[ad_1]

Weekly highlights

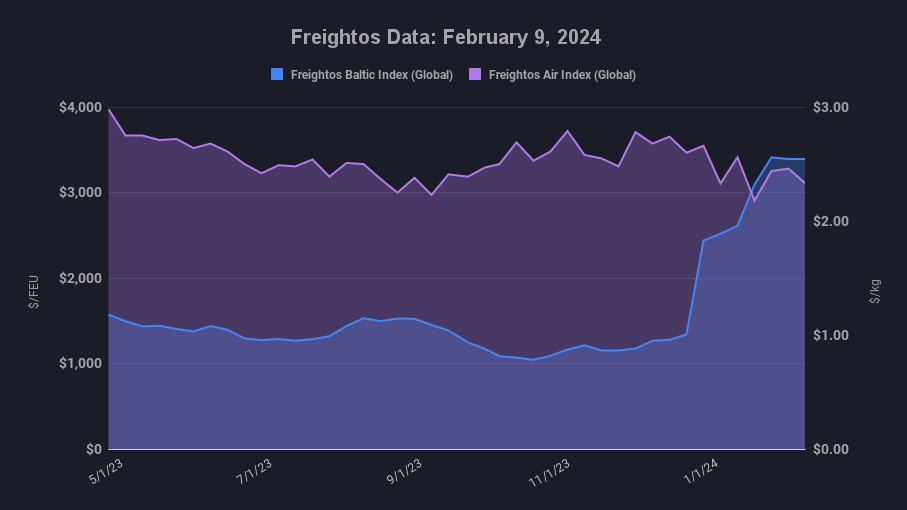

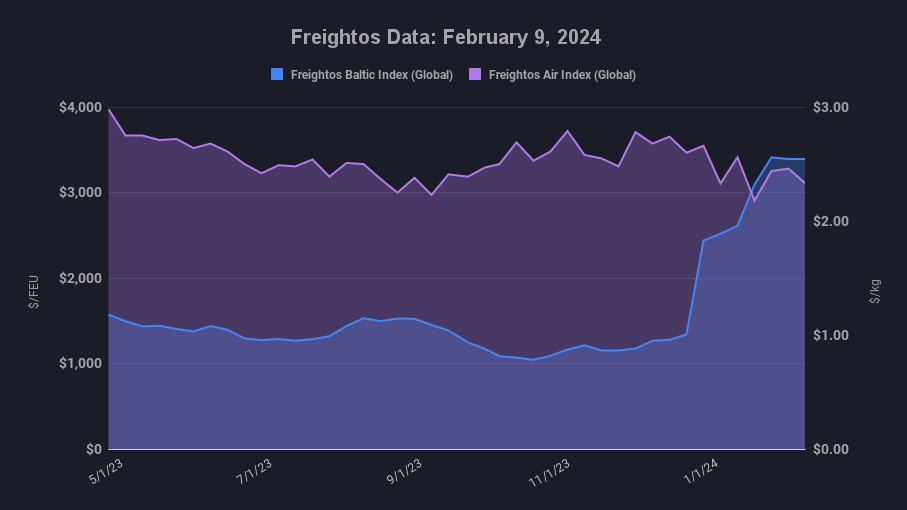

- Asia-US West Coast prices (FBX01 Weekly) increased 11% to $4,859/FEU.

- Asia-US East Coast prices (FBX03 Weekly) climbed 3% to $6,589/FEU.

- Asia-N. Europe prices (FBX11 Weekly) fell 8% to $4,697/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) fell 7% to $5,758/FEU.

- China – N. America weekly prices decreased 35% to $3.91/kg

- China – N. Europe weekly prices increased 13% to $3.51/kg.

- N. Europe – N. America weekly prices fell 1% to $2.03/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Pressure on ocean operations continued to ease last week as the pre-Lunar New Year rush came to an end, more empty containers arrived back at export hubs, and schedules stabilize as carriers add vessels to accommodate diverted lanes with longer distances to cover.

A poll of logistics professionals who attended our recent Red Sea Crisis Update webinar last week found 80% think the worst of the impact on container traffic and rates is behind us, with a third expecting disruption levels and ocean rates to decline in the coming weeks.

Ocean rates from Asia to N. Europe and the Mediterranean both dipped about 7% last week and are 15% lower than their late January peaks as conditions improve and demand decreases. Prices to N. America continued to climb last week, though not as sharply as in January, with daily rates so far this week showing some leveling off.

Before the Red Sea crisis started, overcapacity from sustained fleet growth had been the big story in ocean freight and the main driver of slumping rates. But diversions away from the Suez Canal have carriers using more ships to adjust to longer transits and keep to their weekly departure schedules, which has absorbed much of that otherwise excess capacity. The need for more active capacity saw the number of idle large ships drop to zero last week, and has even led to a rebound in the charter market.

Carriers had anticipated that the knock-on effects of shifting capacity to Red Sea lanes would be enough to push rates up on non-Suez trade as well. Transatlantic prices did climb 25% last week to $1,500/FEU, which is significant, but is still below profitable levels for carriers and well short of the $5k/FEU GRIs announced last month by some carriers.

But even with the Red Sea diversions soaking up capacity and N. America demand expected to grow relative to last year and to 2019, overcapacity looms. Maersk estimates that a reopening of the Red Sea in the near term would lead to a sharp decrease in rates as supply would outstrip demand, while, if diversions continue, rates will nonetheless fall gradually throughout the year as new capacity continues to enter the market.

More carriers are resuming Panama Canal transits as conditions there have stabilized and will hopefully improve with the start of the rainy season in May – another factor that should mitigate the Red Sea crisis impact on N. American ocean trade.

In air cargo, volumes increased in late January on pre-LNY demand as well as some shift to air due to the Red Sea crisis. An increase in sea-air option demand has pushed Freightos Air Index rates from Dubai to some European hubs up 35% since the start of the year. Improvements in ocean operations and the arrival of LNY though saw China – N. America rates fall sharply last week to less than $4/kg.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.

[ad_2]

Source link