[ad_1]

Weekly highlights

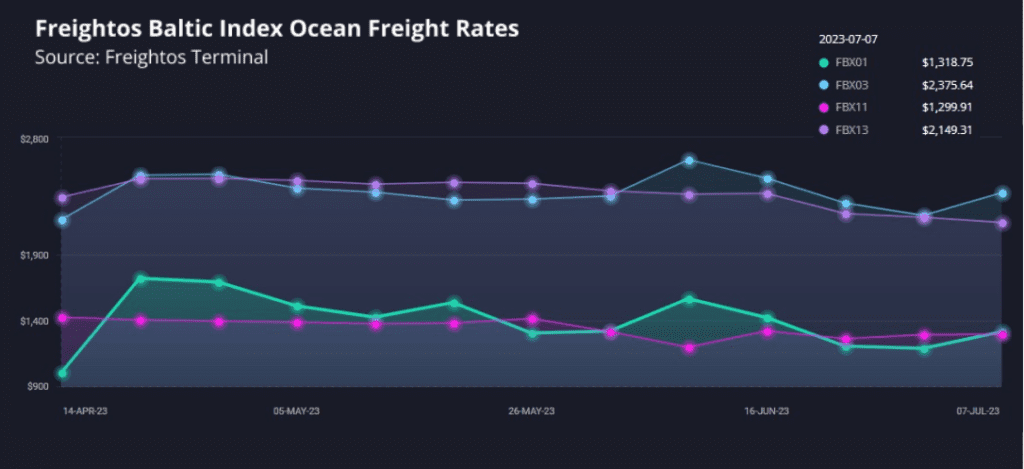

Ocean rates – Freightos Baltic Index:

- Asia-US West Coast prices (FBX01 Weekly) increased 11% to $1,319/FEU. This rate is 82% lower than the same time last year.

- Asia-US East Coast prices (FBX03 Weekly) climbed 8% to $2,376/FEU, and are 76% lower than rates for this week last year.

- Asia-N. Europe prices (FBX11 Weekly) were unchanged at $1,300/FEU, and are 88% lower than rates for this week last year.

- Asia-Mediterranean prices (FBX13 Weekly) fell 2% to $2,149/FEU, and are 83% lower than rates for this week last year.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

After four days without meetings, ILWU Canada talks with the BCMEA resumed Saturday as the port worker strike entered its second week. Federal mediators are now also involved in negotiations.

Container ship backlogs have now developed, with more than 10 vessels anchored near Vancouver and several off Prince Rupert port. And though ILWU and ILA members in the US have pledged not to handle diverted containers to the West or East Coast, respectively, there are already reports of diversions and rotation changes – some already handled – to US West Coast ports.

This diversion of volumes may have been one factor in transpacific ocean rate increases last week, as prices to the West Coast climbed 11% to $1,319/FEU and 8% to the East Coast.

These rate climbs could also reflect some uptick in demand and the hoped-for start of peak season.

In addition to anticipating minimal impact from the strike in Canada for US shippers, and expressing concern over the looming UPS Teamsters strike, the latest National Retail Federation report on US ocean import volumes estimates June volumes declined from May but were about on par with 2019 levels, and projects a 4% monthly increase in July, a 5% climb in August and still-elevated volumes through October – with monthly throughput up to 5% higher than in 2019.

Though not everyone is convinced, these projections predict a return to pretty typical seasonality and growth relative to pre-pandemic. Combined with still-elevated inventories for many retailers, these estimates also imply expectations for resilient consumer spending through the holiday season.

With volumes higher than in 2018 and 2019 in May and June, ocean rates that for the most part have been at or below 2019 levels may be more a function of excess capacity than of subdued demand.

And if volumes do continue to increase, carriers may still have a difficult time pushing freight rates up as new vessels are slated to enter the transpacific in August and September, adding 20-25% more capacity than last year. Carriers are already trying to mitigate the supply-side increase through more blanked sailings, slower sailing speeds, and additional port calls.

In Asia – N. Europe trade more carriers announced significant planned rate increases for the end of the month. But with current rates of $1,300/FEU just below 2019 levels, only moderate signs of demand increases, and more new capacity entering this market as well, many are skeptical that this GRI will succeed.

IATA’s latest air cargo demand data show that global volumes fell by more than 5% in May compared to last year and were 7% lower than in 2019. Freightos Air Index benchmarks for air cargo rates had China – N. Europe prices at $3.12/kg last week, and China – N. America rates at $3.94/kg, both up slightly from a week before, with transatlantic prices of $1.81/kg 5% lower compared to a week prior.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.

[ad_2]

Source link