[ad_1]

For nearly two years, capital markets have punished Zim, the Israeli containership line whose fleet is the 10th-largest on the ocean. Zim’s model, which involves operating a subscale, highly chartered fleet of smaller vessels almost wholly exposed to the spot market, took a beating when collapsing spot rates collided with its high COVID-era lease expenses. The stock peaked at $84.50 per share on March 18, 2022, and took a series of nosedives before finally bottoming at $6.59 on Nov. 28, 2023.

But now the container market may be turning around. The Houthi missile and drone attacks in the Red Sea have forced steamship lines to divert their vessels away from the Suez Canal, around the Cape of Good Hope, and take the long way to Europe from Asia. Radically extending those important trade lanes and transit times has meant that it takes more containership capacity to move the same amount of freight, straining the global fleet and creating the conditions for spot rate increases even on unaffected lanes like the trans-Pacific.

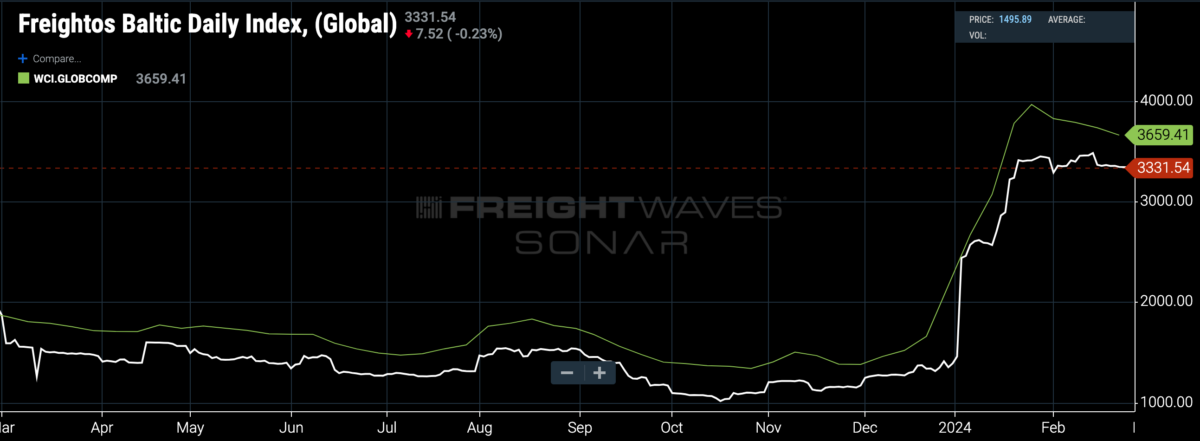

What could have been a temporary blip is taking much longer to resolve than initially anticipated, and now analysts think spot rates could stay higher for longer. Two important indexes tracking average global spot rates are showing sustained, elevated levels: Drewry’s World Container Index – Global Composite, now at $3,659.41, and the Freightos Baltic Daily – Global, now at $3,331.54.

At the end of January, Jefferies equity analyst Omar Nokta upgraded Zim to a “Buy,” affixing a $20 price target to the stock.

“The story has changed for ZIM with cash burn shifting to significant cash generation,” Nokta wrote in the Jan. 29 client note. “ZIM’s high spot, high cost and high leverage platform was a major concern in a period of low freight rates, but it now provides substantial upside given the rise in spot rates.”

Nokta reckoned Zim’s cost per twenty-foot equivalent unit, including leasing fees, at $1,700. For much of 2023, Zim’s realized freight rate had fallen to approximately $1,200 per TEU, and the ocean carrier was burning $300 million per quarter. But Nokta estimates that Zim may be capturing as much as $2,100 per TEU across its service lines.

Zim’s guidance on the Q3 2023 earnings call — it doesn’t release Q4 results until mid-March — was bearish. CEO Eli Glickman cut full-year profitability expectations under some fairly negative baseline assumptions: Continued weakness in freight rates, a slight decline in volume and higher bunker fuel costs would all reduce earnings before interest, taxes, depreciation and amortization.

But just a week before that earnings call, which was on Nov. 15, 2023, Zim management made some moves that indicated the company was starting to see green shoots in the ocean freight market. It announced that it would relaunch its ZIM eCommerce Xpress or ZEX service from China to Los Angeles with its first sailing on Nov. 22 from Yantian. ZEX is a signature Zim service, first brought to market in 2020: It offers the fastest transit time from China to the West Coast (12.5 days), with no-roll guarantees, priority unloading and same-day availability when the vessel reaches its berth. It’s a premium service on small 4,200-TEU vessels meant to service time-sensitive freight and ultimately compete with air cargo, on the rationale that there should be a transportation option between typical ocean container transits (21 days) and typical air cargo transits (one day).

Air cargo is highly levered to the goods economy and freight markets: Volumes and rates can explode if the rest of the market is doing well, but they drop through the floor if ocean, truck and rail are unusually soft. So Zim’s decision to reintroduce its premium services implies a bullishness on the part of management — they thought that eastbound trans-Pacific ocean freight was getting so hot that the market would support a high-priced, high-touch option for overflow or time-sensitive cargo.

“While 4Q23 results are likely to be weak, we expect 1Q24 to be a bounce-back quarter and to set the stage for a stronger 2Q24,” Nokta wrote, concluding that “ZIM is a high-beta play on the container market improvement. While freight rates are likely to remain volatile, we believe they will hold at well above the lows seen in 2023.”

Zim’s network may be particularly well suited to take advantage of container market disruptions in 2024. There was already an outsize flurry of container bookings from China to the United States in the lead-up to the Chinese New Year; although surges in volume prior to the holiday are common, the bump in 2024 exceeded last year’s by a lot. Those bookings have Gene Seroka, executive director of the Port of Los Angeles, calling for a 20% year-over-year volume improvement in the first quarter. Notably, only 53% of LA’s volume now comes from China, down from more than 70% in years past, and Seroka predicts that China’s share of LA’s volume will fall below 50% in the next few years.

The possibility of a Trump electoral victory in November and the threat of draconian tariffs placed on Chinese exports may accelerate that trend. Shippers have already reported pulling forward extra volumes as they replenish their stateside inventories. While the most extreme form of reshoring — pulling their manufacturing operations out of China completely and returning them to the U.S. — is complex, expensive and rare, shippers are reengineering their Asian supply chains, changing the sequence of assemblies and shuttling goods from one port to another in order to export to the United States from countries that won’t face harsh tariffs, like Vietnam, Korea or Japan.

Zim is poised to take advantage of both of these trends — the tariff-avoiding pull-forward trade and the intra-Asia business. In the third quarter of 2023, the company reported carried volumes of 867,000 TEUs. Zim’s two biggest regions in terms of volume were the Pacific and Intra-Asia: the Pacific accounted for 339,000 TEUs, or 39.1% of its volumes, while Intra-Asia handled 250,000 TEUs, or 28.8% of its volumes. In other words, up to 67% of its business is in regions that are poised to get hotter as 2024 progresses.

New liquefied natural gas-powered charters being delivered to Zim throughout this year will help lower the company’s cost per TEU. LNG spot prices at Henry Hub briefly spiked during January’s cold weather but are otherwise staying extremely low, at $1.60 per million Btu. (Compare that to 2022, when prices exceeded $7/mmBtu for months on end.)

Nokta and other Wall Street analysts expect Q4 2023 results to come in fairly week, but a lot hinges on Glickman’s guidance, and whether he will formally raise expectations for what may prove to be another chaotic but lucrative year for Zim.

[ad_2]

Source link