Marc Heath has worked in retail fraud prevention for more than three decades. He’s not used to hearing executives of mega-retailers discuss his line of work in earnings calls or on cable news. That’s changed since 2020. The last few years have made commonplace the once-niche term of “retail shrink,” which refers to products lost to internal or external theft, supply chain snafus or simply “unknown” causes.

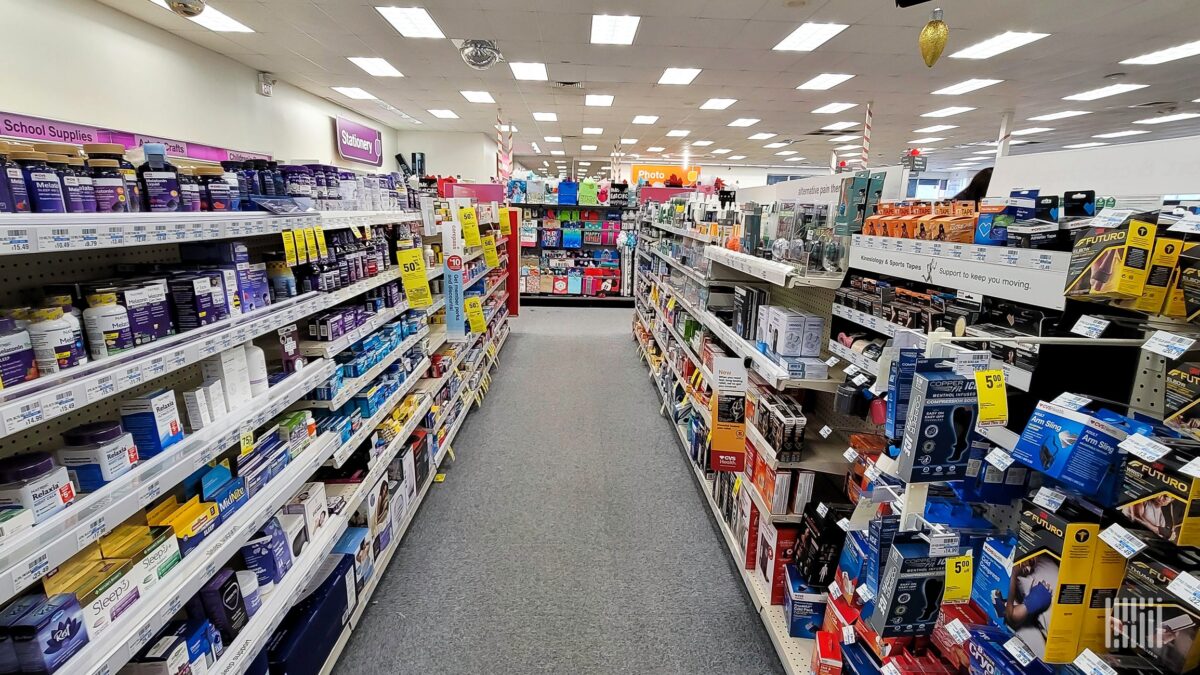

Big brands like Walmart and CVS have taken on unusual, costly tactics to combat this theft. Others have blamed retail theft as a key reason why sales have slumped. And the National Retail Foundation, a key industry group, is lobbying Congress to pass a bill that would devote more federal funds for combating organized retail crime.

Most recently, Target announced it would close nine stores in four states “because theft and organized retail crime are threatening the safety of our team and guests, and contributing to unsustainable business performance.”

“I’ve seen [retail theft become] more newsworthy,” said Heath, who is the CEO and founder of a Boston-based security company. “People are talking about it, especially senior operations people during their conference calls. They’re actually mentioning shrink and how it’s impacting the business.”

Still, some aren’t entirely convinced the retail theft is really that bad. Industry data on the problem is hard to solidify, and it hasn’t exactly shown a massive upswing in shrink either. Others say retail theft, while certainly an issue, might be overstated as an excuse to write off mediocre sales — or harebrained strategy shifts. What’s more, historic inflation (from which, of course, mega-brands have benefited) might be a key reason why we’re seeing any theft bump at all.

While it’s fun and easy to come to a conclusion based on a gut reaction, let’s explore some of the reasons why the retail theft story isn’t quite as clear as it seems.

Industry data doesn’t reveal an utterly astounding increase in overall shrink

A 2023 report from the National Retail Foundation, the leading retail trade association, surveyed 177 retail brands about their experiences with shrink. The rate of inventory lost to shrink increased from 1.4% in 2021 to a whopping … 1.6% in 2022.

OK, maybe your jaw is not thoroughly dropped. But the NRF pointed out that that 0.2 percentage point increase represents an uptick from $93.9 billion in 2021 to $112.1 billion in 2022. This is a 19.3% increase.

External thefts accounted for about 36% of total shrink, the biggest category. As the report noted, that percentage is much higher for, say, convenience stores than, say, Tiffany & Co., where everything is under a lock and key (although quite a few convenience stores nowadays are that way too).

There’s plenty of theft that’s likely not captured as well. The NRF said the majority of respondents do not count e-commerce goods loss or supply chain loss in their shrink numbers. (Don’t worry, we will talk more about supply chain later …)

The level of violence accompanying theft is concerning for retailers

David Johnston, the vice president of asset protection and retail operations for the NRF, told FreightWaves in an interview that the current scale of theft is “unprecedented” in his 37 years in asset protection. What’s particularly unusual is that these crimes are just getting more violent, according to Jonathan Gold, who is the NRF’s vice president of supply chain and customs policy.

“We’re hearing stories of these gangs of folks that go in and bust up the store and take everything,” Gold said. “They’re coming in with bear spray, pepper spray, they’re setting fires in stores to create a distraction.”

Such blatant thefts go beyond, say, teens shoplifting for fun or even a desperate theft of a few essentials. Gold said missing inventory is often stolen en masse then sold online. Federal investigators say these organized groups are also involved in drug trafficking, human trafficking and even terrorism.

Heath said the violence is so bad that it’s sometimes no longer even sensible to recommend employees — or even on-duty security guards — to apprehend thieves. After all, merchandise can be replaced and evidence can be collected to potentially catch the criminal at a later state.

“It’s not worth anybody’s safety or life, no matter what the impact is,” Heath said. “I think people understand that, but I also understand that the people that are stealing understand that they could get away with it.”

The NRF hasn’t solidified any data around increased rates of organized retail theft or what percentage of external theft is organized crime. Retailers aren’t required to break down how much they actually lose to theft. This lack of solid data is especially important now that the NRF is campaigning for more federal spending to combat the issue. (CNBC’s Gabrielle Fonrouge broke that down in this August article, which I recommend giving a read.)

Is this just excushrinkage?

Neil Saunders, managing director at GlobalData Retail, said retail theft is a real issue. But he also noted that it’s a very convenient excuse for, well, maybe not the best business choices.

Take Target’s store closures, for example. Saunders pointed out that Target says shrink is up but won’t specify how much of that is because of crime or simply pallets gone missing.

“We all know that Target is not always the best at managing supply chains,” Saunders said. “We all know Target has a lot of out of stocks and various issues. We all know it has a much more complex multichannel operation than it used to and it’s much easier to lose things.”

If Target said the fault was due to its omnichannel and not a looming, outside, societal issue, investors might not be as forgiving.

“Theft is the ultimate excuse because it’s like, ‘Hey, look, it’s not our problem,’” Saunders said. “‘We try to prevent this but people come in and steal things.’”

S&P Global Ratings retail analysts said in a note that some retailers may be “overstating the contribution of theft this year.” Poor merchandise execution and inventory management could also be major contributors to the uptick in shrink.

Drilling deeper into Target’s nine urban store closings, Saunders said it’s likely that other factors were at play in addition to theft. A key one is the fact that the urban store model is somewhat out of Target’s wheelhouse. The average basket size of a suburban big-box location is going to be much larger than a city one, where customers can’t load up their trunks with impulse buys galore. The impulse buys in a New York City Target must be limited to what you can carry home (or hastily stash in an Uber).

The NRF experts told FreightWaves that employee safety being at risk is an undeniable reason to shutter any retail location. A Target spokesperson declined to answer specific FreightWaves questions on shoplifting and the company’s business strategy. He highlighted a Sept. 26 press release for more information.

There are ways to defeat theft, as retailers like Lowe’s and Costco have found. Obviously, both have their advantages; it’s hard to steal, say, a massive trundle of plywood from a Lowe’s and Costco is members only.

Brandon Rael, a retail operations consultant, told FreightWaves the retailers winning against shoplifting have something else in common, though: They just have good shopping experiences. That means no items locked behind plexiglass and human cashiers. That also probably means significantly more employees per square foot.

“Having spent my entire adult life in retail, at every level, the one thing that I understand clearly is that the greatest deterrent for any theft activity is effective customer service and making sure that you have the right type of merchandising display,” Lowe’s CEO Marvin Ellison said at a recent investors conference.

Increased theft might just be a result of our current economic climate

While some chunk of these increased thefts may be because of the rise in terrifying-sounding organized retail crime, another is likely simply because things have become too expensive. We’re in an economy right now where some everyday staples have risen in price six times faster than the overall rate of inflation. Until July of this year, American paychecks grew at a slower rate than inflation as a whole.

That applies to consumers and the actual workers of any retailer. The second largest contributor to retail shrink is, after all, internal theft. Associates of big-box retailers have increasingly challenging jobs (partially thanks to, well, having to deal with apprehending shoplifters).

One Vox article from August depicts that well. Here’s one particularly jarring snippet:

Over 7.3 million retail workers quit last year; one consulting firm reported a 75 percent turnover rate last year for hourly in-store positions, while a 2023 US News ranking of 190 jobs put retail salespeople at the very bottom.

Sean Vanatta, an economic and social historian at the University of Glasgow, agreed.

“You can see the way the retail economy has developed in the last 30 years has really focused on driving down labor costs,” Vanatta said. “It’s your workers who are also your consumers. That, then, is the core issue. If you’re not paying people enough to shop at your stores, what other options are they going to have? If the solution is always cut wages and bring in more police, what kind of society are you going to end up with?”

Oh, there’s a trucking angle too

Increasingly complex supply chains have made retail shrink more broadly a problem.

One particularly sensitive area of theft along the supply chain, the NRF said, is when truck drivers are waiting at warehouses to be loaded or unloaded. Did someone say detention time?

Thanks for reading this edition of MODES. You can subscribe here for weekly insights. Be sure to send me your thoughts at [email protected].

NOVEMBER 7-9, 2023 • CHATTANOOGA, TN • IN-PERSON EVENT

The second annual F3: Future of Freight Festival will be held in Chattanooga, “The Scenic City,” this November. F3 combines innovation and entertainment — featuring live demos, industry experts discussing freight market trends for 2024, afternoon networking events, and Grammy Award-winning musicians performing in the evenings amidst the cool Appalachian fall weather.

[ad_2]

Source link