[ad_1]

Weekly highlights

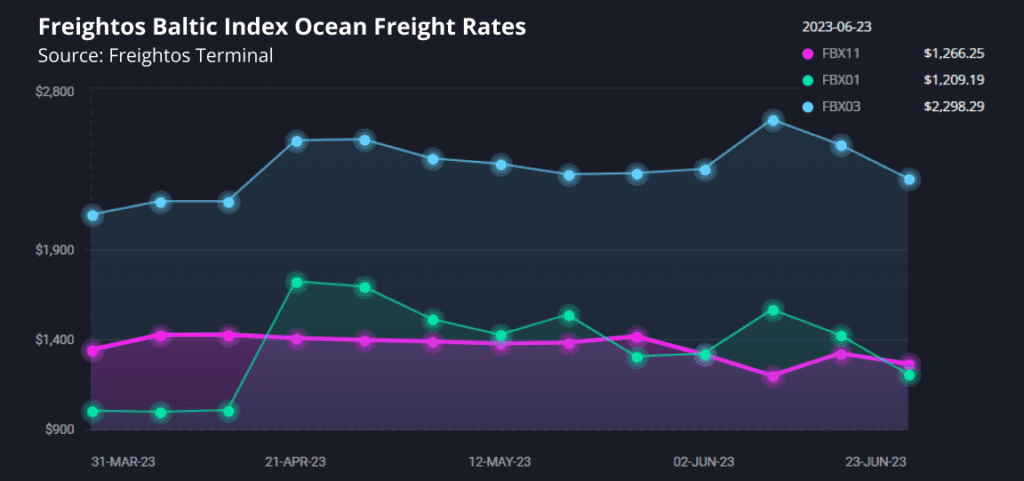

Ocean rates – Freightos Baltic Index:

- Asia-US West Coast prices (FBX01 Weekly) fell 15% to $1,209/FEU. This rate is 87% lower than the same time last year.

- Asia-US East Coast prices (FBX03 Weekly) decreased 8% to $2,298/FEU, and are 80% lower than rates for this week last year.

- Asia-N. Europe prices (FBX11 Weekly) fell 4% to $1,266/FEU, and are 88% lower than rates for this week last year.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

New projections this week reinforce pessimism for much of a peak season rebound in N. America and Europe this year. And in terms of freight rates, any increase in Asia – N. Europe demand could have difficulty pushing prices up as several new ultra large vessels enter the market and replace smaller ships in July and August, likely putting downward pressure on rates.

Without any significant volume increases yet this month, rates have fallen from early-June GRI attempts. Prices from Asia to the US West Coast fell 15% last week to about $1,200/FEU, a level lower than at the end of May.

Rates to the East Coast fell 8% last week to about $2,300/FEU, about on par with rates for much of May and just below 2019 levels. The Panama Canal Authority announced that, due to weather conditions that have recently improved the canal’s watershed, it has canceled additional draft restrictions meant to go into effect shortly which could have further limited the canal’s capacity, and possibly pushed rates up.

Rates for US exports have also fallen recently both on easing volumes and on competition among carriers to increase export bookings as import rates that typically subsidize backhaul costs lag. FBX US West Coast – Asia rates have fallen more than 20% since March to $589/FEU, still 6% higher than in 2019.

Asia – N. Europe prices fell 4% last week to about $1,260/FEU, and remain below levels in May and on par with 2019 rates. Meanwhile, low water levels in the Rhine are resulting in surcharges for containers moving inland by barge.

In air cargo, some voices are still optimistic for a peak season recovery, while other signs point in the opposite direction as FedEx will make further reductions to its air fleet and to its LTL trucking network as well.

Clarification: Last week’s update stated that Freightos Air Index rates for China – N. Europe prices dipped 3% over the last month to $3.18/kg and are 53% lower than last year. China – N. America rates climbed more than 20% this month to $5.60/kg but are 25% lower than a year ago, while transatlantic prices dipped 10% to $2.23/kg and are 39% lower than last June.

Thanks to the sharp-eyed readers who flagged the sharp jump. That update had relied on a specific weight break (100-300kg) while we typically use an overall average rate across all weight classes which was far less dramatic, with China – N. Europe rates down 1% since a month ago to $2.98/kg and 14% lower than last year, China – US prices up 8% to $4.15/kg, down 8% annually, and transatlantic rates down 11% to $2.04/kg and 41% lower than last year.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.

[ad_2]

Source link