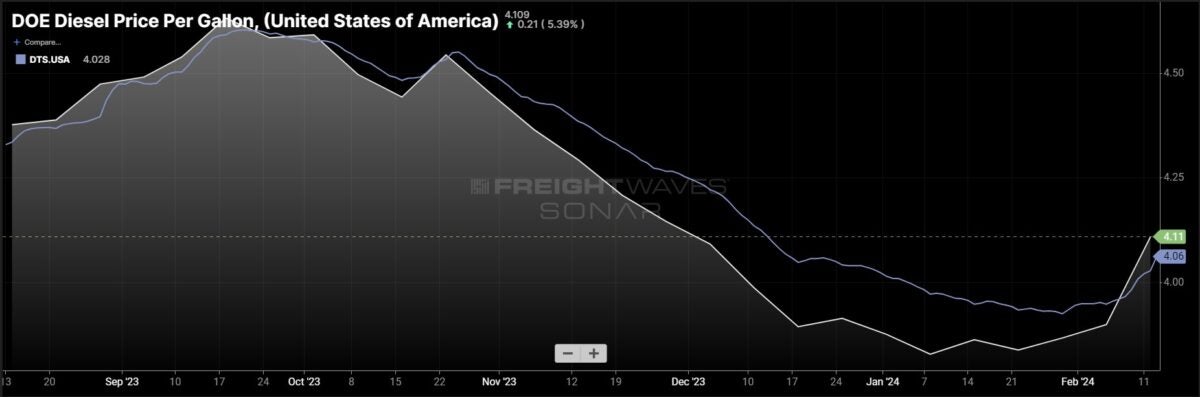

FreightWaves SONAR spotlight: DOE/EIA retail price of diesel tops $4/gallon

Summary: On Monday, the benchmark average retail price of diesel climbed 21 cents per gallon to $4.109 as diesel market volatility and refinery shutdowns roiled futures markets. The recent jump, while large, was only the sixth-largest since Russia invaded Ukraine nearly two years ago. FreightWaves’ John Kingston writes that the price jump “was the largest since a 22.2-cents-per-gallon increase posted July 31. It put the benchmark above $4 a gallon for the first time since Dec. 4 and wiped out all the declines in the price since then.”

Kingston notes that tight inventories are a big factor, with low U.S. stockpiles of ultra low sulfur diesel coinciding with an outage at the BP Whiting, Indiana, refinery. The refinery is expected to be shut down up to three weeks, keeping around 435,000 refined barrels per day out of the market. In addition to domestic outages, European markets are expected to see inventories decline in the next two months as the beginning of refinery maintenance season starts in the later weeks of February and into March.

For carriers that lack exposure to a dedicated fuel buying program or fuel surcharge, the recent rise in diesel prices threatens to further degrade operating margins.

The Routing Guide: Links from around the web

Benchmark diesel price jumps the most since October, back above $4 (FreightWaves)

New tax plan could ease investment burden for truckers (FreightWaves)

Knight-Swift buying 10 more Yellow leases (Trucking Dive)

FMCSA questioned on studies added to safety fitness rulemaking (FreightWaves)

FMC upholds ruling upending current chassis pool system (FreightWaves)

Trucking authority correction accelerates (FreightWaves)

Like the content? Subscribe to the newsletter here.

[ad_2]

Source link